3Q24 Investor Update

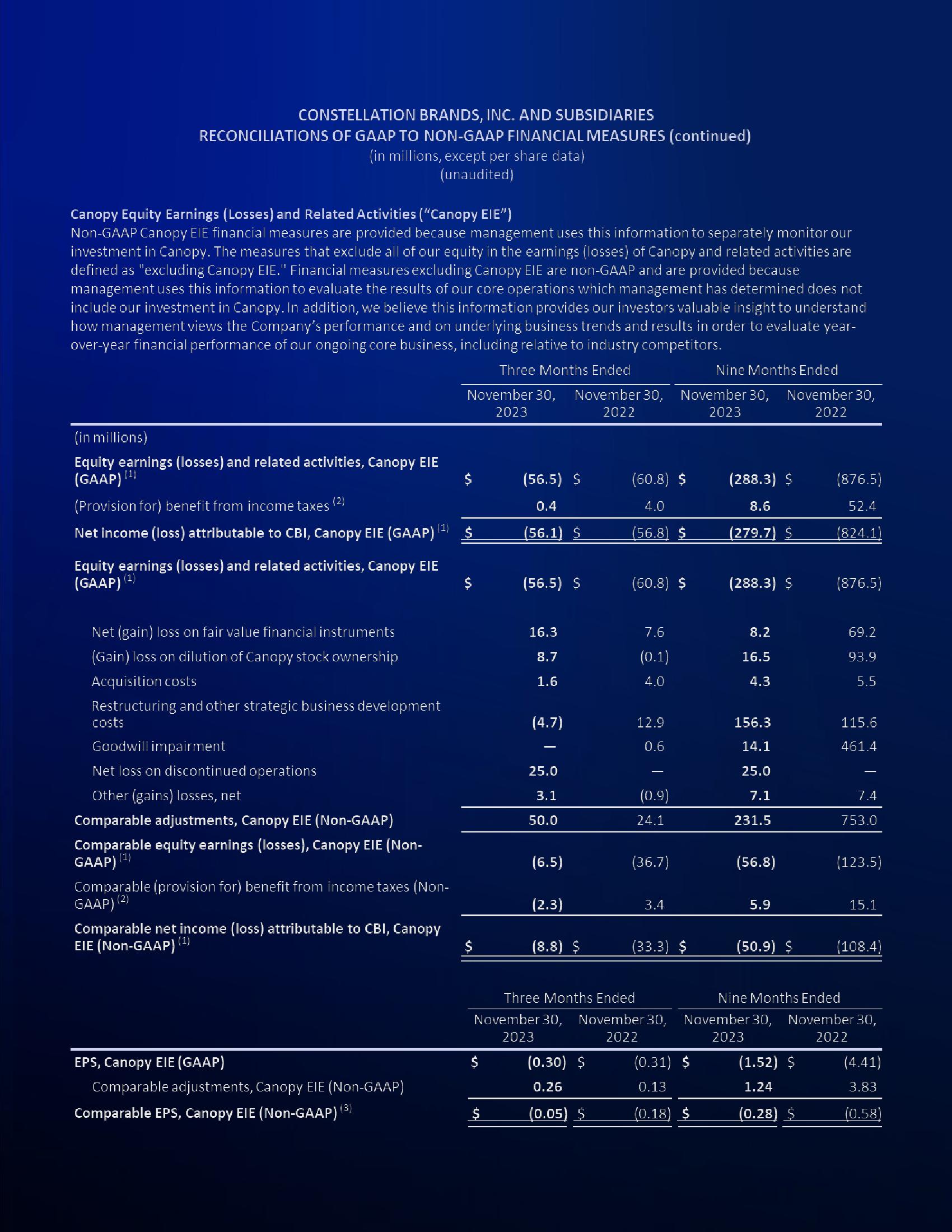

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Canopy Equity Earnings (Losses) and Related Activities ("Canopy EIE")

Non-GAAP Canopy EIE financial measures are provided because management uses this information to separately monitor our

investment in Canopy. The measures that exclude all of our equity in the earnings (losses) of Canopy and related activities are

defined as "excluding Canopy EIE." Financial measures excluding Canopy EIE are non-GAAP and are provided because

management uses this information to evaluate the results of our core operations which management has determined does not

include our investment in Canopy. In addition, we believe this information provides our investors valuable insight to understand

how management views the Company's performance and on underlying business trends and results in order to evaluate year-

over-year financial performance of our ongoing core business, including relative to industry competitors.

Three Months Ended

November 30, November 30,

2023

2022

(in millions)

Equity earnings (losses) and related activities, Canopy EIE

(GAAP) (¹)

(2)

(Provision for) benefit from income taxes

Net income (loss) attributable to CBI, Canopy EIE (GAAP) (¹) $

Equity earnings (losses) and related activities, Canopy EIE

(GAAP) (¹)

Net (gain) loss on fair value financial instruments

(Gain) loss on dilution of Canopy stock ownership

Acquisition costs

Restructuring and other strategic business development

costs

Goodwill impairment

Net loss on discontinued operations

Other (gains) losses, net

Comparable adjustments, Canopy EIE (Non-GAAP)

Comparable equity earnings (losses), Canopy EIE (Non-

GAAP) (¹)

Comparable (provision for) benefit from income taxes (Non-

(2)

GAAP) (2

Comparable net income (loss) attributable to CBI, Canopy

EIE (Non-GAAP) (¹)

EPS, Canopy EIE (GAAP)

Comparable adjustments, Canopy EIE (Non-GAAP)

Comparable EPS, Canopy EIE (Non-GAAP) (3)

(56.5) $

0.4

(56.1) $

$

(56.5) $

16.3

8.7

1.6

(4.7)

25.0

3.1

50.0

(6.5)

(2.3)

(8.8) $

(0.30) $

0.26

(0.05) $

(60.8) $

4.0

(56.8) $

(60.8) $

7.6

(0.1)

4.0

12.9

0.6

(0.9)

24.1

(36.7)

Nine Months Ended

November 30, November 30,

2023

2022

3.4

Three Months Ended

November 30, November 30,

2023

2022

(33.3) $

(288.3) $

8.6

(279.7) $

(0.31) $

0.13

(0.18) $

(288.3) $

8.2

16.5

4.3

156.3

14.1

25.0

7.1

231.5

(56.8)

5.9

(50.9) $

(876.5)

52.4

(824.1)

(1.52) $

1.24

(0.28) $

(876.5)

69.2

93.9

5.5

115.6

461.4

7.4

753.0

(123.5)

15.1

Nine Months Ended

November 30, November 30,

2023

2022

(108.4)

(4.41)

3.83

(0.58)View entire presentation