Inovalon Results Presentation Deck

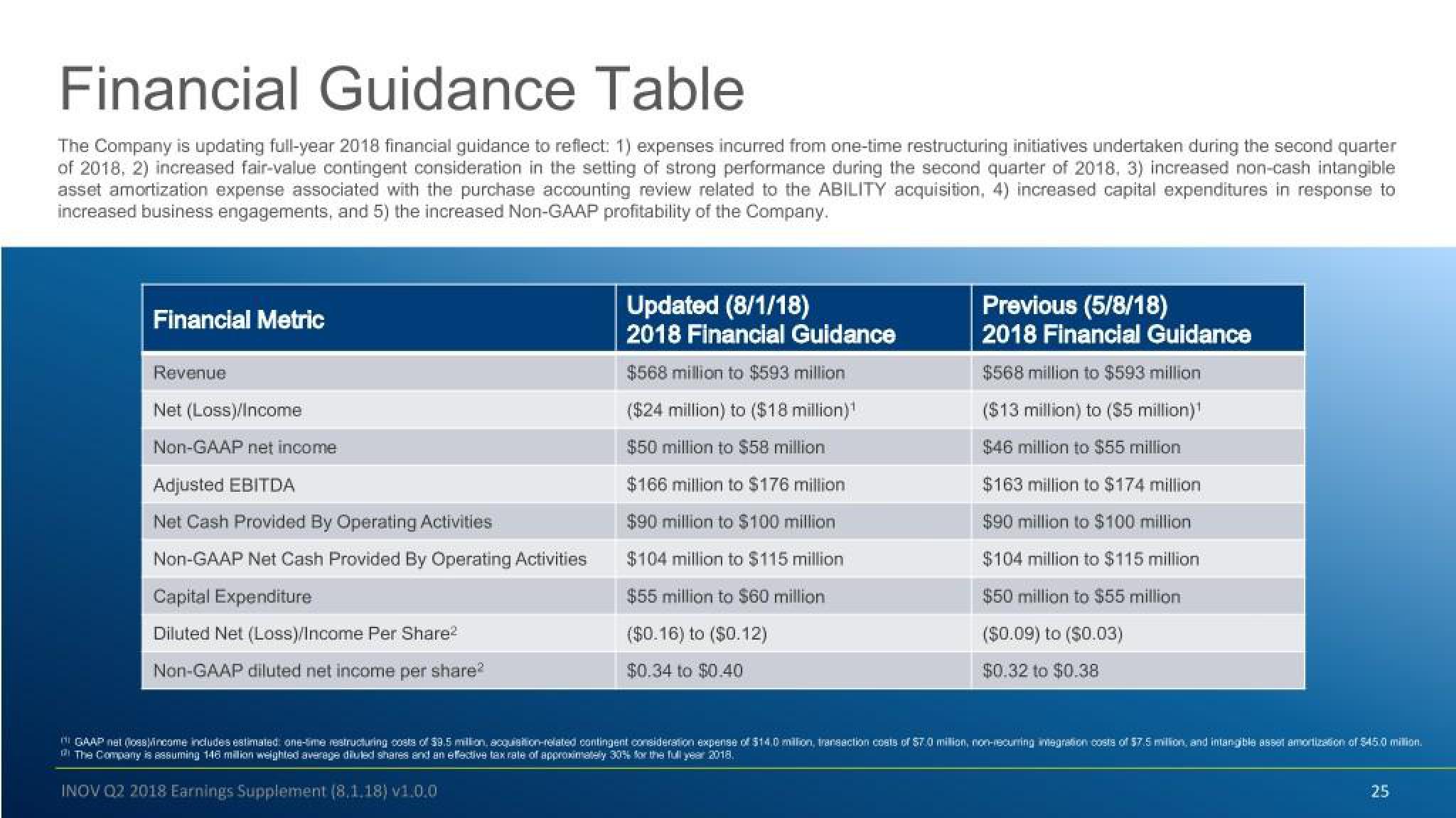

Financial Guidance Table

The Company is updating full-year 2018 financial guidance to reflect: 1) expenses incurred from one-time restructuring initiatives undertaken during the second quarter

of 2018, 2) increased fair-value contingent consideration in the setting of strong performance during the second quarter of 2018, 3) increased non-cash intangible

asset amortization expense associated with the purchase accounting review related to the ABILITY acquisition, 4) increased capital expenditures in response to

increased business engagements, and 5) the increased Non-GAAP profitability of the Company.

Financial Metric

Revenue

Net (Loss)/Income

Non-GAAP net income

Adjusted EBITDA

Net Cash Provided By Operating Activities

Non-GAAP Net Cash Provided By Operating Activities

Capital Expenditure

Diluted Net (Loss)/Income Per Share²

Non-GAAP diluted net income per share²

Updated (8/1/18)

2018 Financial Guidance

$568 million to $593 million

($24 million) to ($18 million)¹

$50 million to $58 million

$166 million to $176 million

$90 million to $100 million

$104 million to $115 million

$55 million to $60 million

($0.16) to ($0.12)

$0.34 to $0.40

Previous (5/8/18)

2018 Financial Guidance

$568 million to $593 million

($13 million) to ($5 million)¹

$46 million to $55 million

$163 million to $174 million

$90 million to $100 million

$104 million to $115 million

$50 million to $55 million

($0.09) to ($0.03)

$0.32 to $0.38

GAAP net (loss Mincome includes estimated: one-time restructuring costs of $9.5 million, acquisition-related contingent consideration expense of $14,0 million, transaction costs of $7.0 million, non-recurring integration costs of $7.5 million, and intangible asset amortization of $45.0 million.

The Company is assuming 146 million weighted average diluted shares and an effective tax rate of approximately 30% for the full year 2018.

INOV Q2 2018 Earnings Supplement (8.1.18) v1.0.0

25View entire presentation