Sonos Results Presentation Deck

Significant Cash Flow and Strong Balance Sheet

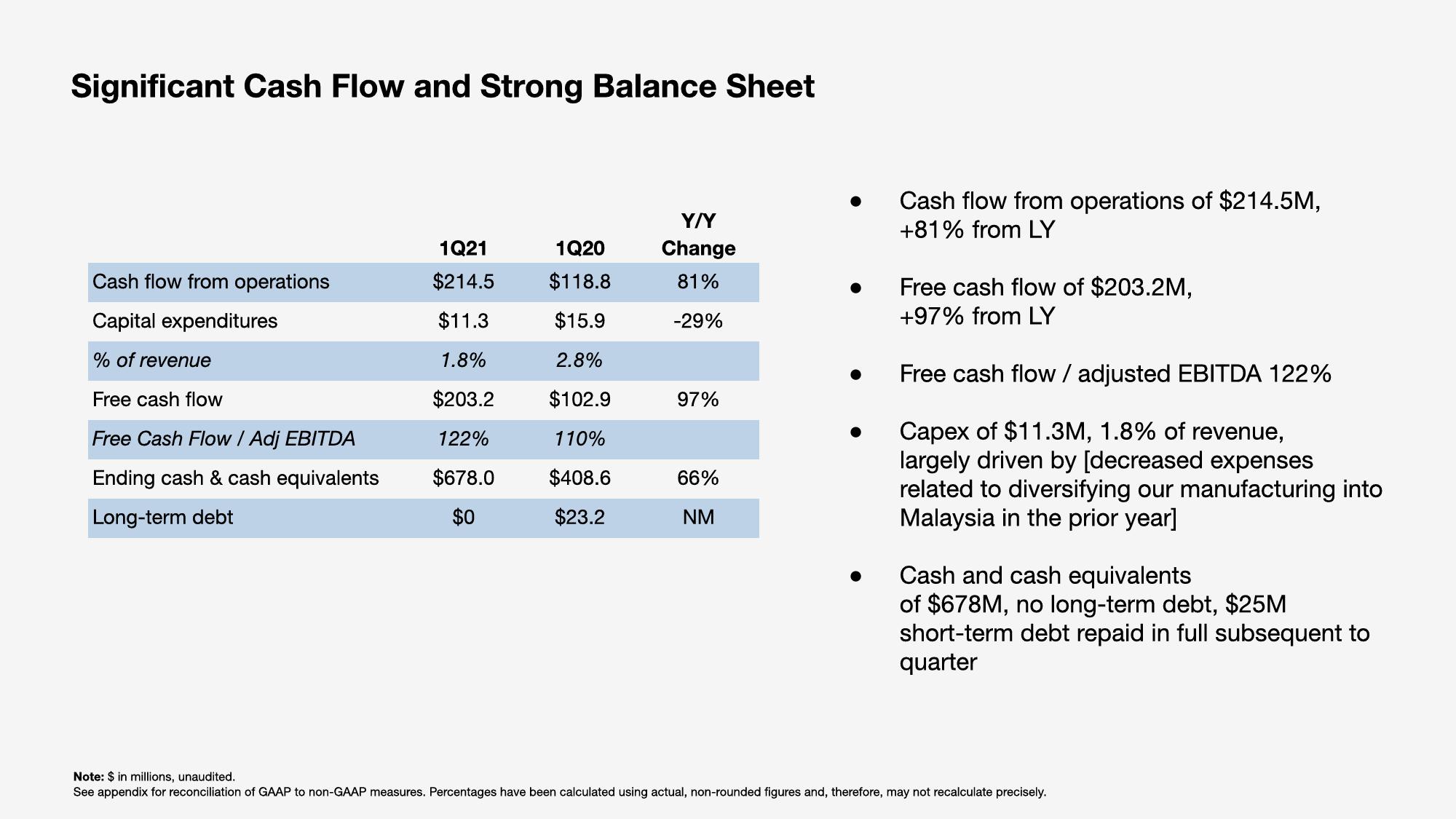

Cash flow from operations

Capital expenditures

% of revenue

Free cash flow

Free Cash Flow / Adj EBITDA

Ending cash & cash equivalents

Long-term debt

1Q21

$214.5

$11.3

1.8%

$203.2

122%

$678.0

$0

1Q20

$118.8

$15.9

2.8%

$102.9

110%

$408.6

$23.2

Y/Y

Change

81%

-29%

97%

66%

NM

●

Cash flow from operations of $214.5M,

+81% from LY

Free cash flow of $203.2M,

+97% from LY

Free cash flow / adjusted EBITDA 122%

Capex of $11.3M, 1.8% of revenue,

largely driven by [decreased expenses

related to diversifying our manufacturing into

Malaysia in the prior year]

Cash and cash equivalents

of $678M, no long-term debt, $25M

short-term debt repaid in full subsequent to

quarter

Note: $ in millions, unaudited.

See appendix for reconciliation of GAAP to non-GAAP measures. Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.View entire presentation