Melrose Mergers and Acquisitions Presentation Deck

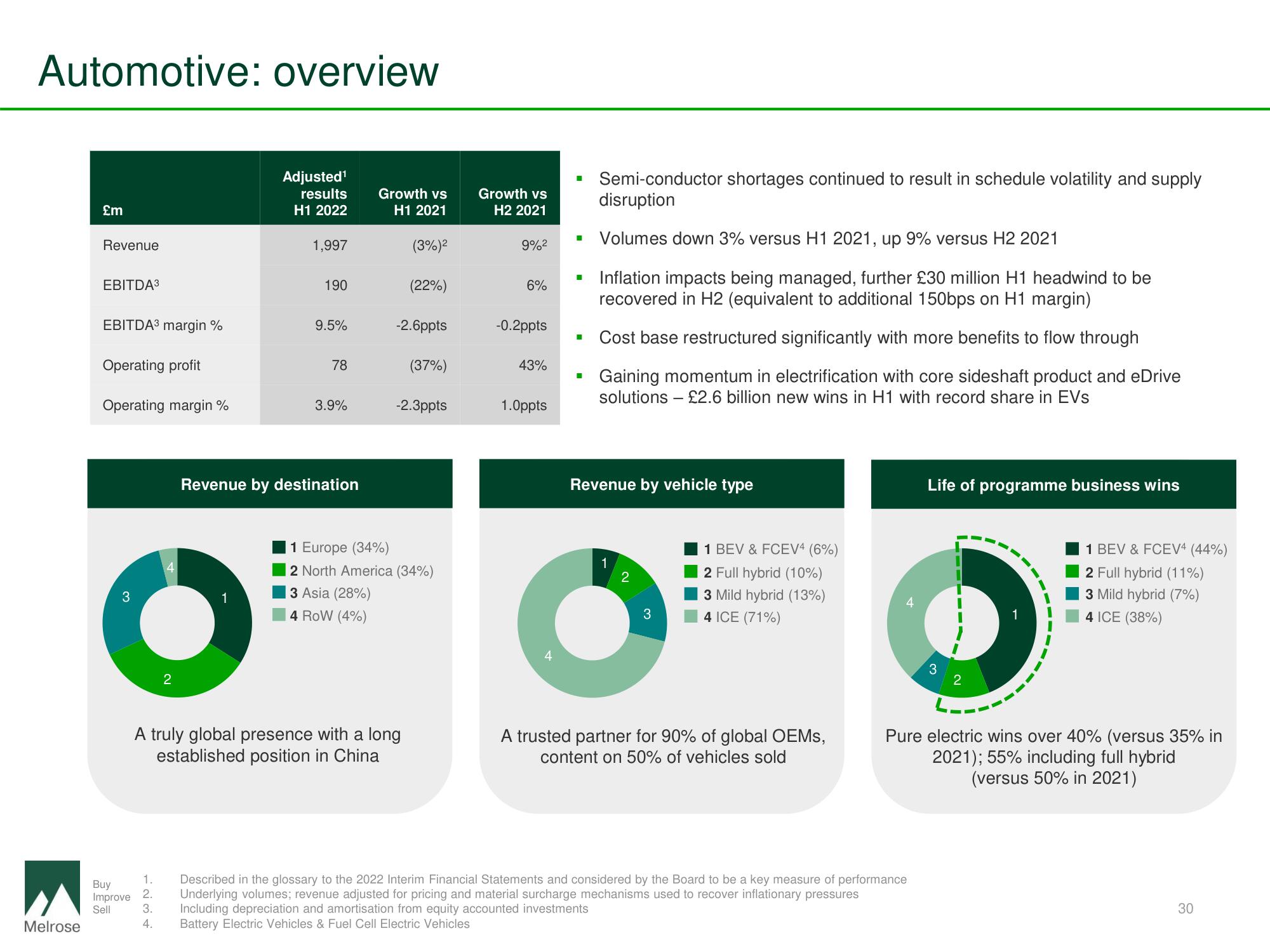

Automotive: overview

Melrose

£m

Revenue

EBITDA³

EBITDA3 margin %

Operating profit

Operating margin %

3

1

O

2

Adjusted¹

results

H1 2022

1.

Buy

Improve 2.

Sell

3.

4.

1,997

190

9.5%

78

3.9%

Revenue by destination

Growth vs

H1 2021

(3%)²

(22%)

-2.6ppts

A truly global presence with a long

established position in China

(37%)

-2.3ppts

Europe (34%)

North America (34%)

3 Asia (28%)

4 ROW (4%)

Growth vs

H2 2021

9%²

6%

-0.2ppts

43%

1.0ppts

■

Semi-conductor shortages continued to result in schedule volatility and supply

disruption

Volumes down 3% versus H1 2021, up 9% versus H2 2021

Inflation impacts being managed, further £30 million H1 headwind to be

recovered in H2 (equivalent to additional 150bps on H1 margin)

Cost base restructured significantly with more benefits to flow through

Gaining momentum in electrification with core sideshaft product and eDrive

solutions - £2.6 billion new wins in H1 with record share in EVs

Revenue by vehicle type

1

2

3

1 BEV & FCEV4 (6%)

2 Full hybrid (10%)

3 Mild hybrid (13%)

4 ICE (71%)

A trusted partner for 90% of global OEMs,

content on 50% of vehicles sold

Life of programme business wins

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Underlying volumes; revenue adjusted for pricing and material surcharge mechanisms used to recover inflationary pressures

Including depreciation and amortisation from equity accounted investments

Battery Electric Vehicles & Fuel Cell Electric Vehicles

3

2

1 BEV & FCEV4 (44%)

2 Full hybrid (11%)

3 Mild hybrid (7%)

4 ICE (38%)

Pure electric wins over 40% (versus 35% in

2021); 55% including full hybrid

(versus 50% in 2021)

30View entire presentation