Deutsche Bank Results Presentation Deck

Commercial Real Estate (CRE)

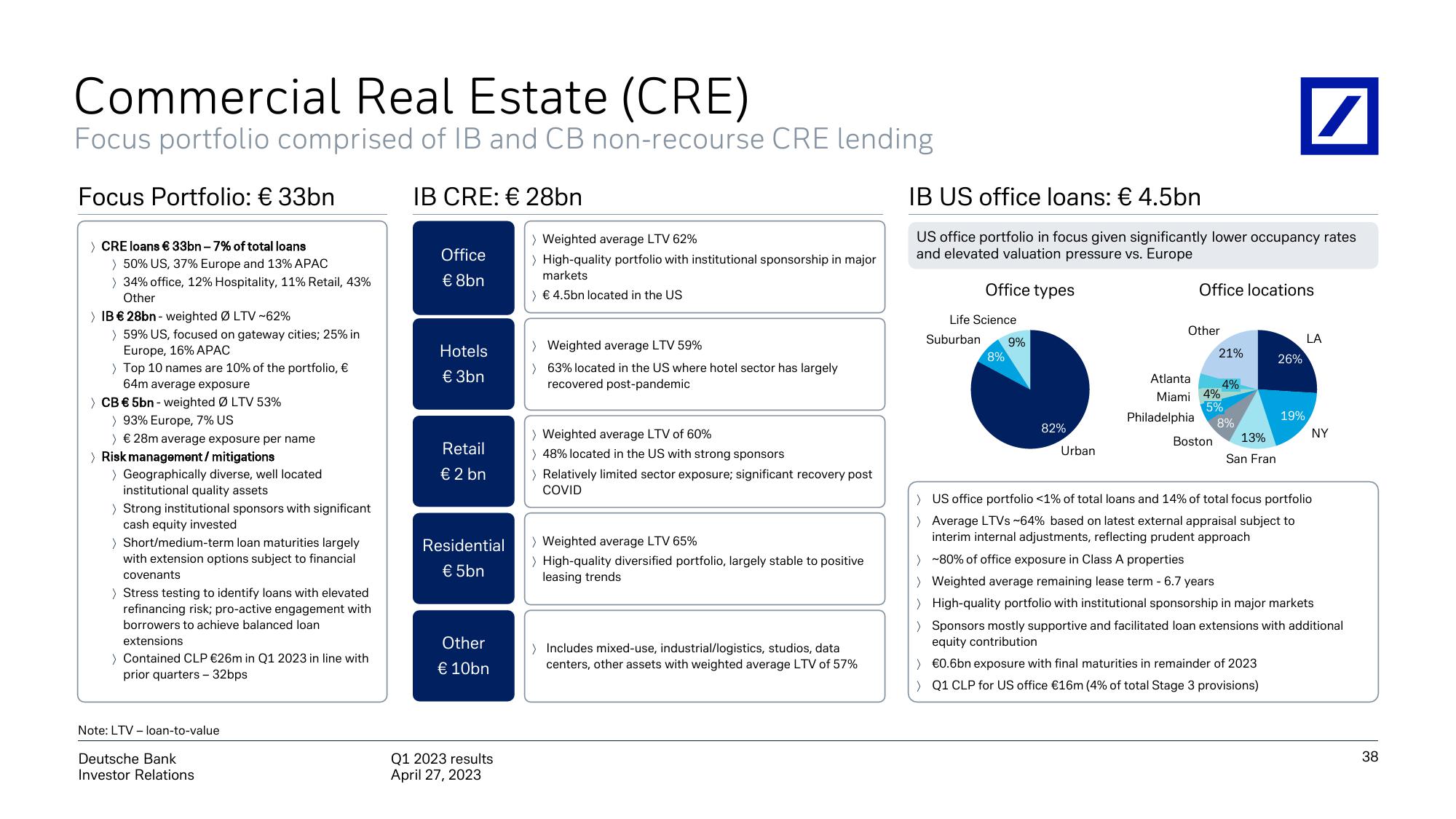

Focus portfolio comprised of IB and CB non-recourse CRE lending

Focus Portfolio: € 33bn

IB CRE: € 28bn

> CRE loans € 33bn -7% of total loans

> 50% US, 37% Europe and 13% APAC

> 34% office, 12% Hospitality, 11% Retail, 43%

Other

> IB € 28bn - weighted ØLTV~62%

> 59% US, focused on gateway cities; 25% in

Europe, 16% APAC

> Top 10 names are 10% of the portfolio, €

64m average exposure

> CB € 5bn - weighted Ø LTV 53%

> 93% Europe, 7% US

> € 28m average exposure per name

> Risk management / mitigations

> Geographically diverse, well located.

institutional quality assets

> Strong institutional sponsors with significant

cash equity invested

> Short/medium-term loan maturities largely

with extension options subject to financial

covenants

> Stress testing to identify loans with elevated

refinancing risk; pro-active engagement with

borrowers to achieve balanced loan

extensions

> Contained CLP €26m in Q1 2023 in line with

prior quarters - 32bps

Note: LTV loan-to-value

Deutsche Bank

Investor Relations

Office

€ 8bn

Hotels

€ 3bn

Retail

€ 2 bn

Residential

€ 5bn

Other

€ 10bn

Q1 2023 results

April 27, 2023

> Weighted average LTV 62%

> High-quality portfolio with institutional sponsorship in major

markets

> € 4.5bn located in the US

> Weighted average LTV 59%

> 63% located in the US where hotel sector has largely

recovered post-pandemic

> Weighted average LTV of 60%

> 48% located in the US with strong sponsors

> Relatively limited sector exposure; significant recovery post

COVID

> Weighted average LTV 65%

> High-quality diversified portfolio, largely stable to positive

leasing trends

> Includes mixed-use, industrial/logistics, studios, data

centers, other assets with weighted average LTV of 57%

IB US office loans: € 4.5bn

US office portfolio in focus given significantly lower occupancy rates

and elevated valuation pressure vs. Europe

Office types

Life Science

Suburban 9%

8%

82%

Urban

Office locations.

Other

21%

Atlanta

4%

Miami 4%

5%

Philadelphia

8%

Boston

13%

San Fran

/

26%

19%

LA

NY

> US office portfolio <1% of total loans and 14% of total focus portfolio

> Average LTVs ~64% based on latest external appraisal subject to

interim internal adjustments, reflecting prudent approach

> ~80% of office exposure in Class A properties

> Weighted average remaining lease term - 6.7 years

> High-quality portfolio with institutional sponsorship in major markets

> Sponsors mostly supportive and facilitated loan extensions with additional

equity contribution

> €0.6bn exposure with final maturities in remainder of 2023

> Q1 CLP for US office €16m (4% of total Stage 3 provisions)

38View entire presentation