Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

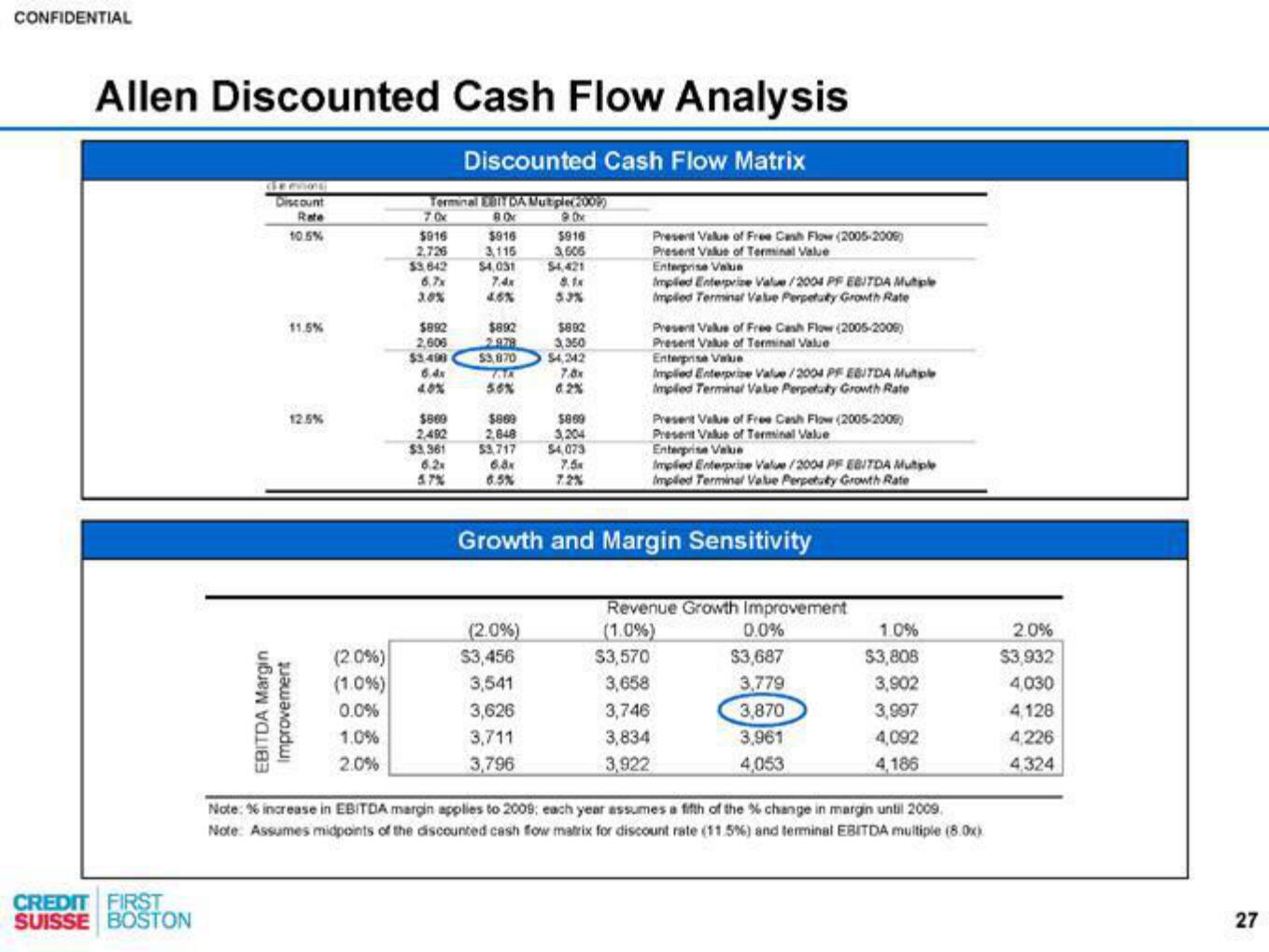

Allen Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

Terminal EBITDA Multiple(2009)

80%

9 the

CREDIT FIRST

SUISSE BOSTON

GENRE

Discount

Rate

10.5%

11.5%

12.5%

EBITDA Margin

Improvement

(2.0%)

(1.0%)

0.0%

1.0%

2.0%

70x

$916

2,726

$3.642

6.7x

30%

$892

2,606

$3.498

6.4x

40%

$869

2,492

$3,361

5.7%

$916

3,115

$4,031

7.4x

4.6%

$892

2978

$3,870

LAR

56%

$916

3,606

$4,421

8.1x

5.3%

(2.0%)

$892

3,350

$869

$869

2,848

3,204

53,717 $4,073

6.8x

7.5x

6.5%

7.2%

$3,456

3,541

3,626

3,711

3,796

$4,242

7.8x

62%

Present Value of Free Cash Flow (2005-2006)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004 PF EBITDA Multiple

Implied Terminal Value Perpetuty Growth Rate

Present Value of Free Cash Flow (2005-2006)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004 PF EBITDA Multiple

Implied Terminal Value Perpetuty Growth Rate

Present Value of Free Cash Flow (2005-2006)

Present Value of Terminal Value

Growth and Margin Sensitivity

Enterprise Value

Implied Enterprise Value/2004 PF EBITDA Mutiple

Implied Terminal Value Perpetuty Growth Rate

Revenue Growth Improvement

(1.0%)

$3,570

3,658

3,746

3,834

3,922

0.0%

$3,687

3,779

3,870

3,961

4,053

1.0%

$3,808

3,902

3,997

4,092

4,186

Note: % increase in EBITDA margin applies to 2009; each year assumes a fifth of the % change in margin until 2009.

Note: Assumes midpoints of the discounted cash flow matrix for discount rate (11.5%) and terminal EBITDA multiple (8.0x)

2.0%

$3,932

4,030

4,128

4,226

4,324

27View entire presentation