Zegna Investor Presentation Deck

ZEGNA GROUP

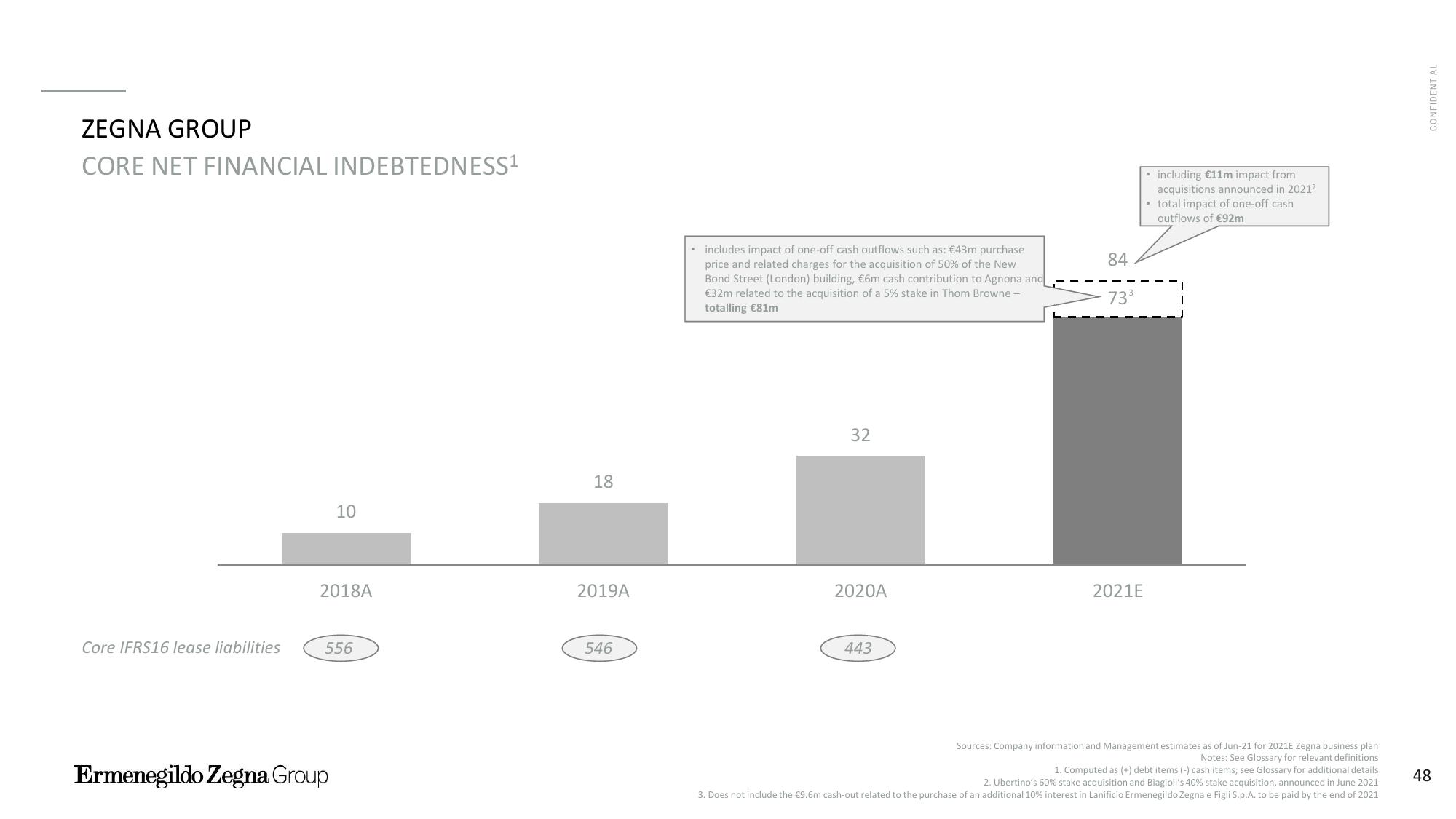

CORE NET FINANCIAL INDEBTEDNESS¹

Core IFRS16 lease liabilities

10

2018A

556

Ermenegildo Zegna Group

18

2019A

546

• includes impact of one-off cash outflows such as: €43m purchase

price and related charges for the acquisition of 50% of the New

Bond Street (London) building, €6m cash contribution to Agnona and

€32m related to the acquisition of a 5% stake in Thom Browne -

totalling €81m

32

2020A

443

84

73³

2021E

including €11m impact from

acquisitions announced in 2021²

• total impact of one-off cash

outflows of €92m

Sources: Company information and Management estimates as of Jun-21 for 2021E Zegna business plan

Notes: See Glossary for relevant definitions

1. Computed as (+) debt items (-) cash items; see Glossary for additional details

2. Ubertino's 60% stake acquisition and Biagioli's 40% stake acquisition, announced in June 2021

3. Does not include the €9.6m cash-out related to the purchase of an additional 10% interest in Lanificio Ermenegildo Zegna e Figli S.p.A. to be paid by the end of 2021

CONFIDENTIAL

48View entire presentation