Pershing Square Activist Presentation Deck

A. Pershing's Proposal: Assumptions

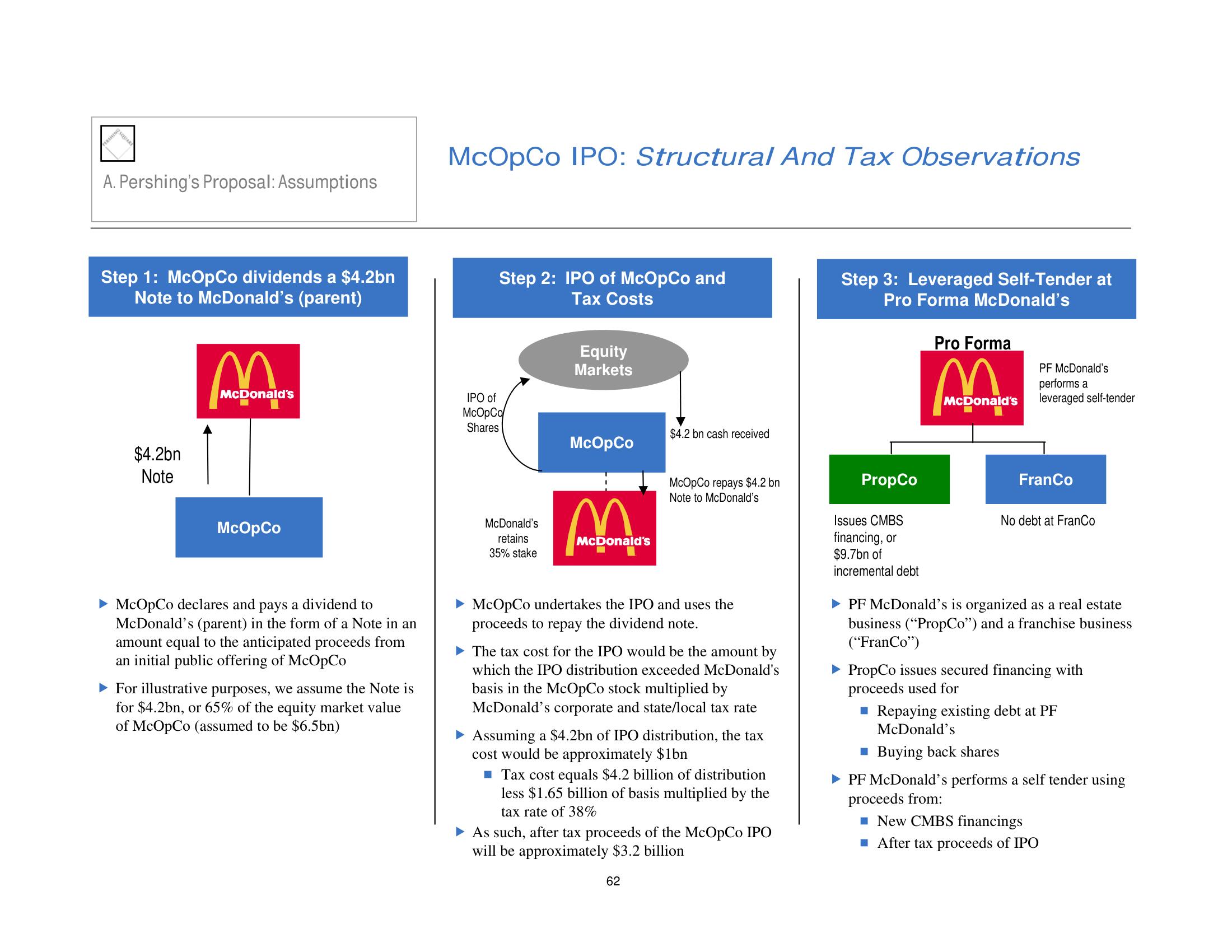

Step 1: McOpCo dividends a $4.2bn

Note to McDonald's (parent)

$4.2bn

Note

M

McDonald's

McOpCo

► McOpCo declares and pays a dividend to

McDonald's (parent) in the form of a Note in an

amount equal to the anticipated proceeds from

an initial public offering of McOpCo

► For illustrative purposes, we assume the Note is

for $4.2bn, or 65% of the equity market value

of McOpCo (assumed to be $6.5bn)

McOpCo IPO: Structural And Tax Observations

Step 2: IPO of McOpCo and

Tax Costs

IPO of

McOpCo

Shares

McDonald's

retains

35% stake

Equity

Markets

McOpCo

McDonald's

■

$4.2 bn cash received

McOpCo repays $4.2 bn

Note to McDonald's

McOpCo undertakes the IPO and uses the

proceeds to repay the dividend note.

The tax cost for the IPO would be the amount by

which the IPO distribution exceeded McDonald's

basis in the McOpCo stock multiplied by

McDonald's corporate and state/local tax rate

Assuming a $4.2bn of IPO distribution, the tax

cost would be approximately $1bn

■ Tax cost equals $4.2 billion of distribution

less $1.65 billion of basis multiplied by the

tax rate of 38%

62

As such, after tax proceeds of the McOpCo IPO

will be approximately $3.2 billion

Step 3: Leveraged Self-Tender at

Pro Forma McDonald's

PropCo

Issues CMBS

financing, or

$9.7bn of

incremental debt

Pro Forma

M

McDonald's

PF McDonald's

performs a

leveraged self-tender

FranCo

No debt at FranCo

► PF McDonald's is organized as a real estate

business ("PropCo") and a franchise business

("Franco")

PropCo issues secured financing with

proceeds used for

■ Repaying existing debt at PF

McDonald's

■ Buying back shares

► PF McDonald's performs a self tender using

proceeds from:

New CMBS financings

■ After tax proceeds of IPOView entire presentation