CubeSmart Investor Presentation Deck

Liquidity and Access to Capital to Grow

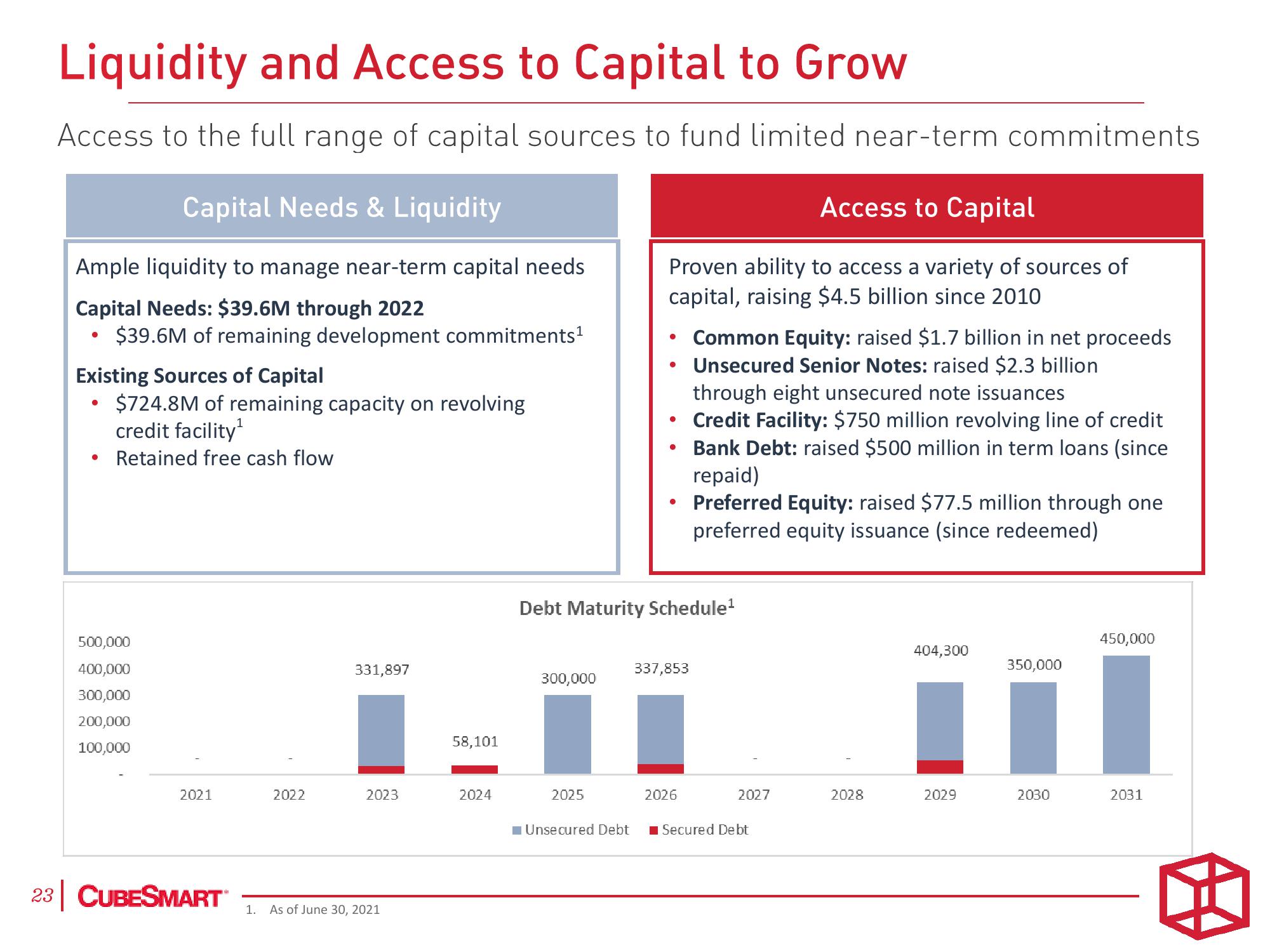

Access to the full range of capital sources to fund limited near-term commitments

Access to Capital

Proven ability to access a variety of sources of

capital, raising $4.5 billion since 2010

Capital Needs & Liquidity

Ample liquidity to manage near-term capital needs

Capital Needs: $39.6M through 2022

$39.6M of remaining development commitments¹

●

Existing Sources of Capital

$724.8M of remaining capacity on revolving

credit facility¹

Retained free cash flow

●

●

500,000

400,000

300,000

200,000

100,000

2021

23 CUBESMART

2022

331,897

2023

1. As of June 30, 2021

58,101

2024

Debt Maturity Schedule¹

300,000

2025

Common Equity: raised $1.7 billion in net proceeds

Unsecured Senior Notes: raised $2.3 billion

through eight unsecured note issuances

• Credit Facility: $750 million revolving line of credit

• Bank Debt: raised $500 million in term loans (since

repaid)

Preferred Equity: raised $77.5 million through one

preferred equity issuance (since redeemed)

Unsecured Debt

337,853

2026

2027

Secured Debt

2028

404,300

2029

350,000

2030

450,000

2031View entire presentation