Benson Hill SPAC Presentation Deck

BENSON HILL

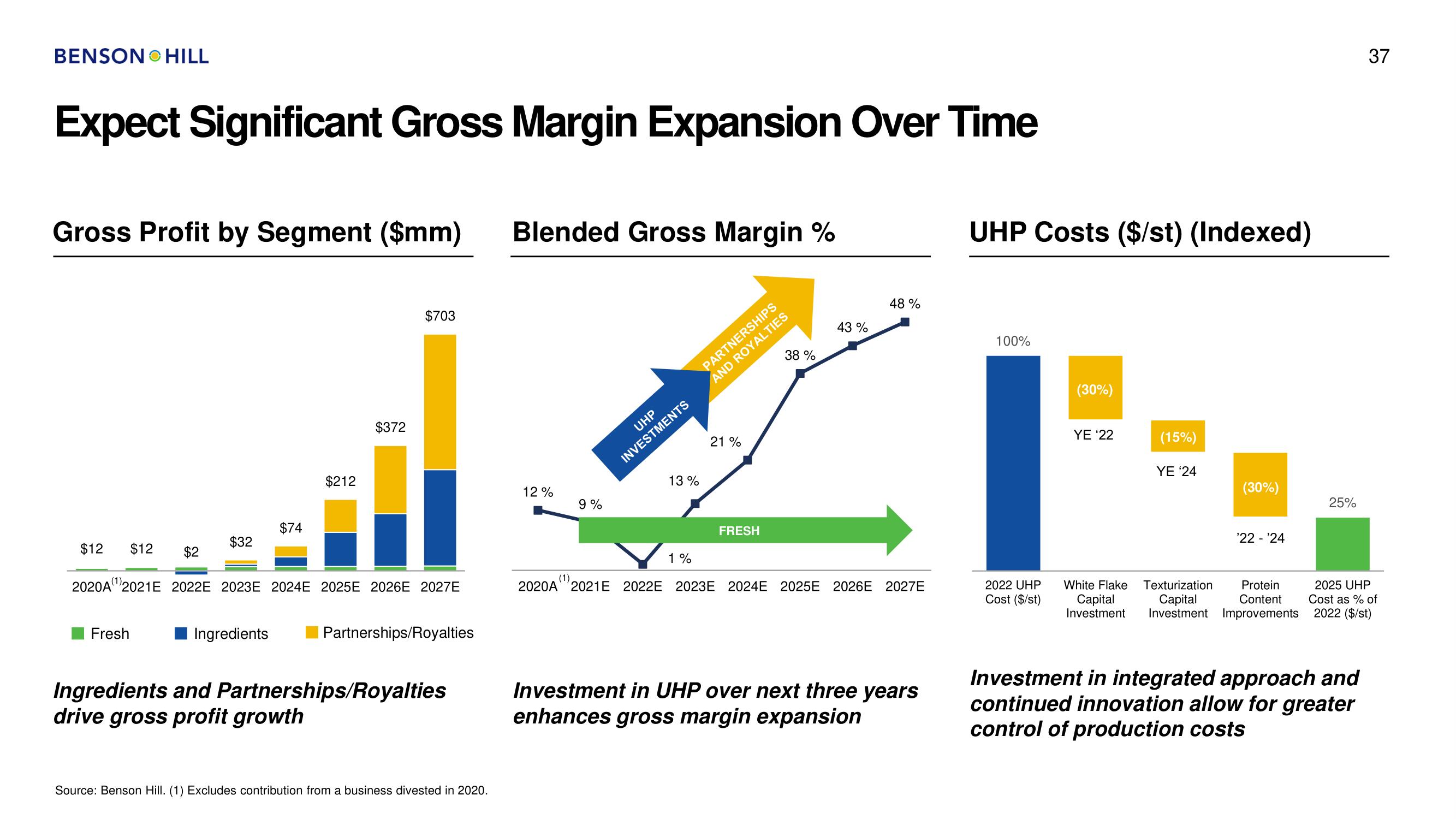

Expect Significant Gross Margin Expansion Over Time

Gross Profit by Segment ($mm) Blended Gross Margin %

$32

Fresh

$74

Ingredients

$212

$372

$12 $12 $2

2020A¹2021E 2022E 2023E 2024E 2025E 2026 2027E

$703

Partnerships/Royalties

Ingredients and Partnerships/Royalties

drive gross profit growth

Source: Benson Hill. (1) Excludes contribution from a business divested in 2020.

12%

9%

UHP

INVESTMENTS

13%

1%

PARTNERSHIPS

AND ROYALTIES

21 %

38 %

FRESH

43%

48 %

(1)

2020A 2021 E 2022E 2023E 2024E 2025E 2026 2027E

Investment in UHP over next three years

enhances gross margin expansion

UHP Costs ($/st) (Indexed)

100%

2022 UHP

Cost ($/st)

(30%)

YE '22

(15%)

YE '24

(30%)

¹22-¹24

White Flake Texturization Protein

Capital Capital

Content

Investment Investment Improvements

25%

37

2025 UHP

Cost as % of

2022 ($/st)

Investment in integrated approach and

continued innovation allow for greater

control of production costsView entire presentation