Building a Leading P&C Insurer

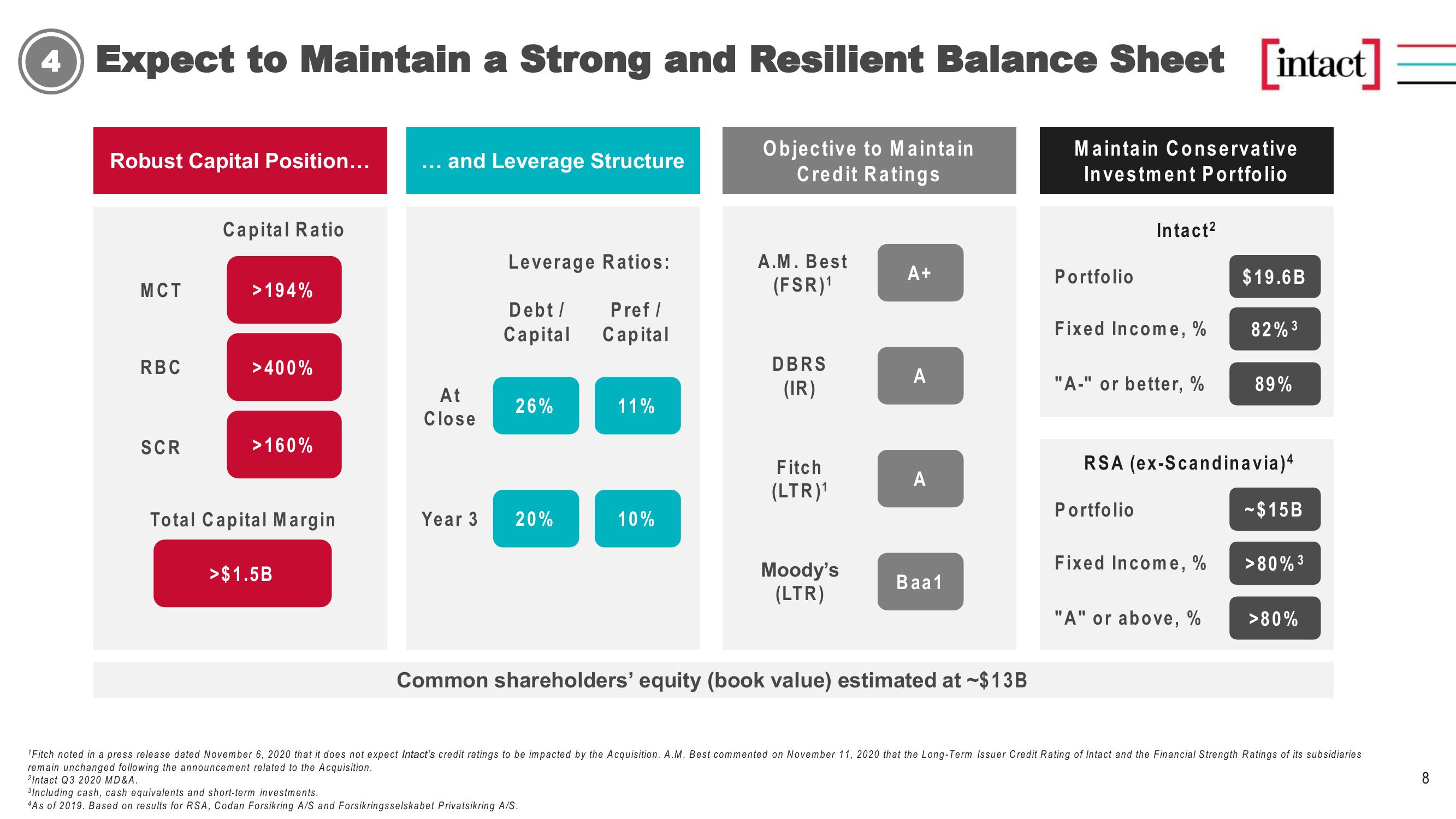

4 Expect to Maintain a Strong and Resilient Balance Sheet [intact

Objective to Maintain

Credit Ratings

Robust Capital Position... ... and Leverage Structure

MCT

RBC

SCR

Capital Ratio

>194%

>400%

>160%

Total Capital Margin

>$1.5B

At

Close

Year 3

Leverage Ratios:

Debt /

Capital

26%

20%

Pref/

Capital

11%

3Including cash, cash equivalents and short-term investments.

4As of 2019. Based on results for RSA, Codan Forsikring A/S and Forsikringsselskabet Privatsikring A/S.

10%

A.M. Best

(FSR)1

DBRS

(IR)

Fitch

(LTR)¹

Moody's

(LTR)

A+

A

A

Baa1

Common shareholders' equity (book value) estimated at -$13B

Maintain Conservative

Investment Portfolio

Portfolio

Intact²

Fixed Income, %

"A-" or better, %

Portfolio

Fixed Income, %

$19.6B

RSA (ex-Scandinavia) 4

-$15B

"A" or above, %

82% ³

89%

>80% ³

>80%

¹Fitch noted in a press release dated November 6, 2020 that it does not expect Intact's credit ratings to be impacted by the Acquisition. A.M. Best commented on November 11, 2020 that the Long-Term Issuer Credit Rating of Intact and the Financial Strength Ratings of its subsidiaries

remain unchanged following the announcement related to the Acquisition.

2Intact Q3 2020 MD&A.

8View entire presentation