GMS Results Presentation Deck

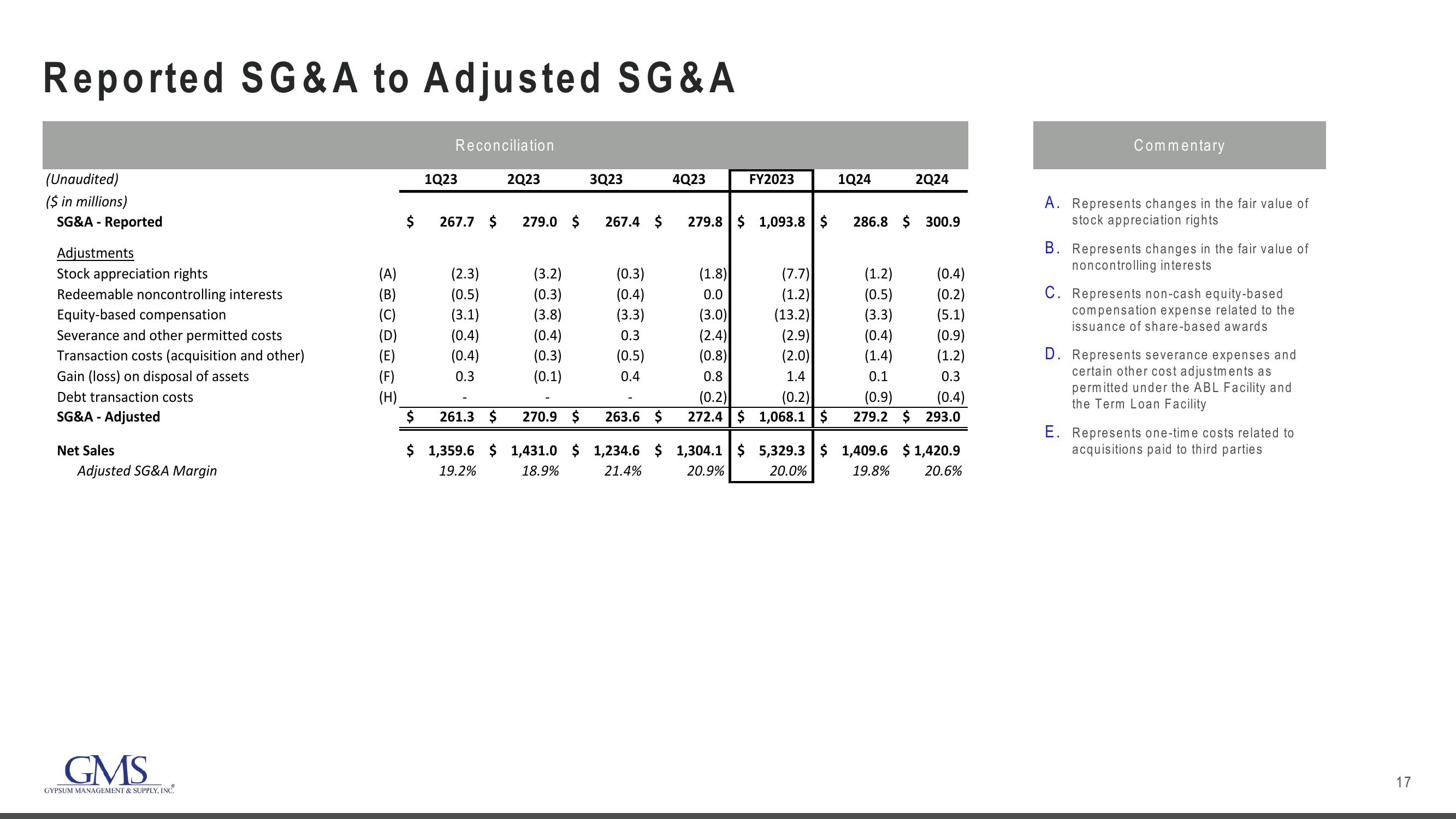

Reported SG&A to Adjusted SG&A

(Unaudited)

($ in millions)

SG&A - Reported

Adjustments

Stock appreciation rights

Redeemable noncontrolling interests

Equity-based compensation

Severance and other permitted costs

Transaction costs (acquisition and other)

Gain (loss) on disposal of assets

Debt transaction costs

SG&A - Adjusted

Net Sales

Adjusted SG&A Margin

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

(A)

(B)

(C)

(D)

(H)

$

$

$

Reconciliation

1Q23

267.7 $

(2.3)

(0.5)

(3.1)

(0.4)

(0.4)

0.3

261.3 $

1,359.6 $

19.2%

2Q23

279.0 $

(3.2)

(0.3)

(3.8)

(0.4)

(0.3)

(0.1)

270.9 $

1,431.0 $

18.9%

3Q23

267.4 $

(0.3)

(0.4)

(3.3)

0.3

(0.5)

0.4

263.6 $

1,234.6 $

21.4%

4Q23

FY2023

(1.8)

0.0

(3.0)

(2.4)

(0.8)

0.8

279.8 $1,093.8 $ 286.8 $ 300.9

(7.7)

(1.2)

(13.2)

(2.9)

(2.0)

1.4

(0.2)

(0.2)

272.4 $ 1,068.1 $

1Q24

1,304.1 $ 5,329.3 $

20.9%

20.0%

(1.2)

(0.5)

(3.3)

2Q24

(0.4)

(0.2)

(5.1)

(0.4)

(0.9)

(1.4)

(1.2)

0.1

0.3

(0.9) (0.4)

279.2 $293.0

1,409.6

19.8%

$ 1,420.9

20.6%

Commentary

A. Represents changes in the fair value of

stock appreciation rights

B. Represents changes in the fair value of

noncontrolling interests

C. Represents non-cash equity-based

compensation expense related to the

issuance of share-based awards

D. Represents severance expenses and

certain other cost adjustments as

permitted under the ABL Facility and

the Term Loan Facility

E. Represents one-time costs related to

acquisitions paid to third parties

17View entire presentation