Main Street Capital Investor Day Presentation Deck

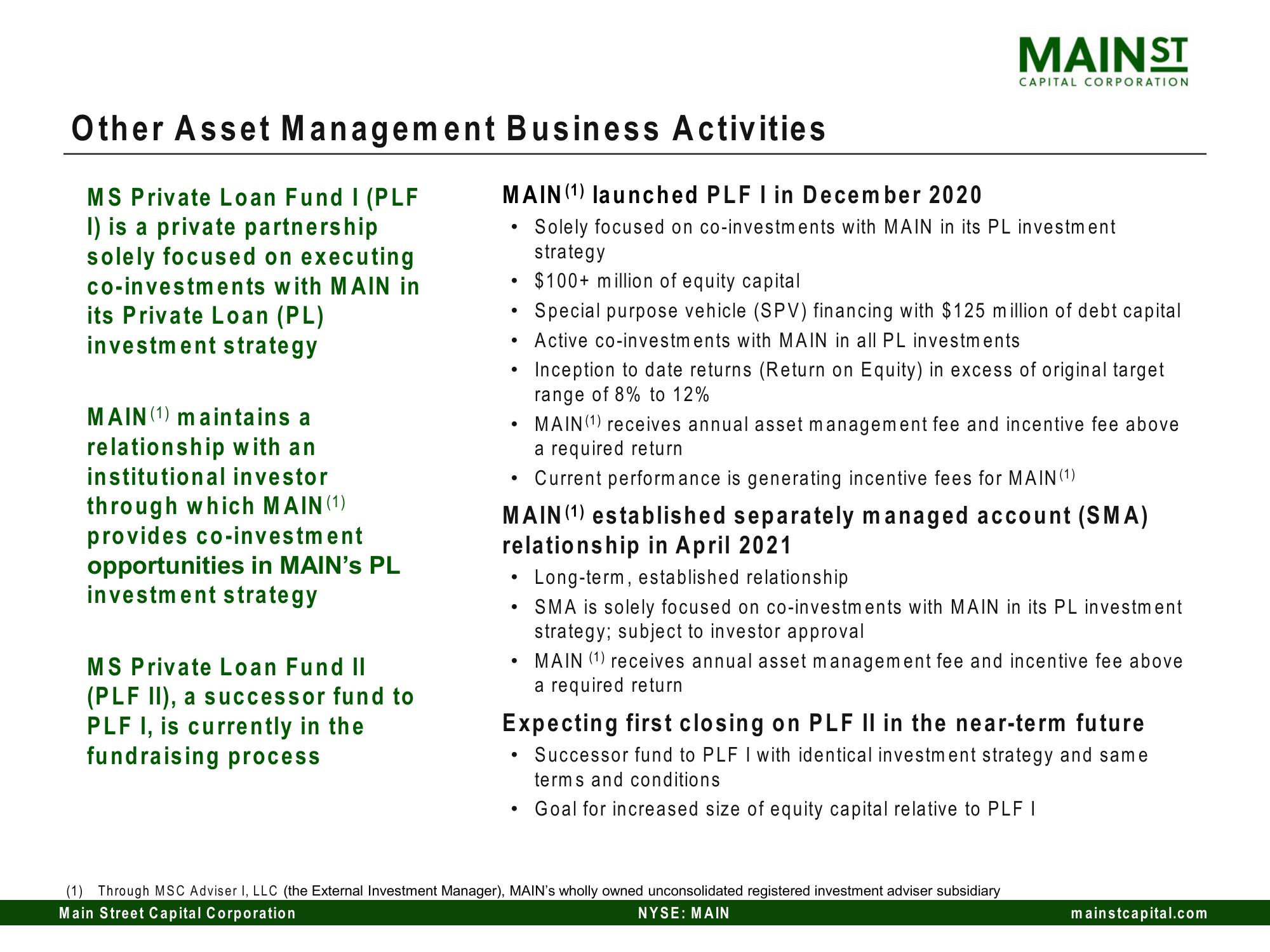

Other Asset Management Business Activities

MS Private Loan Fund I (PLF

I) is a private partnership

solely focused on executing

co-investments with MAIN in

its Private Loan (PL)

investment strategy

MAIN (1) maintains a

relationship with an

institutional investor

through which MAIN (1)

provides co-investment

opportunities in MAIN's PL

investment strategy

MS Private Loan Fund II

(PLF II), a successor fund to

PLF I, is currently in the

fundraising process

●

MAIN (1) launched PLF I in December 2020

Solely focused on co-investments with MAIN in its PL investment

strategy

●

• $100+ million of equity capital

●

Special purpose vehicle (SPV) financing with $125 million of debt capital

Active co-investments with MAIN in all PL investments

●

●

●

●

●

●

MAIN ST

MAIN (1) established separately managed account (SMA)

relationship in April 2021

CAPITAL CORPORATION

●

●

Inception to date returns (Return on Equity) in excess of original target

range of 8% to 12%

MAIN (1) receives annual asset management fee and incentive fee above

a required return

Current performance is generating incentive fees for MAIN (¹)

Long-term, established relationship

SMA is solely focused on co-investments with MAIN in its PL investment

strategy; subject to investor approval

Expecting first closing on PLF II in the near-term future

Successor fund to PLF I with identical investment strategy and same

terms and conditions

Goal for increased size of equity capital relative to PLF I

MAIN (1) receives annual asset management fee and incentive fee above

a required return

(1) Through MSC Adviser I, LLC (the External Investment Manager), MAIN's wholly owned unconsolidated registered investment adviser subsidiary

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation