Maersk Investor Presentation Deck

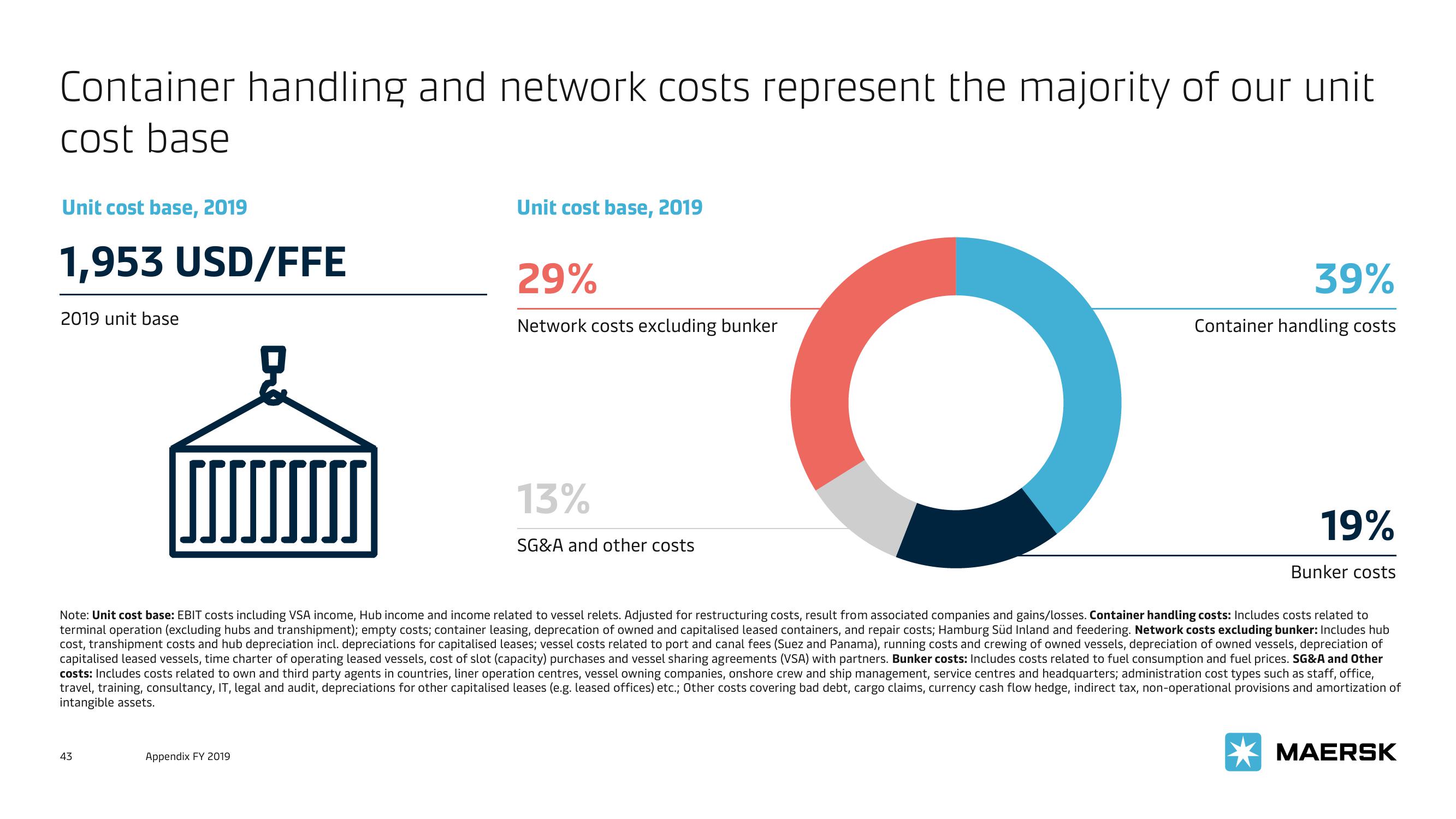

Container handling and network costs represent the majority of our unit

cost base

Unit cost base, 2019

1,953 USD/FFE

2019 unit base

43

Unit cost base, 2019

2

Note: Unit cost base: EBIT costs including VSA income, Hub income and income related to vessel relets. Adjusted for restructuring costs, result from associated companies and gains/losses. Container handling costs: Includes costs related to

terminal operation (excluding hubs and transhipment); empty costs; container leasing, deprecation of owned and capitalised leased containers, and repair costs; Hamburg Süd Inland and feedering. Network costs excluding bunker: Includes hub

cost, transhipment costs and hub depreciation incl. depreciations for capitalised leases; vessel costs related to port and canal fees (Suez and Panama), running costs and crewing of owned vessels, depreciation of owned vessels, depreciation of

capitalised leased vessels, time charter of operating leased vessels, cost of slot (capacity) purchases and vessel sharing agreements (VSA) with partners. Bunker costs: Includes costs related to fuel consumption and fuel prices. SG&A and Other

costs: Includes costs related to own and third party agents in countries, liner operation centres, vessel owning companies, onshore crew and ship management, service centres and headquarters; administration cost types such as staff, office,

travel, training, consultancy, IT, legal and audit, depreciations for other capitalised leases (e.g. leased offices) etc.; Other costs covering bad debt, cargo claims, currency cash flow hedge, indirect tax, non-operational provisions and amortization of

intangible assets.

Appendix FY 2019

29%

Network costs excluding bunker

13%

39%

Container handling costs

SG&A and other costs

19%

Bunker costs

MAERSKView entire presentation