Energy Vault SPAC Presentation Deck

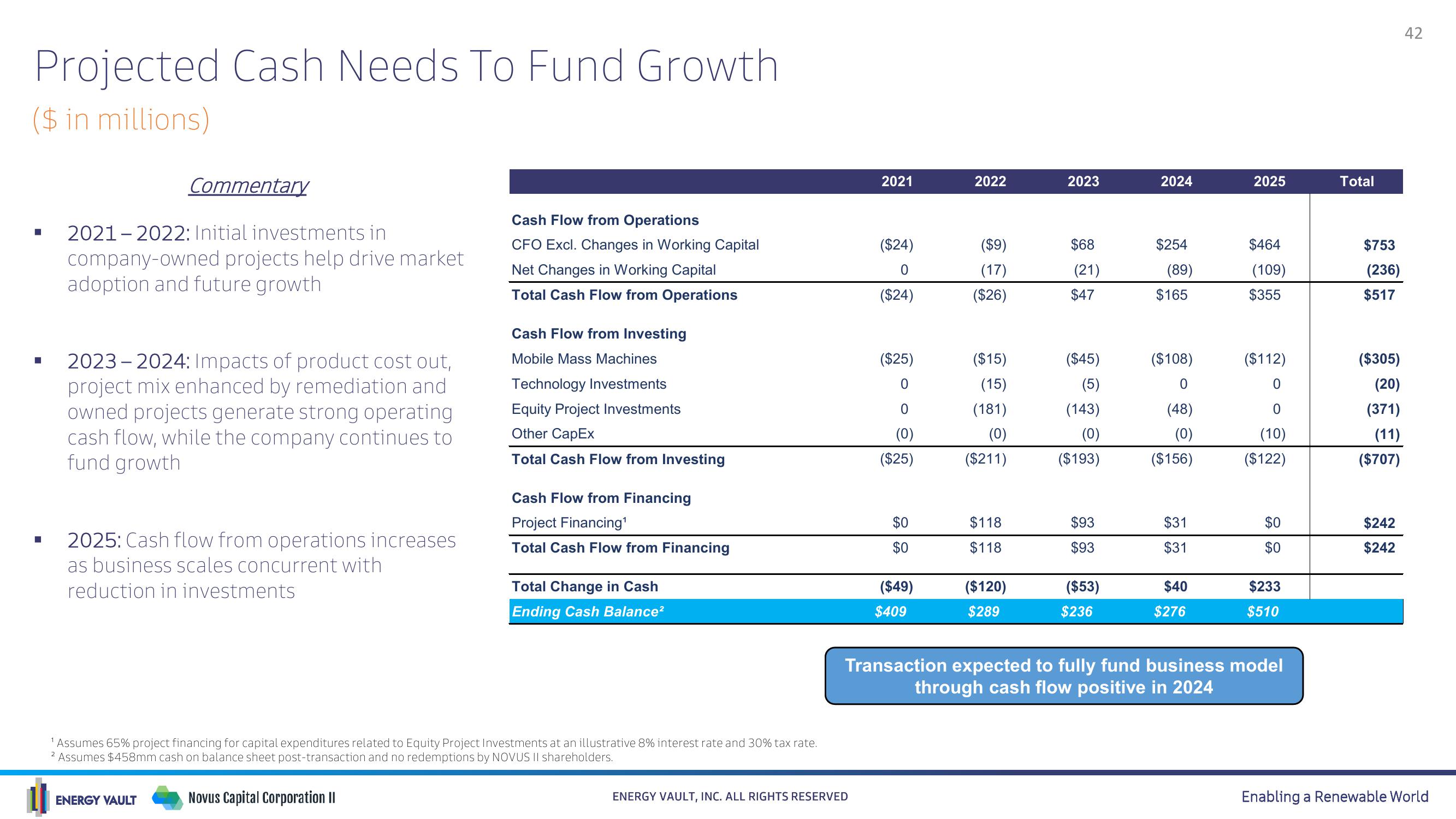

Projected Cash Needs To Fund Growth.

($ in millions)

■

■

■

Commentary

2021 2022: Initial investments in

company-owned projects help drive market

adoption and future growth

2023 2024: Impacts of product cost out,

project mix enhanced by remediation and

owned projects generate strong operating

cash flow, while the company continues to

fund growth

2025: Cash flow from operations increases

as business scales concurrent with

reduction in investments

ENERGY VAULT

Cash Flow from Operations

CFO Excl. Changes in Working Capital

Net Changes in Working Capital

Total Cash Flow from Operations

Cash Flow from Investing

Mobile Mass Machines

Technology Investments

Equity Project Investments

Other CapEx

Total Cash Flow from Investing

Cash Flow from Financing

Project Financing¹

Total Cash Flow from Financing

Total Change in Cash

Ending Cash Balance²

Assumes 65% project financing for capital expenditures related to Equity Project Investments at an illustrative 8% interest rate and 30% tax rate.

² Assumes $458mm cash on balance sheet post-transaction and no redemptions by NOVUS II shareholders.

Novus Capital Corporation II

2021

ENERGY VAULT, INC. ALL RIGHTS RESERVED

($24)

0

($24)

($25)

0

0

(0)

($25)

$0

$0

($49)

$409

2022

($9)

(17)

($26)

($15)

(15)

(181)

(0)

($211)

$118

$118

($120)

$289

2023

$68

(21)

$47

($45)

(5)

(143)

(0)

($193)

$93

$93

($53)

$236

2024

$254

(89)

$165

($108)

0

(48)

(0)

($156)

$31

$31

$40

$276

2025

$464

(109)

$355

($112)

0

0

(10)

($122)

$0

$0

$233

$510

Transaction expected to fully fund business model

through cash flow positive in 2024

Total

$753

(236)

$517

($305)

(20)

(371)

(11)

($707)

$242

$242

42

Enabling a Renewable WorldView entire presentation