HSBC Investor Day Presentation Deck

UK WPB snapshot

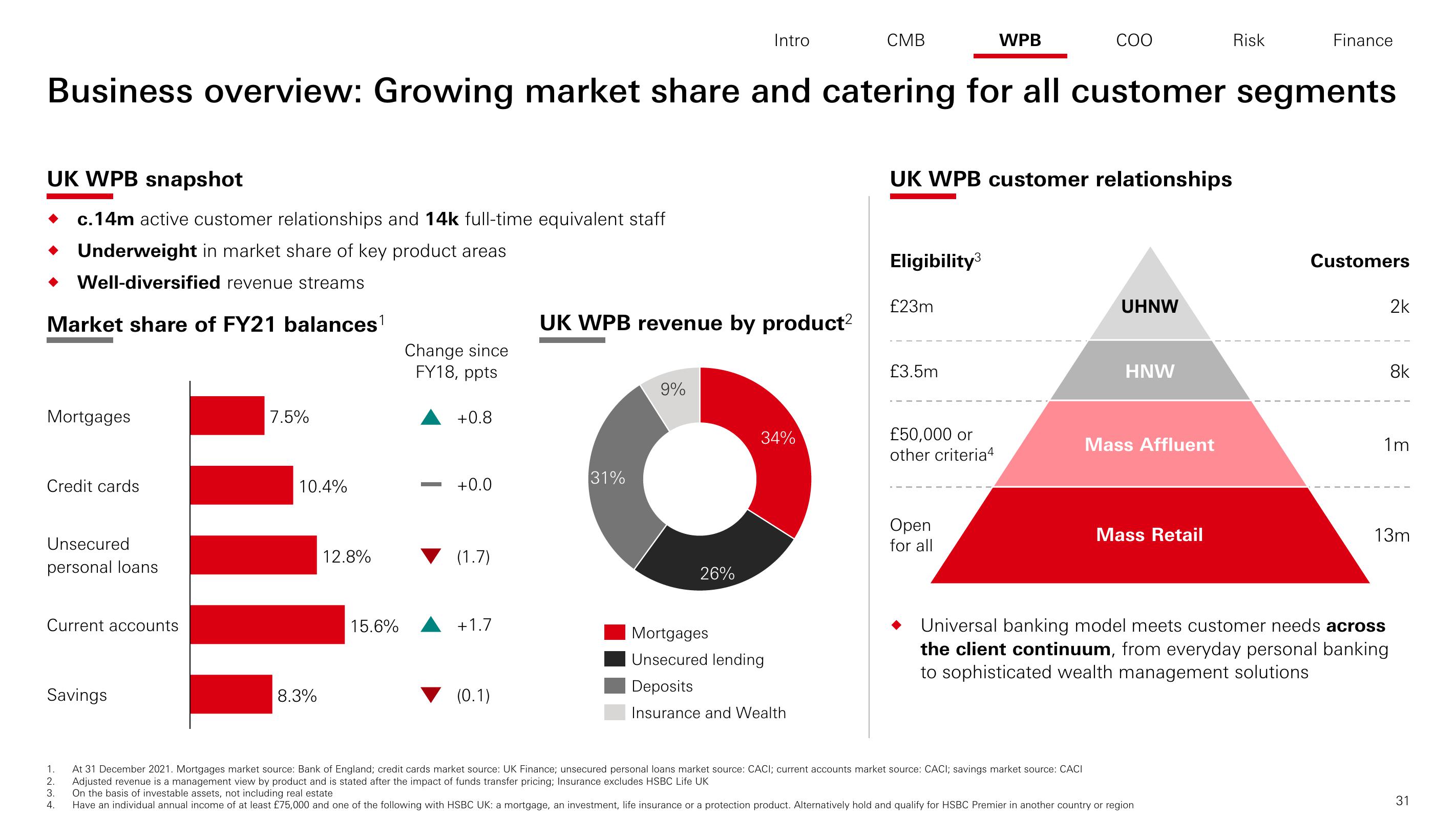

c.14m active customer relationships and 14k full-time equivalent staff

◆ Underweight in market share of key product areas

Well-diversified revenue streams

Market share of FY21 balances¹

Mortgages

Credit cards

Unsecured

personal loans

Current accounts

Business overview: Growing market share and catering for all customer segments

Savings

1.

2.

3.

4.

7.5%

10.4%

8.3%

12.8%

15.6%

Change since

FY18, ppts

+0.8

+0.0

(1.7)

+1.7

(0.1)

UK WPB revenue by product²

31%

Intro

9%

26%

34%

CMB

Mortgages

Unsecured lending

Deposits

Insurance and Wealth

Eligibility³

UK WPB customer relationships

£23m

£3.5m

WPB

£50,000 or

other criteria4

COO

Open

for all

UHNW

HNW

Mass Affluent

Mass Retail

Risk

Finance

At 31 December 2021. Mortgages market source: Bank of England; credit cards market source: UK Finance; unsecured personal loans market source: CACI; current accounts market source: CACI; savings market source: CACI

Adjusted revenue is a management view by product and is stated after the impact of funds transfer pricing; Insurance excludes HSBC Life UK

On the basis of investable assets, not including real estate

Have an individual annual income of at least £75,000 and one of the following with HSBC UK: a mortgage, an investment, life insurance or a protection product. Alternatively hold and qualify for HSBC Premier in another country or region

Customers

2k

Universal banking model meets customer needs across

the client continuum, from everyday personal banking

to sophisticated wealth management solutions

8k

1m

13m

31View entire presentation