First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

FirsTech

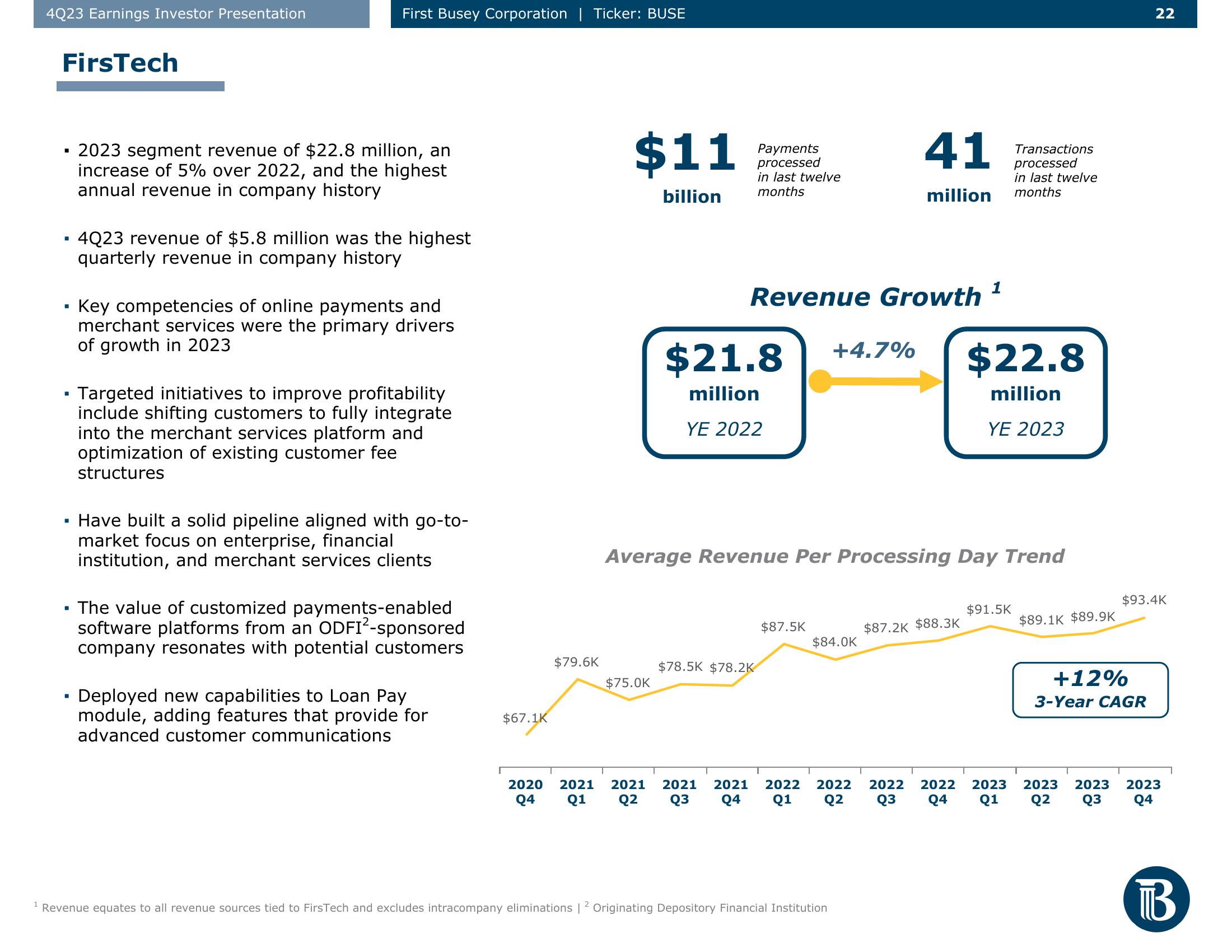

▪ 2023 segment revenue of $22.8 million, an

increase of 5% over 2022, and the highest

annual revenue in company history

First Busey Corporation | Ticker: BUSE

▪ 4Q23 revenue of $5.8 million was the highest

quarterly revenu in company history

■

▪ Targeted initiatives to improve profitability

include shifting customers to fully integrate

into the merchant services platform and

optimization of existing customer fee

structures

■

Key competencies of online payments and

merchant services were the primary drivers

of growth in 2023

Have built a solid pipeline aligned with go-to-

market focus on enterprise, financial

institution, and merchant services clients

The value of customized payments-enabled

software platforms from an ODFI²-sponsored

company resonates with potential customers

▪ Deployed new capabilities to Loan Pay

module, adding features that provide for

advanced customer communications

$67.1K

$79.6K

$11

billion

$75.0K

Payments

processed

in last twelve

months

Revenue Growth ¹

$21.8

million

YE 2022

$78.5K $78.2K

$87.5K

Average Revenue Per Processing Day Trend

2020 2021 2021 2021 2021 2022

Q4 Q1 Q2 Q3 Q4 Q1

+4.7%

41

million

$84.0K

¹ Revenue equates to all revenue sources tied to FirsTech and excludes intracompany eliminations | ² Originating Depository Financial Institution

$87.2K $88.3K

$22.8

million

YE 2023

Transactions

processed

in last twelve

months

$91.5K

2022 2022 2022 2023

Q2 Q3

Q4 Q1

$89.1K $89.9K

+12%

3-Year CAGR

1

22

$93.4K

2023 2023 2023

Q2 ૦૩

Q4

BView entire presentation