Q2 Quarter 2023

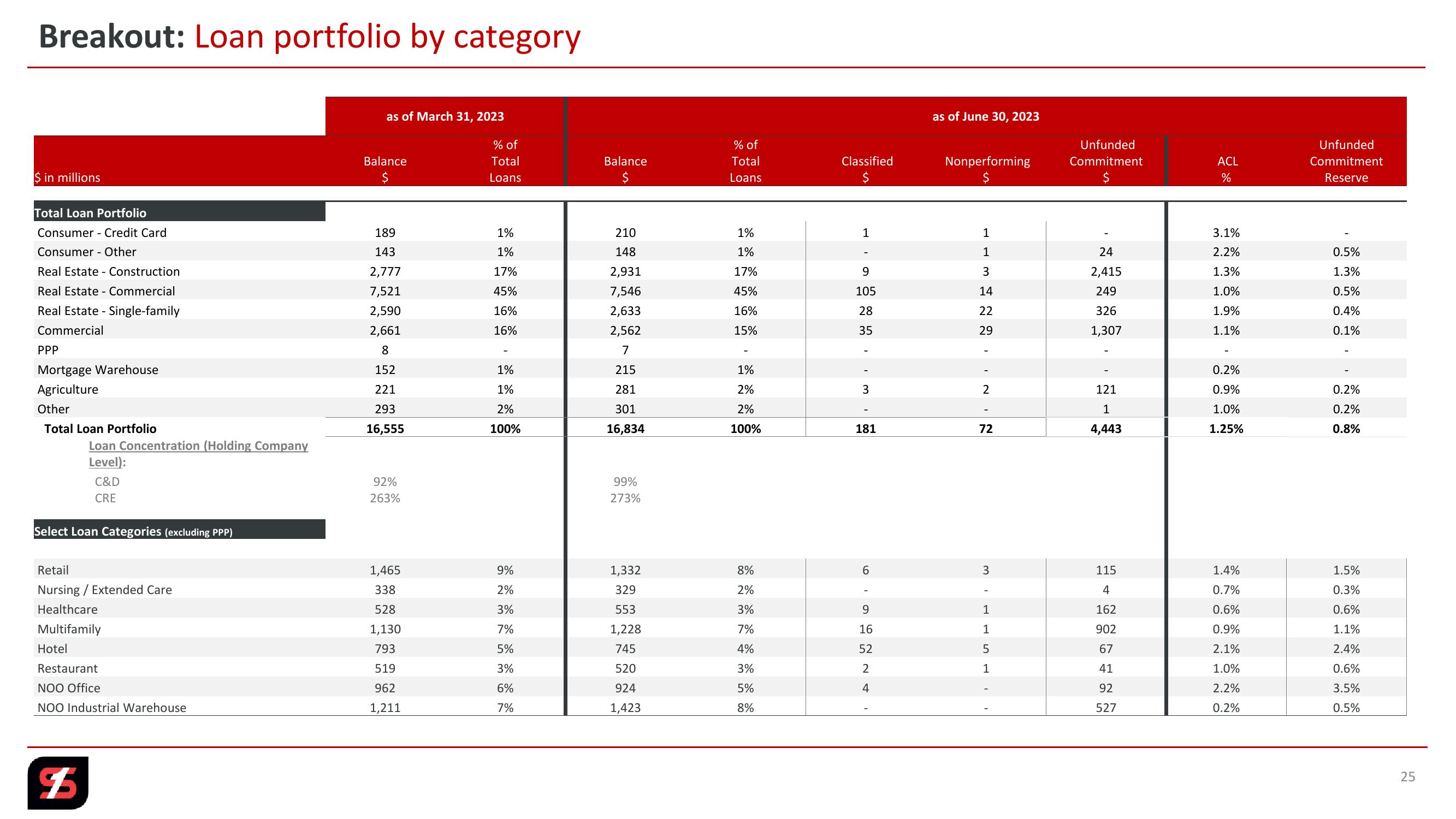

Breakout: Loan portfolio by category

as of March 31, 2023

% of

% of

Balance

Total

Balance

Total

Classified

$

Loans

Loans

as of June 30, 2023

Nonperforming

Unfunded

Commitment

ACL

%

Unfunded

Commitment

Reserve

$ in millions

Total Loan Portfolio

Consumer Credit Card

189

1%

210

1%

1

Consumer Other

143

1%

148

1%

Real Estate

Construction

2,777

17%

2,931

17%

9

Real Estate Commercial

7,521

45%

7,546

45%

105

Real Estate - Single-family

2,590

16%

2,633

16%

28

Commercial

2,661

16%

2,562

15%

35

29

PPP

8

7

Mortgage Warehouse

152

1%

215

1%

Agriculture

221

1%

281

2%

3

Other

293

2%

301

2%

Total Loan Portfolio

16,555

100%

16,834

100%

181

113222,22

3.1%

24

2.2%

0.5%

2,415

1.3%

1.3%

14

249

1.0%

0.5%

326

1.9%

0.4%

1,307

1.1%

0.1%

0.2%

121

0.9%

0.2%

-

1

1.0%

0.2%

72

4,443

1.25%

0.8%

Loan Concentration (Holding Company

Level):

C&D

92%

CRE

263%

99%

273%

Select Loan Categories (excluding PPP)

Retail

1,465

9%

1,332

8%

Nursing/Extended Care

338

2%

329

2%

Healthcare

528

3%

553

3%

Multifamily

1,130

7%

1,228

7%

Hotel

793

5%

745

4%

Restaurant

519

3%

520

3%

NOO Office

962

6%

924

5%

622224

3

115

1.4%

1.5%

-

4

0.7%

0.3%

9

1

162

0.6%

0.6%

16

1

902

0.9%

1.1%

52

5

67

2.1%

2.4%

1

41

1.0%

0.6%

92

2.2%

3.5%

NOO Industrial Warehouse

1,211

7%

1,423

8%

527

0.2%

0.5%

$

25View entire presentation