RELX Investor Day Presentation Deck

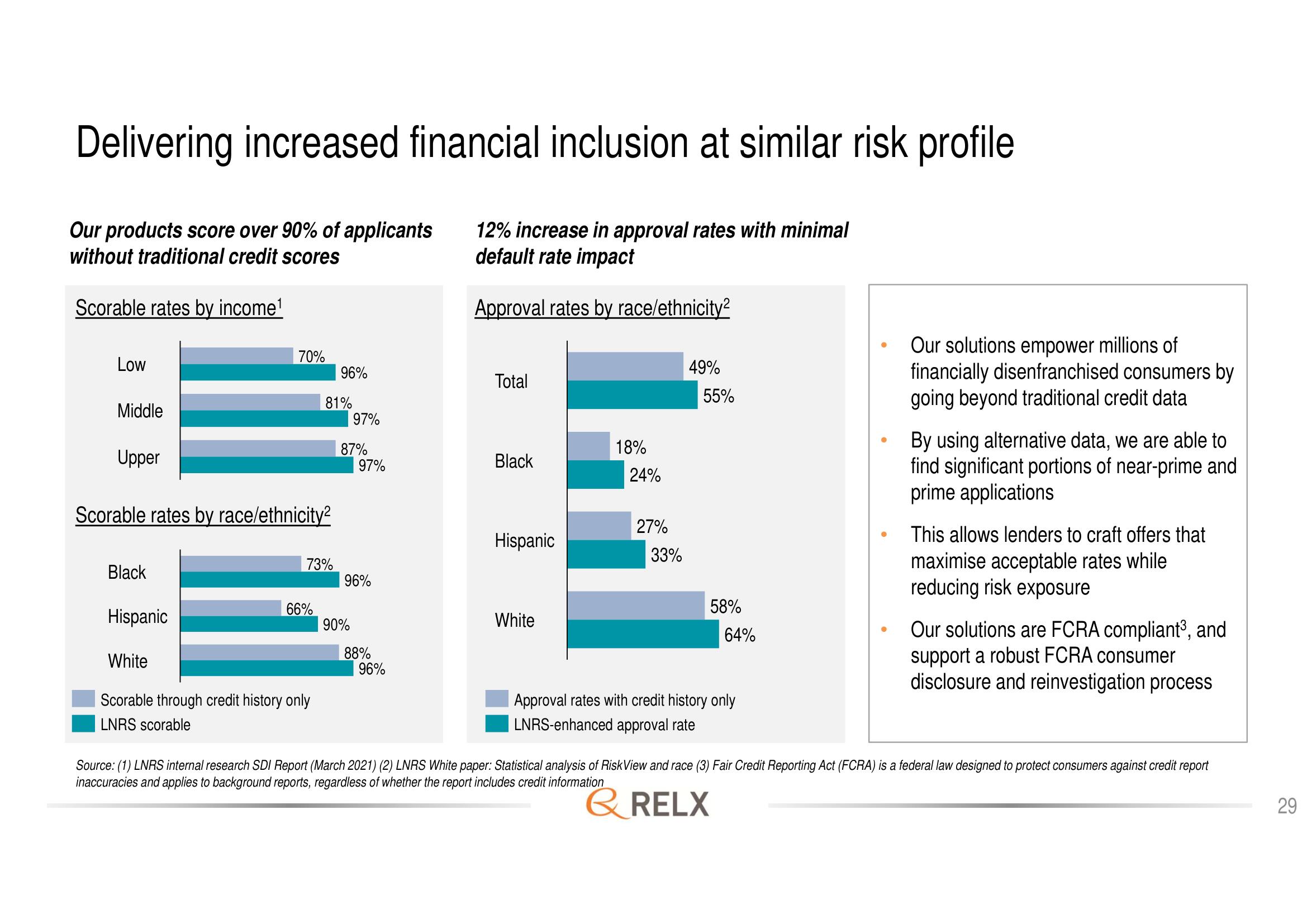

Delivering increased financial inclusion at similar risk profile

Our products score over 90% of applicants

without traditional credit scores

12% increase in approval rates with minimal

default rate impact

Scorable rates by income¹

Approval rates by race/ethnicity²

Low

Middle

Upper

Black

70%

Scorable rates by race/ethnicity²

Hispanic

73%

66%

81%

White

Scorable through credit history only

LNRS scorable

96%

97%

87%

90%

97%

96%

88%

96%

Total

Black

Hispanic

White

18%

24%

27%

33%

49%

55%

58%

64%

Approval rates with credit history only

LNRS-enhanced approval rate

Our solutions empower millions of

financially disenfranchised consumers by

going beyond traditional credit data

By using alternative data, we are able to

find significant portions of near-prime and

prime applications

This allows lenders to craft offers that

maximise acceptable rates while

reducing risk exposure

Our solutions are FCRA compliant³, and

support a robust FCRA consumer

disclosure and reinvestigation process

Source: (1) LNRS internal research SDI Report (March 2021) (2) LNRS White paper: Statistical analysis of RiskView and race (3) Fair Credit Reporting Act (FCRA) is a federal law designed to protect consumers against credit report

inaccuracies and applies to background reports, regardless of whether the report includes credit information

& RELX

29View entire presentation