Industry Leader in Lithium Battery Power Solutions for RV, Marine & More

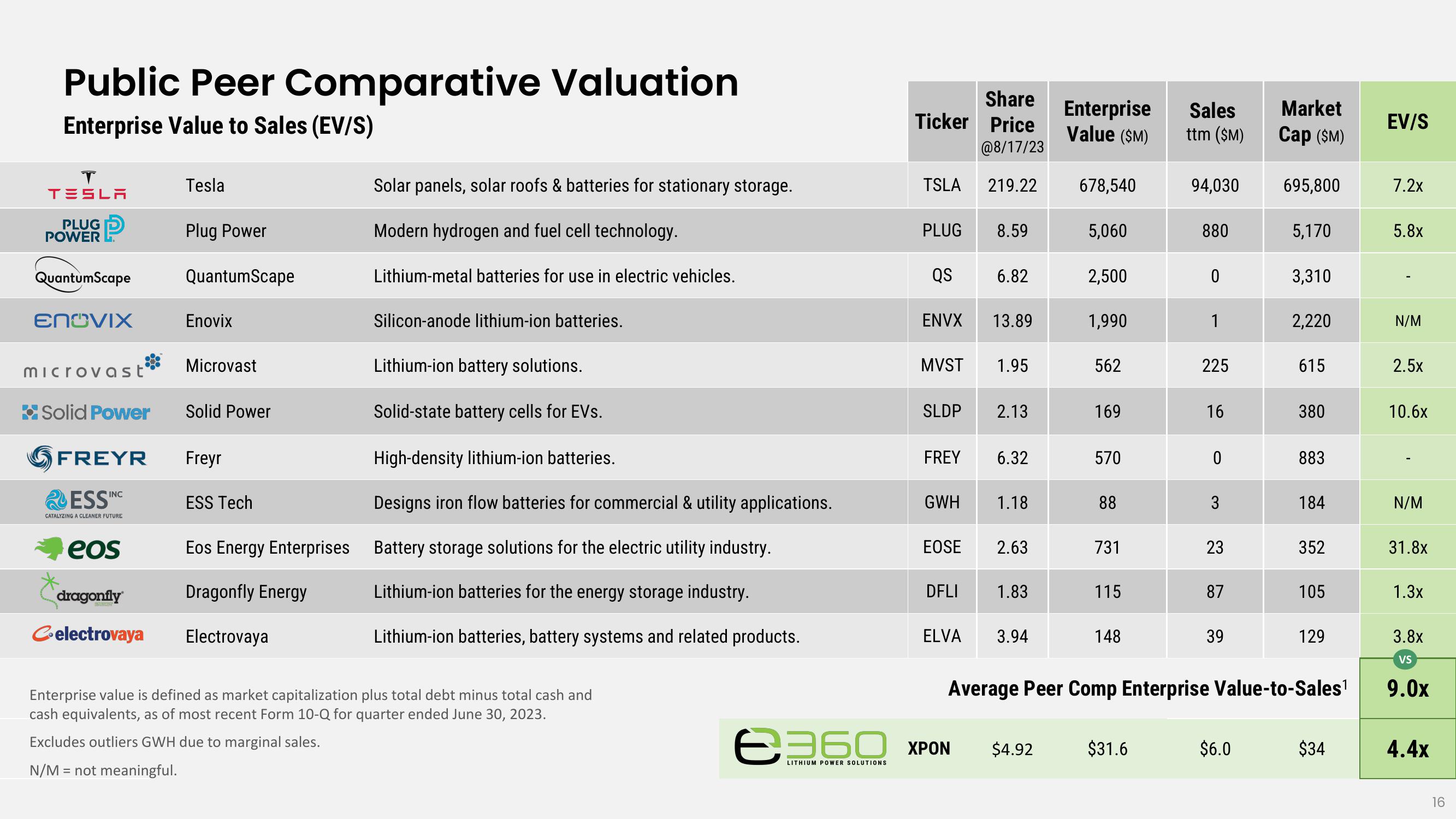

Public Peer Comparative Valuation

Enterprise Value to Sales (EV/S)

Share

Ticker Price

Enterprise

Sales

Market

EV/S

Value ($M)

ttm ($M)

Cap ($M)

@8/17/23

T

TESLA

PLUG

POWER

Tesla

Solar panels, solar roofs & batteries for stationary storage.

TSLA 219.22

678,540

94,030

695,800

7.2x

Plug Power

Modern hydrogen and fuel cell technology.

PLUG

8.59

5,060

880

5,170

5.8x

QuantumScape

QuantumScape

Lithium-metal batteries for use in electric vehicles.

QS

6.82

2,500

0

3,310

ENOVIX

Enovix

Silicon-anode lithium-ion batteries.

ENVX

13.89

1,990

1

2,220

N/M

microvast

Microvast

Lithium-ion battery solutions.

MVST

1.95

562

225

615

2.5x

Solid Power

Solid Power

Solid-state battery cells for EVs.

SLDP

2.13

169

16

380

10.6x

FREYR

Freyr

High-density lithium-ion batteries.

FREY

6.32

570

0

883

ESS INC

CATALYZING A CLEANER FUTURE

ESS Tech

Designs iron flow batteries for commercial & utility applications.

GWH

1.18

88

3

184

N/M

eos

dragonfly

Celectrovaya

Dragonfly Energy

Electrovaya

Eos Energy Enterprises Battery storage solutions for the electric utility industry.

Lithium-ion batteries for the energy storage industry.

Lithium-ion batteries, battery systems and related products.

EOSE

2.63

731

23

352

31.8x

DFLI

1.83

115

87

105

1.3x

ELVA

3.94

148

39

129

3.8x

VS

Enterprise value is defined as market capitalization plus total debt minus total cash and

cash equivalents, as of most recent Form 10-Q for quarter ended June 30, 2023.

Excludes outliers GWH due to marginal sales.

N/M = not meaningful.

Average Peer Comp Enterprise Value-to-Sales¹

9.0x

6360 XPON $4.92

$31.6

$6.0

$34

4.4x

LITHIUM POWER SOLUTIONS

16View entire presentation