Inovalon Results Presentation Deck

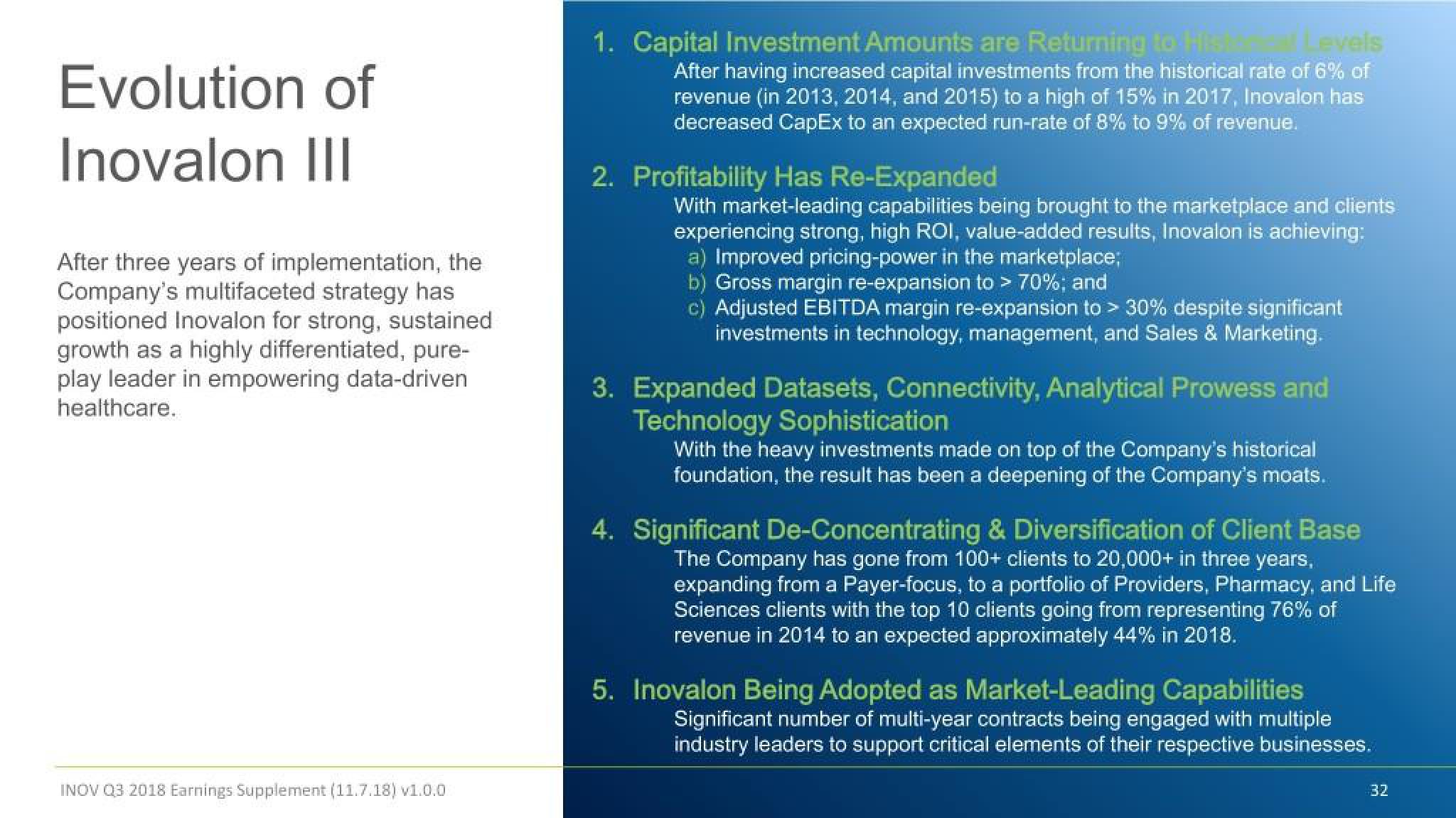

Evolution of

Inovalon III

After three years of implementation, the

Company's multifaceted strategy has

positioned Inovalon for strong, sustained

growth as a highly differentiated, pure-

play leader in empowering data-driven

healthcare.

INOV Q3 2018 Earnings Supplement (11.7.18) v1.0.0

1. Capital Investment Amounts are Returning to His

Levels

After having increased capital investments from the historical rate of 6% of

revenue (in 2013, 2014, and 2015) to a high of 15% in 2017, Inovalon has

decreased CapEx to an expected run-rate of 8% to 9% of revenue.

2. Profitability Has Re-Expanded

With market-leading capabilities being brought to the marketplace and clients

experiencing strong, high ROI, value-added results, Inovalon is achieving:

a) Improved pricing-power in the marketplace;

b) Gross margin re-expansion to > 70%; and

c) Adjusted EBITDA margin re-expansion to > 30% despite significant

investments in technology, management, and Sales & Marketing.

3. Expanded Datasets, Connectivity, Analytical Prowess and

Technology Sophistication

With the heavy investments made on top of the Company's historical

foundation, the result has been a deepening of the Company's moats.

4. Significant De-Concentrating & Diversification of Client Base

The Company has gone from 100+ clients to 20,000+ in three years,

expanding from a Payer-focus, to a portfolio of Providers, Pharmacy, and Life

Sciences clients with the top 10 clients going from representing 76% of

revenue in 2014 to an expected approximately 44% in 2018.

5. Inovalon Being Adopted as Market-Leading Capabilities

Significant number of multi-year contracts being engaged with multiple

industry leaders to support critical elements of their respective businesses.

32View entire presentation