Investing in Private Credit

Corporate lending

Long term partnership

Theme: Leverage PIMCO's breadth and depth of capital to meet borrowers where they are

Investment background

PIMCO is one of the largest active fixed income managers globally, managing $2.2 trillion across the risk/return spectrum

Our breadth and depth of capital allow us to provide financings to companies ranging from mid-market all the way to large cap

This means that PIMCO has the unique ability to serve as a holistic and long term partner to borrowers through time as they grow from private

middle market borrowers to tapping capital markets as IG issuers

Our business model does not focus on "loan-to-own" strategies but rather emphasizes long-term constructive lending partnerships

●

Stock Price ($)

$45

$40

$35

$30

$25

$20

$15

$10

$5

$0

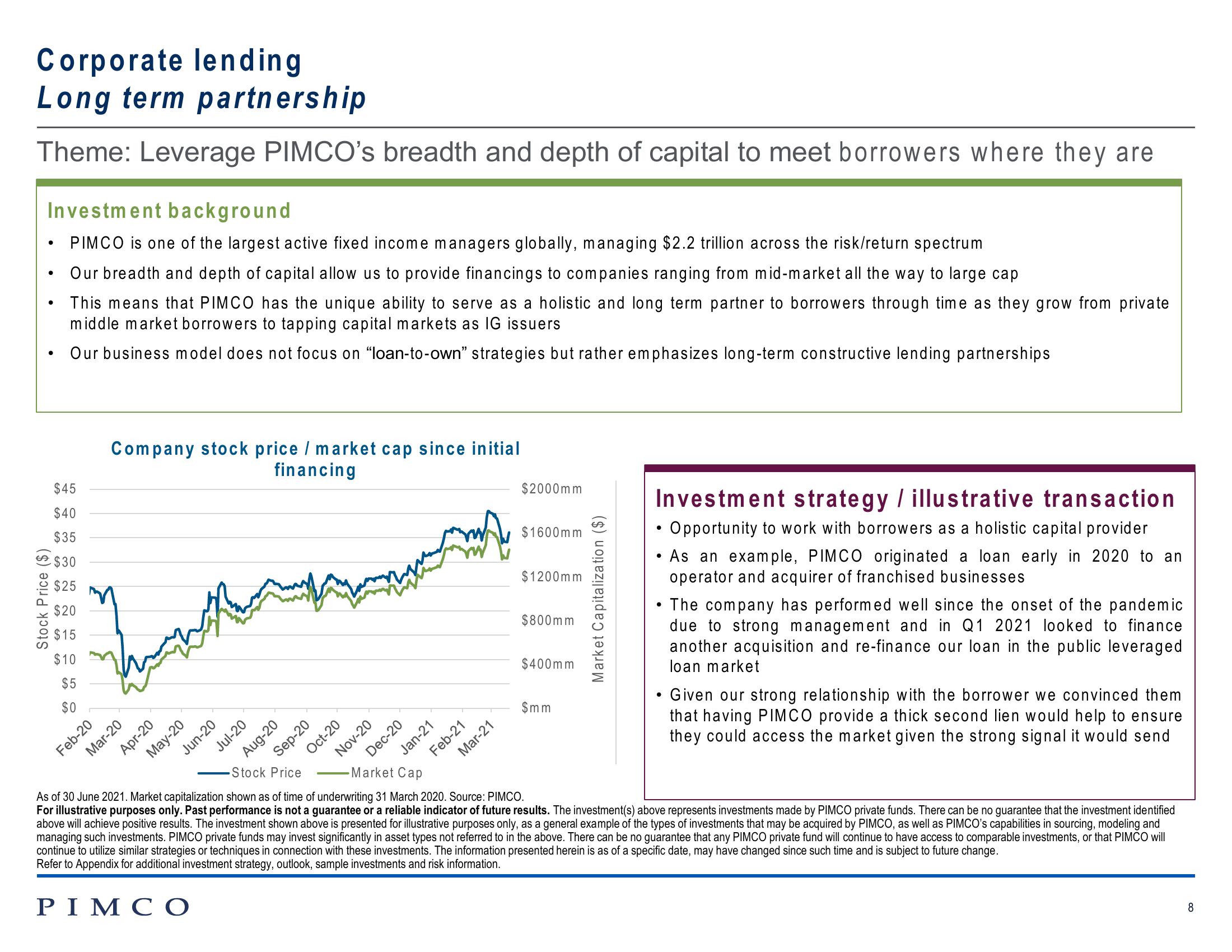

Company stock price / market cap since initial

financing

M

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Mar-21

$2000mm

CFeb-21

$1600mm

$1200mm

$800mm

$400mm

$mm

Market Capitalization ($)

Investment strategy / illustrative transaction

• Opportunity to work with borrowers as a holistic capital provider

• As an example, PIMCO originated a loan early in 2020 to an

operator and acquirer of franchised businesses

• The company has performed well since the onset of the pandemic

due to strong management and in Q1 2021 looked to finance

another acquisition and re-finance our loan in the public leveraged

loan market

Given our strong relationship with the borrower we convinced them

that having PIMCO provide a thick second lien would help to ensure

they could access the market given the strong signal it would send

- Stock Price

-Market Cap

As of 30 June 2021. Market capitalization shown as of time of underwriting 31 March 2020. Source: PIMCO.

For illustrative purposes only. Past performance is not a guarantee or a reliable indicator of future results. The investment(s) above represents investments made by PIMCO private funds. There can be no guarantee that the investment identified

above will achieve positive results. The investment shown above is presented for illustrative purposes only, as a general example of the types of investments that may be acquired by PIMCO, as well as PIMCO's capabilities in sourcing, modeling and

managing such investments. PIMCO private funds may invest significantly in asset types not referred to in the above. There can be no guarantee that any PIMCO private fund will continue to have access to comparable investments, or that PIMCO will

continue to utilize similar strategies or techniques in connection with these investments. The information presented herein is as of a specific date, may have changed since such time and is subject to future change.

Refer to Appendix for additional investment strategy, outlook, sample investments and risk information.

PIMCO

8View entire presentation