Deutsche Bank Fixed Income Presentation Deck

Stable deposit base

In € bn, unless stated otherwise

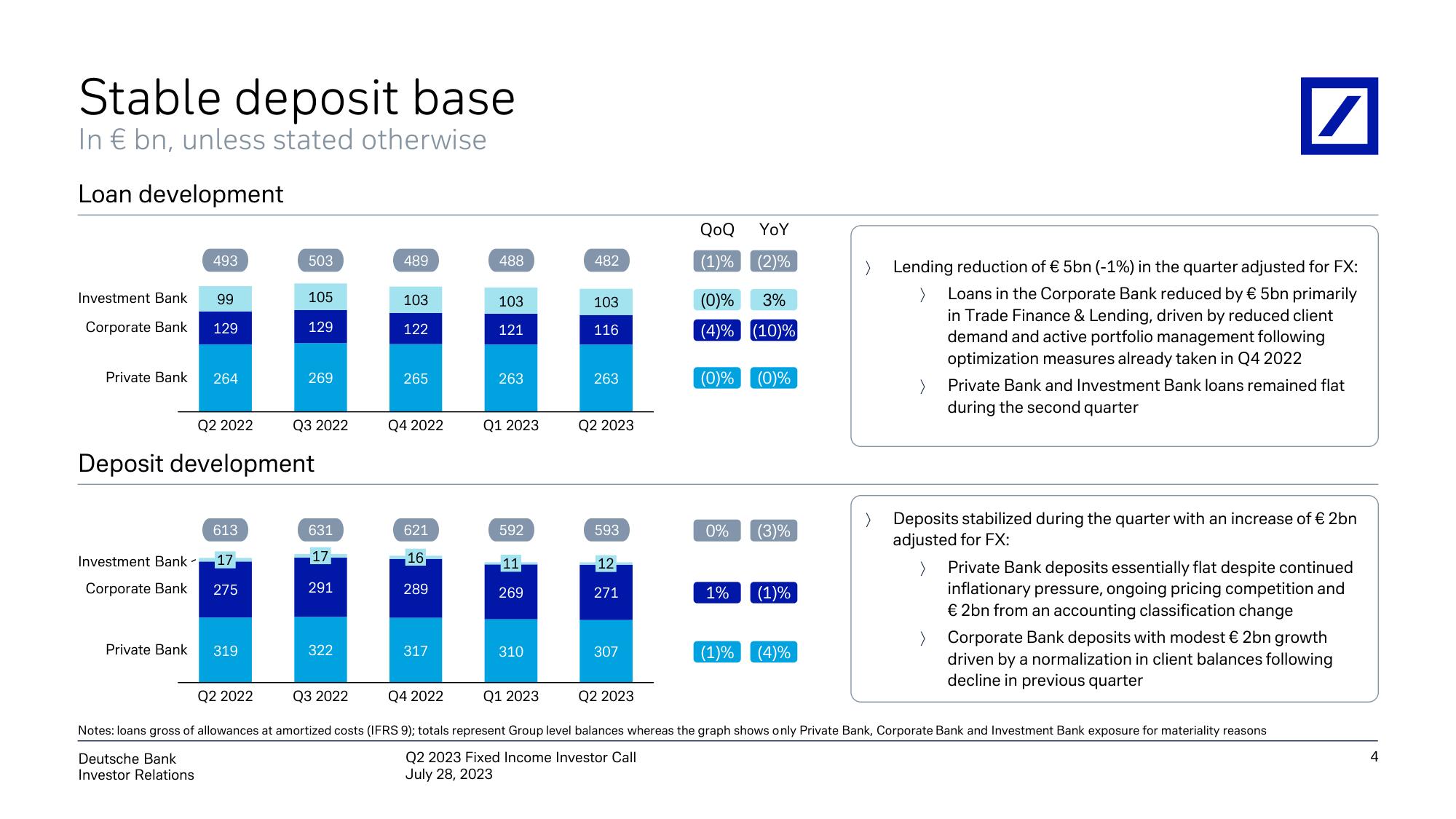

Loan development

493

Investment Bank 99

Corporate Bank 129

Private Bank 264

Q2 2022

613

Investment Bank - 17

Corporate Bank

275

503

Private Bank 319

105

129

269

Deposit development

Q3 2022

631

17

291

322

489

103

122

265

Q4 2022

621

16

289

317

Q4 2022

488

103

121

263

Q1 2023

592

11

269

310

482

103

116

263

Q2 2023

593

12

271

307

QoQ

(1)%

YoY

(2)%

(0)%

3%

(4)% (10)%

(0)% (0)%

0% (3)%

1%

(1)%

(1)% (4)%

>

Lending reduction of € 5bn (-1%) in the quarter adjusted for FX:

Loans in the Corporate Bank reduced by € 5bn primarily

in Trade Finance & Lending, driven by reduced client

demand and active portfolio management following

optimization measures already taken in Q4 2022

>

/

Private Bank and Investment Bank loans remained flat

during the second quarter

Deposits stabilized during the quarter with an increase of € 2bn

adjusted for FX:

Private Bank deposits essentially flat despite continued

inflationary pressure, ongoing pricing competition and

€ 2bn from an accounting classification change

>

Corporate Bank deposits with modest € 2bn growth

driven by a normalization in client balances following

decline in previous quarter

Q2 2022

Q3 2022

Q1 2023

Q2 2023

Notes: loans gross of allowances at amortized costs (IFRS 9); totals represent Group level balances whereas the graph shows only Private Bank, Corporate Bank and Investment Bank exposure for materiality reasons

Deutsche Bank

Q2 2023 Fixed Income Investor Call

Investor Relations

July 28, 2023

4View entire presentation