Commercial Metals Company Investor Presentation Deck

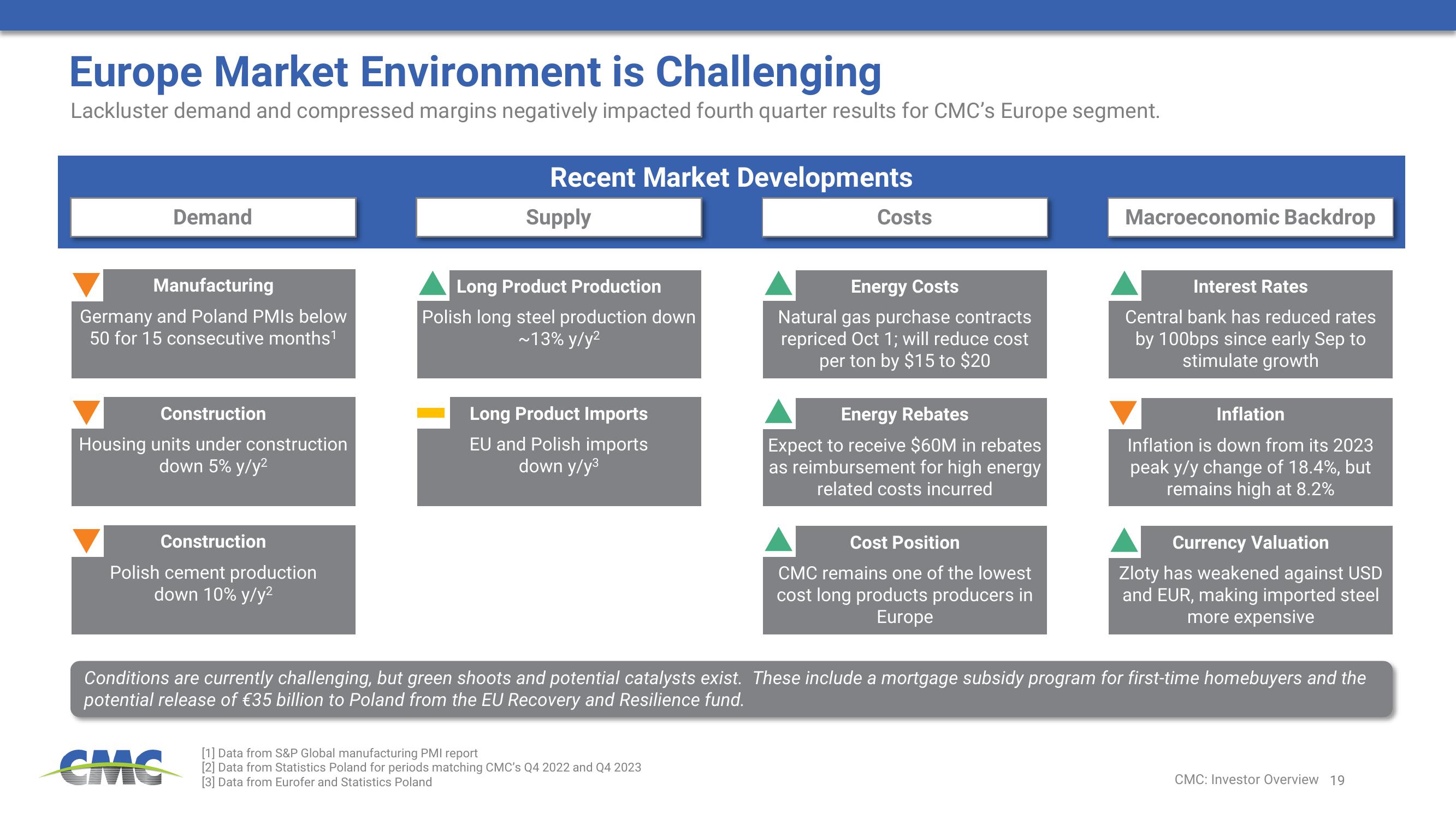

Europe Market Environment is Challenging

Lackluster demand and compressed margins negatively impacted fourth quarter results for CMC's Europe segment.

Demand

Manufacturing

Germany and Poland PMIs below

50 for 15 consecutive months¹

Construction

Housing units under construction

down 5% y/y²

Construction

Polish cement production

down 10% y/y²

Recent Market Developments

Supply

Long Product Production

Polish long steel production down

~13% y/y²

Long Product Imports

EU and Polish imports

down y/y³

Costs

[1] Data from S&P Global manufacturing PMI report

[2] Data from Statistics Poland for periods matching CMC's Q4 2022 and Q4 2023

[3] Data from Eurofer and Statistics Poland

Energy Costs

Natural gas purchase contracts

repriced Oct 1; will reduce cost

per ton by $15 to $20

Energy Rebates

Expect to receive $60M in rebates

as reimbursement for high energy

related costs incurred

Cost Position

CMC remains one of the lowest

cost long products producers in

Europe

Macroeconomic Backdrop

Interest Rates

Central bank has reduced rates

by 100bps since early Sep to

stimulate growth

Inflation

Inflation is down from its 2023

peak y/y change of 18.4%, but

remains high at 8.2%

Currency Valuation

Zloty has weakened against USD

and EUR, making imported steel

more expensive

Conditions are currently challenging, but green shoots and potential catalysts exist. These include a mortgage subsidy program for first-time homebuyers and the

potential release of €35 billion to Poland from the EU Recovery and Resilience fund.

CMC

CMC: Investor Overview 19View entire presentation