Barclays Capital 2010 Global Financial Services Conference

-

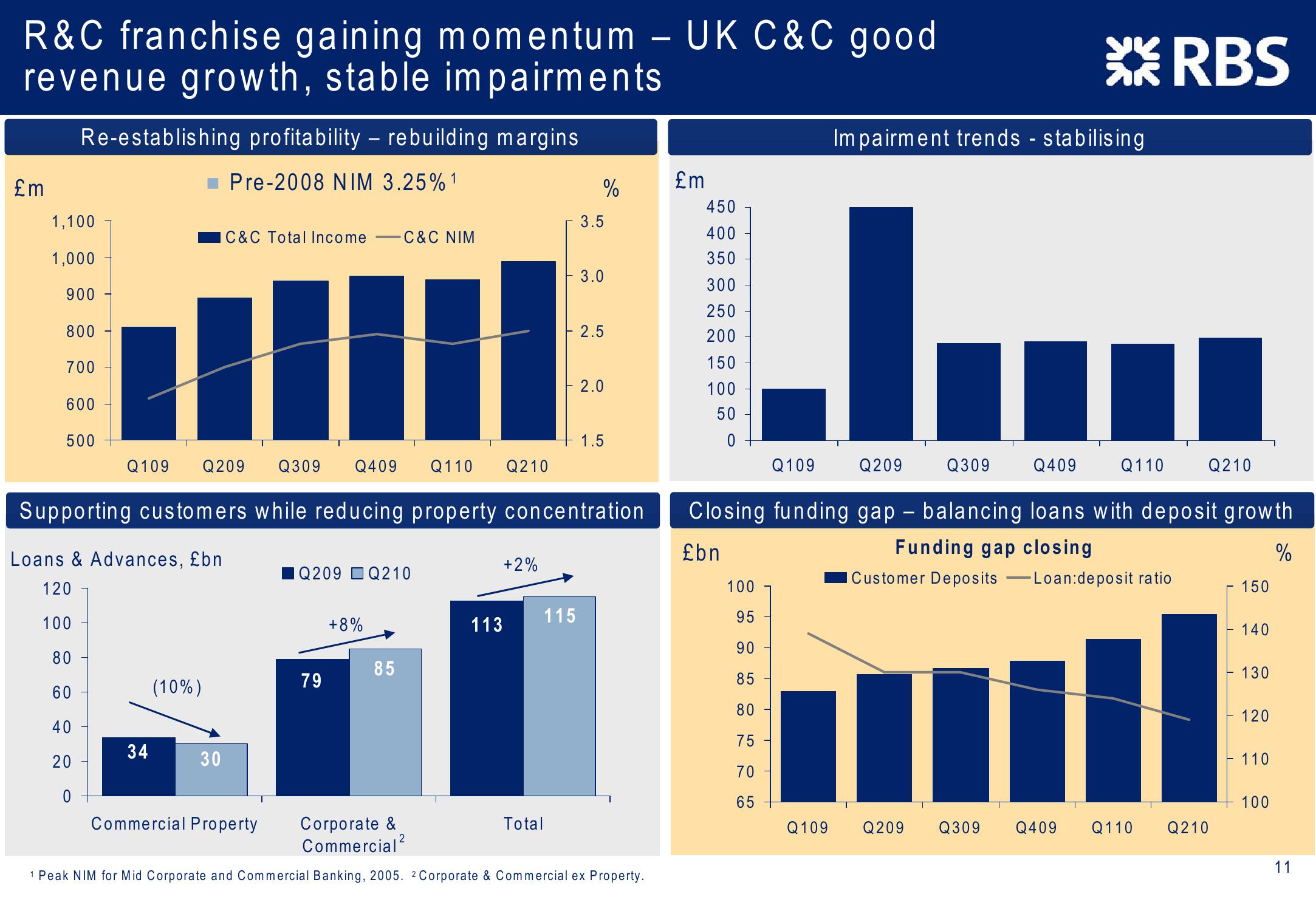

R&C franchise gaining momentum – UK C&C good

revenue growth, stable impairments

Re-establishing profitability - rebuilding margins

Impairment trends - stabilising

RBS

£m

Pre-2008 NIM 3.25% 1

%

£m

450

1,100

3.5

C&C Total Income

C&C NIM

400

1,000

350

3.0

300

900

250

800

2.5

200

700

150

2.0

100

600

50

500

1.5

0

Q109 Q209 Q309 Q409 Q110 Q210

Q109

Q209

Q309

Q409

Q110

Q210

Supporting customers while reducing property concentration

Closing funding gap balancing loans with deposit growth

Loans & Advances, £bn

£bn

+2%

IQ209 Q210

120

100

Funding gap closing

Customer Deposits

%

Loan:deposit ratio

150

100

115

95

+8%

113

140

90

80

85

130

60

(10%)

79

85

80

120

40

75

34

20

30

110

70

65

100

Commercial Property

Corporate &

Commercial2

Total

Q109

Q209

Q309 Q409 Q110 Q210

1 Peak NIM for Mid Corporate and Commercial Banking, 2005. 2 Corporate & Commercial ex Property.

11View entire presentation