Tudor, Pickering, Holt & Co Investment Banking

(in millions, unless otherwise noted)

AR Base Case

(1)

(2)

GO

140

(9)

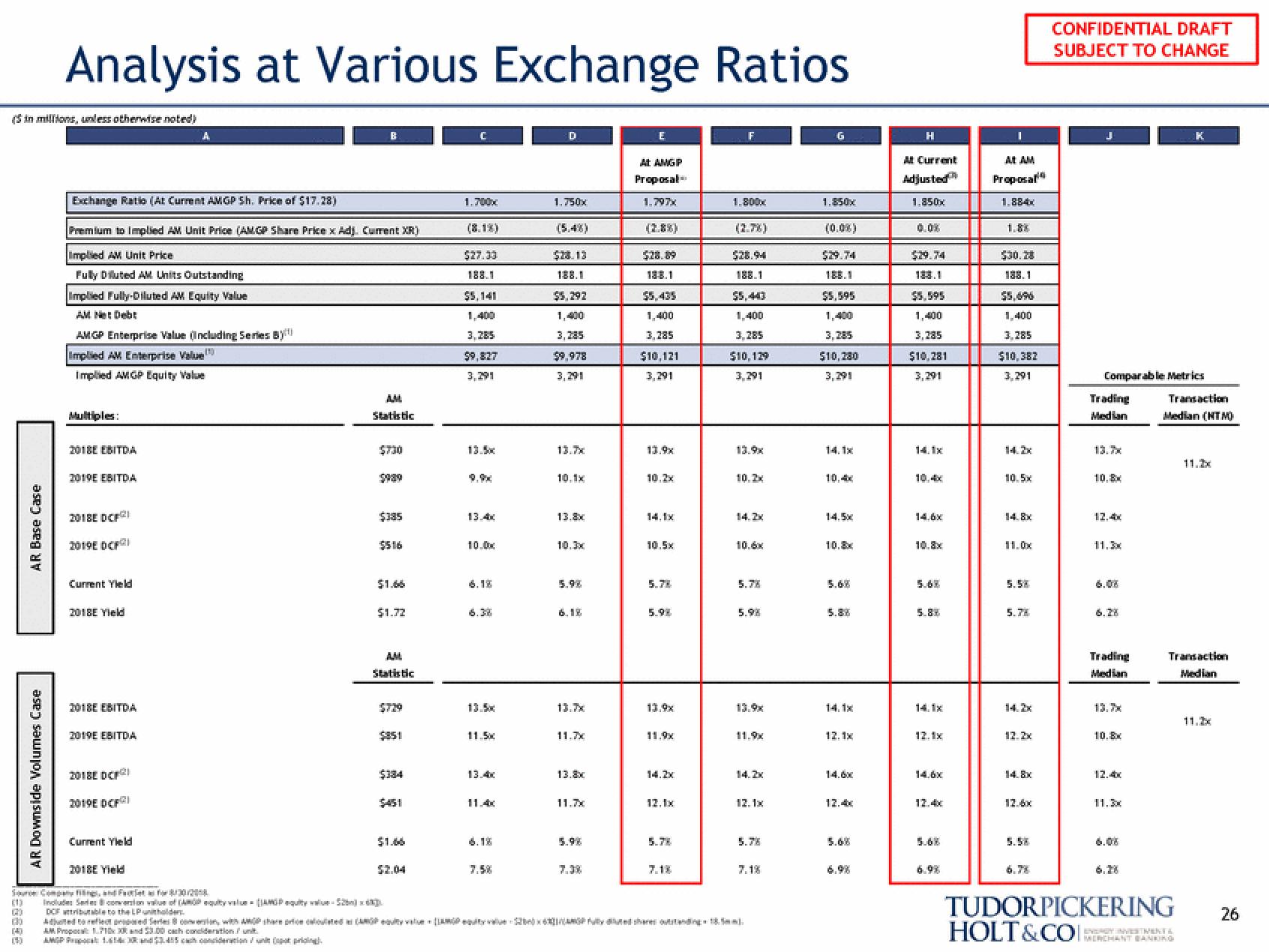

Analysis at Various Exchange Ratios

AR Downside Volumes Case

Exchange Ratio (At Current AMGP Sh. Price of $17.28)

Premium to implied AM Unit Price (AMGP Share Price x Adj. Current XR)

Implied AM Unit Price

Fully Diluted AM Units Outstanding

Implied Fully-Diluted AM Equity Value

AM Net Debt

AMGP Enterprise Value (Including Series By

Implied AM Enterprise Value

Implied AMGP Equity Value

Multiples:

2018E EBITDA

2019E EBITDA

2018E DCFI

2019E DCF

Current Yleld

2018E Yield

A

2018E EBITDA

2019E EBITDA

2018E DCF21

2019E DCF)

Current Yield

2018E Yield

Sour Company filing and Foret for $/30/2018

Includes

DCF but

AMA Prop1710x Rand 53.00 cach concideration / unit.

AM

Statistic

$730

$385

$516

$1.72

AM

Statistic

$851

$334

$451

$1.66

$2.04

conversion value of (AMP equity value [JANGPaquity value-526) D

to the LPunitholder

$27.33

188.1

$5,141

3,285

$9,827

3,291

lax

13.4x

10.0x

6.38

13.4x

11.4x

D

1.750x

(5.4%)

$28.13

188.1

$5,292

1,400

3,285

$9,978

3,291

13.7x

10.1x

13.8x

10.3x

5.98

13.7x

11.7x

13.8x

11.7x

E

At AMGP

Proposal

1.797x

528.89

188.1

$5,435

1,400

3,285

$10,121

3,291

13.9x

10.5x

5.78

5.98

13.9x

11.9x

12.1x

5.78

1.800x

(2.7%)

$28.94

188.1

$5,443

1,400

3,285

$10,129

3,291

13.9x

10,2x

14.2x

10.6x

5.78

5.98

14.2x

12.1x

7.1%

G

1.850x

(0.0%)

$29.74

$5,595

3,285

$10,280

14.1x

10.4x

1.5

10.8x

5.68

5.88

14.1x

12.1x

14.6x

12.4x

5.68

H

A Current

Adjusted

1.850x

0.0%

$29.74

183.1

$5,595

1,400

3,285

$10,281

3,291

10,4x

14.6x

10.3x

5.68

5.88

12.1x

14.6x

12.4x

5.68

T

Proposal

1.884x

1.8%

$30.28

188.1

$5,096

1,400

3,285

$10,382

3,291

TÙ 5x

14.8x

11.0x

5.58

5.78

14.2x

12.2x

12.6x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Comparable Metrics

Trading

Median

13.x

12.4x

11.3x

6.28

Trading

13.7x

10. Bx

12.4x

11.3x

K

Transaction

Median (NTM)

Transaction

Median

TUDORPICKERING

HOLT&COI:

26View entire presentation