Snap Inc Investor Presentation Deck

Snap Inc.

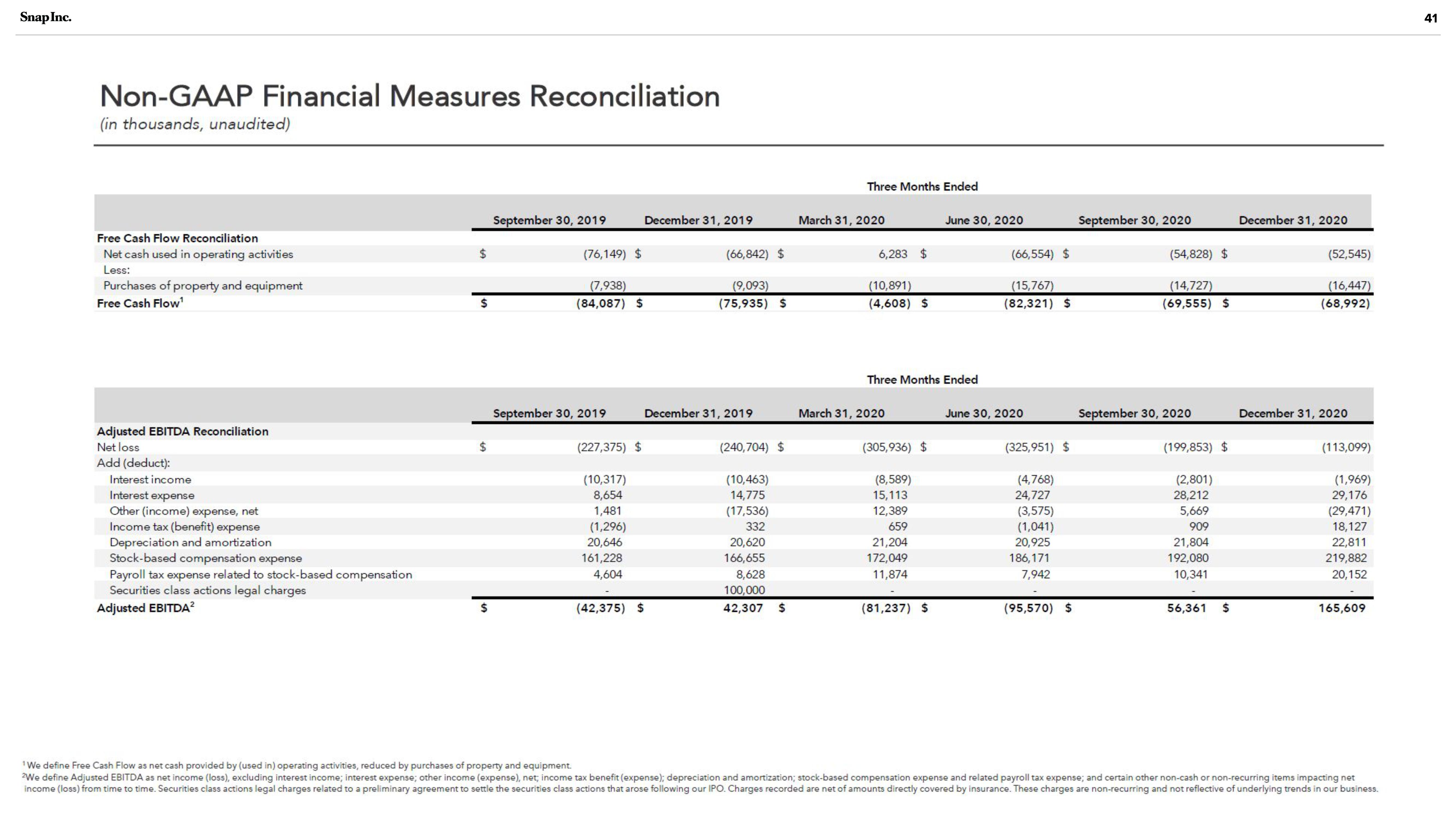

Non-GAAP Financial Measures Reconciliation

(in thousands, unaudited)

Free Cash Flow Reconciliation

Net cash used in operating activities

Less:

Purchases of property and equipment

Free Cash Flow¹

Adjusted EBITDA Reconciliation

Net loss

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Securities class actions legal charges

Adjusted EBITDA²

$

$

September 30, 2019

(76,149) $

(7,938)

(84,087) $

September 30, 2019

(227,375) $

(10,317)

8,654

1,481

(1,296)

20,646

161,228

4,604

December 31, 2019

(66,842) $

(9,093)

(75,935) $

December 31, 2019

(42,375) $

(240,704) $

(10,463)

14,775

(17,536)

332

20,620

166,655

8,628

100,000

42,307 $

Three Months Ended

March 31, 2020

6,283

$

(10,891)

(4,608) $

March 31, 2020

Three Months Ended

(305,936) $

(8,589)

15,113

12,389

659

21,204

172,049

11,874

June 30, 2020

(81,237) $

(66,554) $

(15,767)

(82,321) $

June 30, 2020

(325,951) $

(4,768)

24,727

(3,575)

(1,041)

20,925

186,171

7,942

(95,570) $

September 30, 2020

(54,828) $

(14,727)

(69,555) $

September 30, 2020

(199,853) $

(2,801)

28,212

5,669

909

21,804

192,080

10,341

56,361

$

December 31, 2020

(52,545)

(16,447)

(68,992)

December 31, 2020

(113,099)

(1,969)

29,176

(29,471)

18,127

22,811

219,882

20,152

165,609

¹We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net;, income tax benefit (expense); depreciation and amortization; stock-based compensation expense and related payroll tax expense; and certain other non-cash or non-recurring items impacting net

income (loss) from time to time. Securities class actions legal charges related to a preliminary agreement to settle the securities class actions that arose following our IPO. Charges recorded are net of amounts directly covered by insurance. These charges are non-recurring and not reflective of underlying trends in our business.

41View entire presentation