Liberty Global Results Presentation Deck

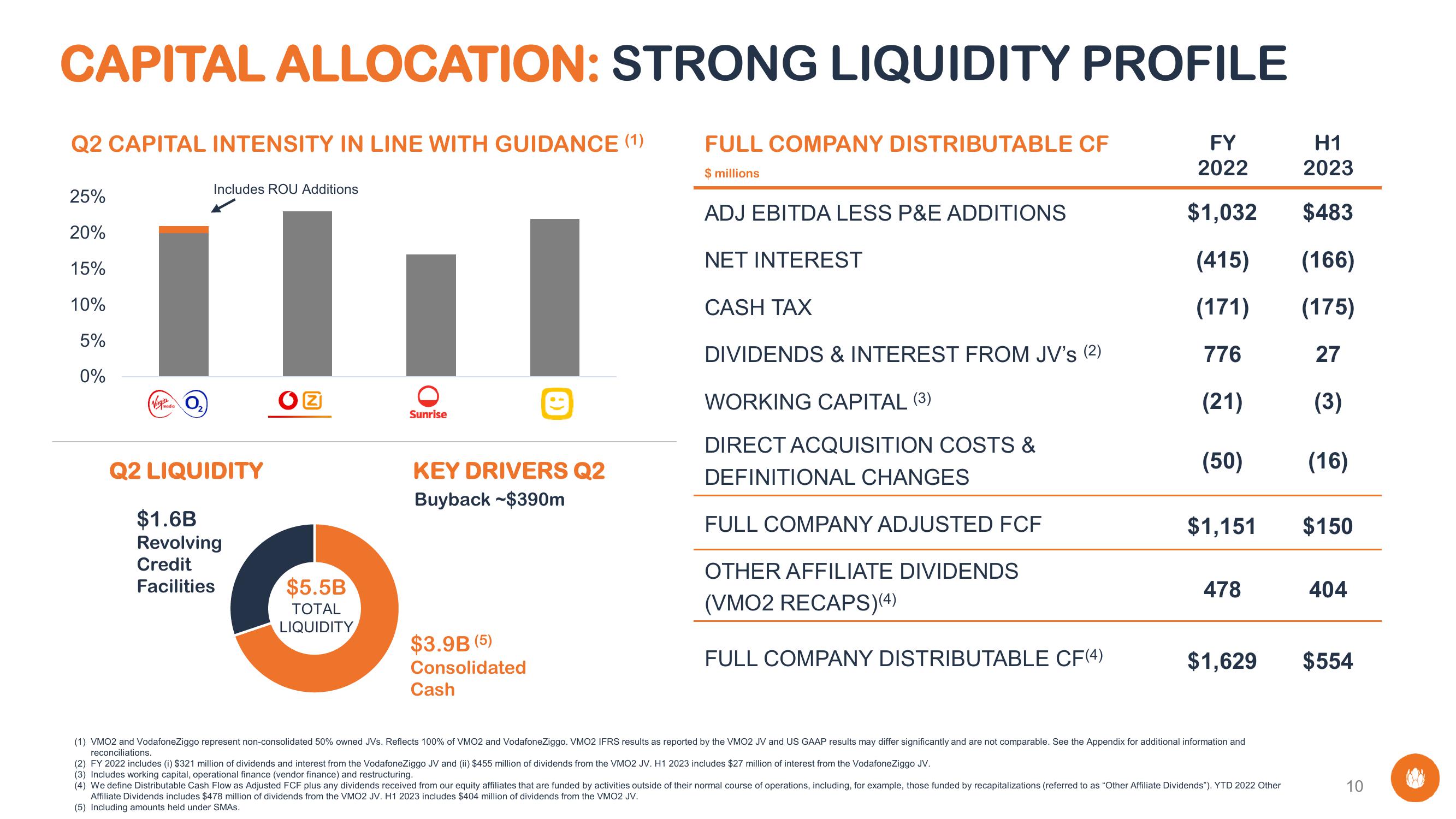

CAPITAL ALLOCATION: STRONG LIQUIDITY PROFILE

Q2 CAPITAL INTENSITY IN LINE WITH GUIDANCE (1)

25%

20%

15%

10%

5%

0%

(Vido O₂)

Includes ROU Additions

I

OZ

Q2 LIQUIDITY

$1.6B

Revolving

Credit

Facilities

$5.5B

TOTAL

LIQUIDITY

Sunrise

KEY DRIVERS Q2

Buyback-$390m

$3.9B (5)

Consolidated

Cash

FULL COMPANY DISTRIBUTABLE CF

$ millions

ADJ EBITDA LESS P&E ADDITIONS

NET INTEREST

CASH TAX

DIVIDENDS & INTEREST FROM JV's (2)

WORKING CAPITAL (3)

DIRECT ACQUISITION COSTS &

DEFINITIONAL CHANGES

FULL COMPANY ADJUSTED FCF

OTHER AFFILIATE DIVIDENDS

(VMO2 RECAPS)(4)

FULL COMPANY DISTRIBUTABLE CF(4)

FY

2022

$1,032

(415)

(171)

776

(21)

(50)

$1,151

478

$1,629

(1) VMO2 and VodafoneZiggo represent non-consolidated 50% owned JVs. Reflects 100% of VMO2 and VodafoneZiggo. VMO2 IFRS results as reported by the VMO2 JV and US GAAP results may differ significantly and are not comparable. See the Appendix for additional information and

reconciliations.

(2) FY 2022 includes (i) $321 million of dividends and interest from the VodafoneZiggo JV and (ii) $455 million of dividends from the VMO2 JV. H1 2023 includes $27 million of interest from the VodafoneZiggo JV.

(3) Includes working capital, operational finance (vendor finance) and restructuring.

(4) We define Distributable Cash Flow as Adjusted FCF plus any dividends received from our equity affiliates that are funded by activities outside of their normal course of operations, including, for example, those funded by recapitalizations (referred to as "Other Affiliate Dividends"). YTD 2022 Other

Affiliate Dividends includes $478 million of dividends from the VMO2 JV. H1 2023 includes $404 million of dividends from the VMO2 JV.

(5) Including amounts held under SMAS.

H1

2023

$483

(166)

(175)

27

(3)

(16)

$150

404

$554

10View entire presentation