OppFi Investor Presentation Deck

32

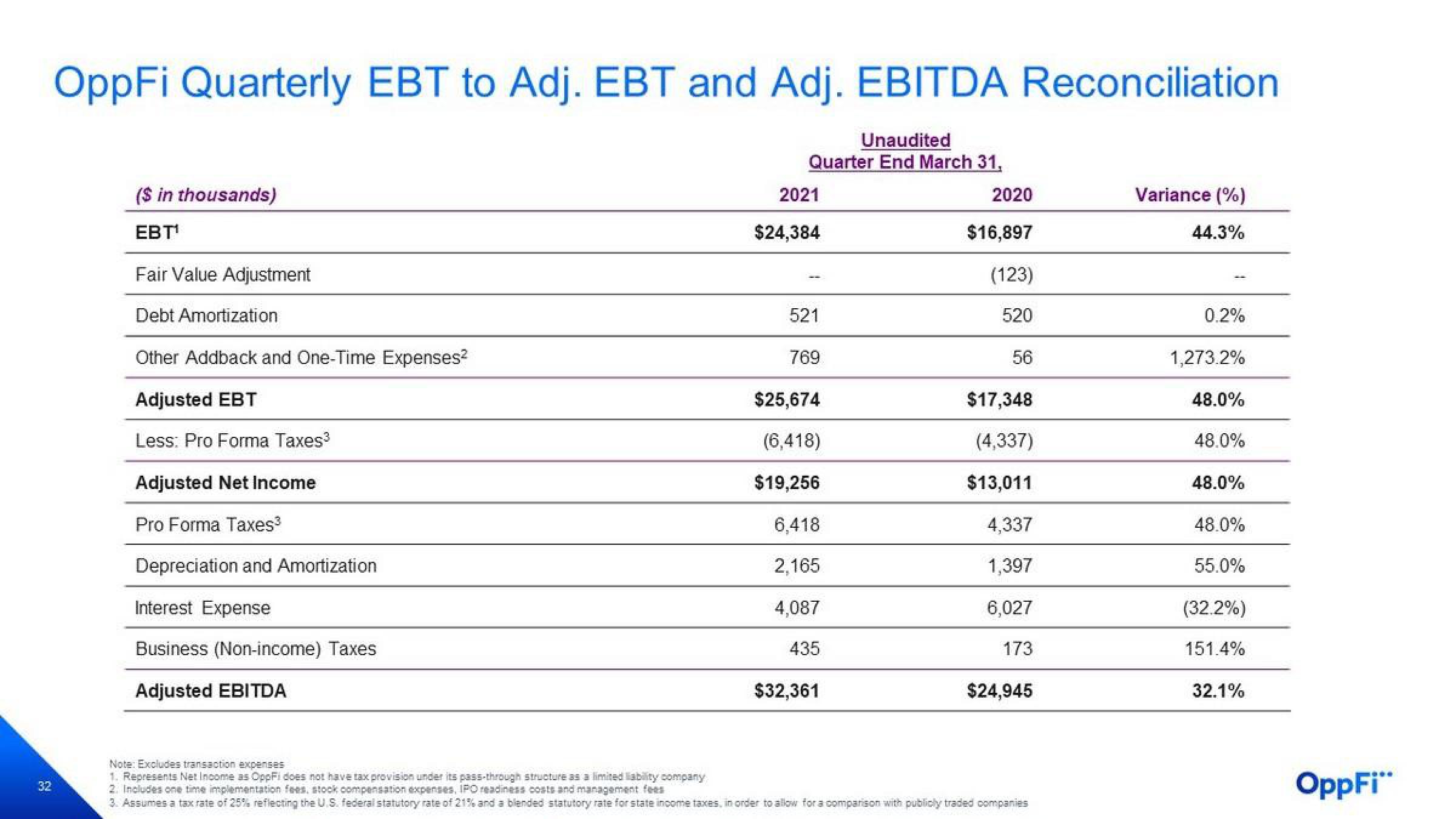

OppFi Quarterly EBT to Adj. EBT and Adj. EBITDA Reconciliation

Unaudited

Quarter End March 31,

($ in thousands)

EBT¹

Fair Value Adjustment

Debt Amortization

Other Addback and One-Time Expenses²

Adjusted EBT

Less: Pro Forma Taxes³

Adjusted Net Income

Pro Forma Taxes³

Depreciation and Amortization

Interest Expense

Business (Non-income) Taxes

Adjusted EBITDA

2021

$24,384

521

769

$25,674

(6,418)

$19,256

6,418

2,165

4,087

435

$32,361

2020

$16,897

(123)

520

56

$17,348

(4,337)

$13,011

4,337

1,397

6,027

173

$24,945

Note: Excludes transaction expenses

1. Represents Net Income as OppFi does not have tax provision under its pass-through structure as a limited liability company

2. Includes one time implementation fees, stock compensation expenses, IPO readiness costs and management fees

3. Assumes a tax rate of 25% reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with publicly traded companies

Variance (%)

44.3%

0.2%

1,273.2%

48.0%

48.0%

48.0%

48.0%

55.0%

(32.2%)

151.4%

32.1%

OppFi"View entire presentation