jetBlue Results Presentation Deck

Committed to Maintaining Our Competitive Cost Structure

jetBlue

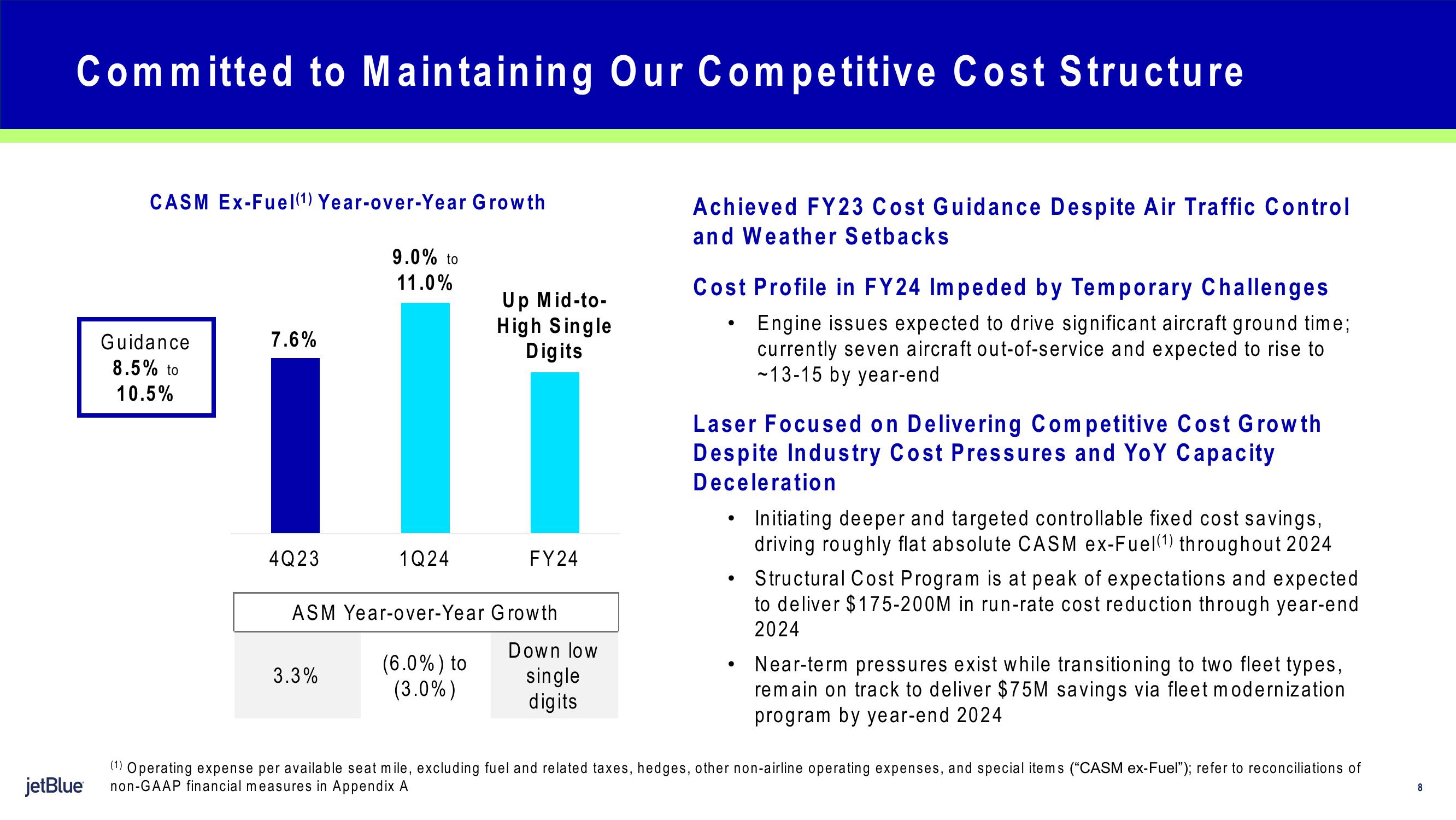

CASM Ex-Fuel(1) Year-over-Year Growth

Guidance

8.5% to

10.5%

7.6%

4Q23

9.0% to

11.0%

3.3%

1Q24

Up Mid-to-

High Single

Digits

ASM Year-over-Year Growth

(6.0%) to

(3.0%)

FY24

Down low

single

digits

Achieved FY23 Cost Guidance Despite Air Traffic Control

and Weather Setbacks

Cost Profile in FY24 Impeded by Temporary Challenges

Engine issues expected to drive significant aircraft ground time;

currently seven aircraft out-of-service and expected to rise to

~13-15 by year-end

●

Laser Focused on Delivering Competitive Cost Growth

Despite Industry Cost Pressures and YoY Capacity

Deceleration

●

●

●

Initiating deeper and targeted controllable fixed cost savings,

driving roughly flat absolute CASM ex-Fuel (¹) throughout 2024

Structural Cost Program is at peak of expectations and expected

to deliver $175-200M in run-rate cost reduction through year-end

2024

Near-term pressures exist while transitioning to two fleet types,

remain on track to deliver $75M savings via fleet modernization

program by year-end 2024

(1) Operating expense per available seat mile, excluding fuel and related taxes, hedges, other non-airline operating expenses, and special items ("CASM ex-Fuel"); refer to reconciliations of

non-GAAP financial measures in Appendix A

8View entire presentation