AngloAmerican Results Presentation Deck

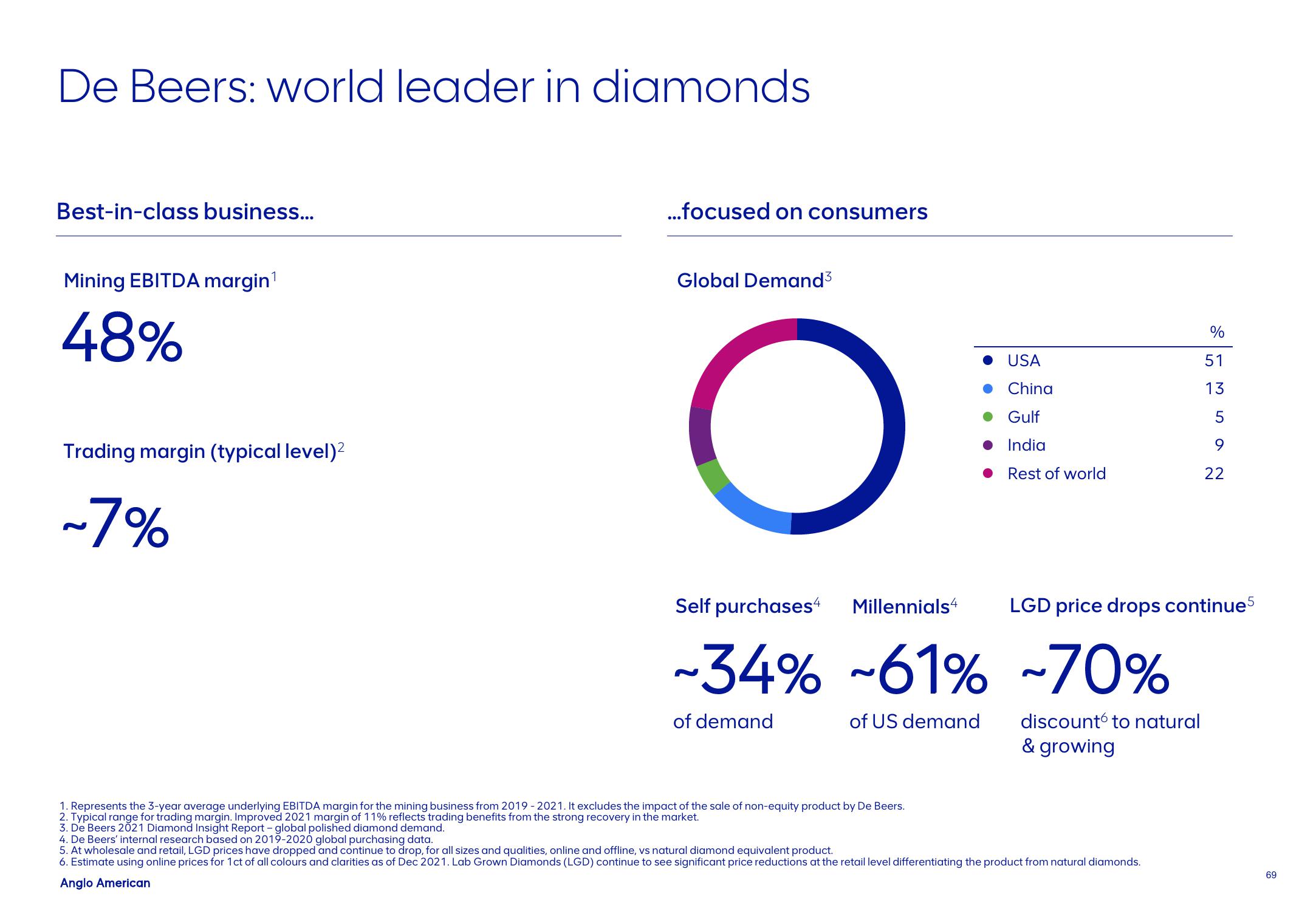

De Beers: world leader in diamonds

Best-in-class business...

Mining EBITDA margin¹

48%

Trading margin (typical level)²

~7%

...focused on consumers

Global Demand³

Millennials4

USA

China

Gulf

India

● Rest of world

Self purchases4

~34% -61% ~70%

of demand

of US demand

1. Represents the 3-year average underlying EBITDA margin for the mining business from 2019-2021. It excludes the impact of the sale of non-equity product by De Beers.

2. Typical range for trading margin. Improved 2021 margin of 11% reflects trading benefits from the strong recovery in the market.

3. De Beers 2021 Diamond Insight Report - global polished diamond demand.

discount to natural

& growing

%

4. De Beers' internal research based on 2019-2020 global purchasing data.

5. At wholesale and retail, LGD prices have dropped and continue to drop, for all sizes and qualities, online and offline, vs natural diamond equivalent product.

6. Estimate using online prices for 1 ct of all colours and clarities as of Dec 2021. Lab Grown Diamonds (LGD) continue to see significant price reductions at the retail level differentiating the product from natural diamonds.

Anglo American

53592

51

LGD price drops continue5

13

22

69View entire presentation