Dutch Bros Investor Presentation Deck

1

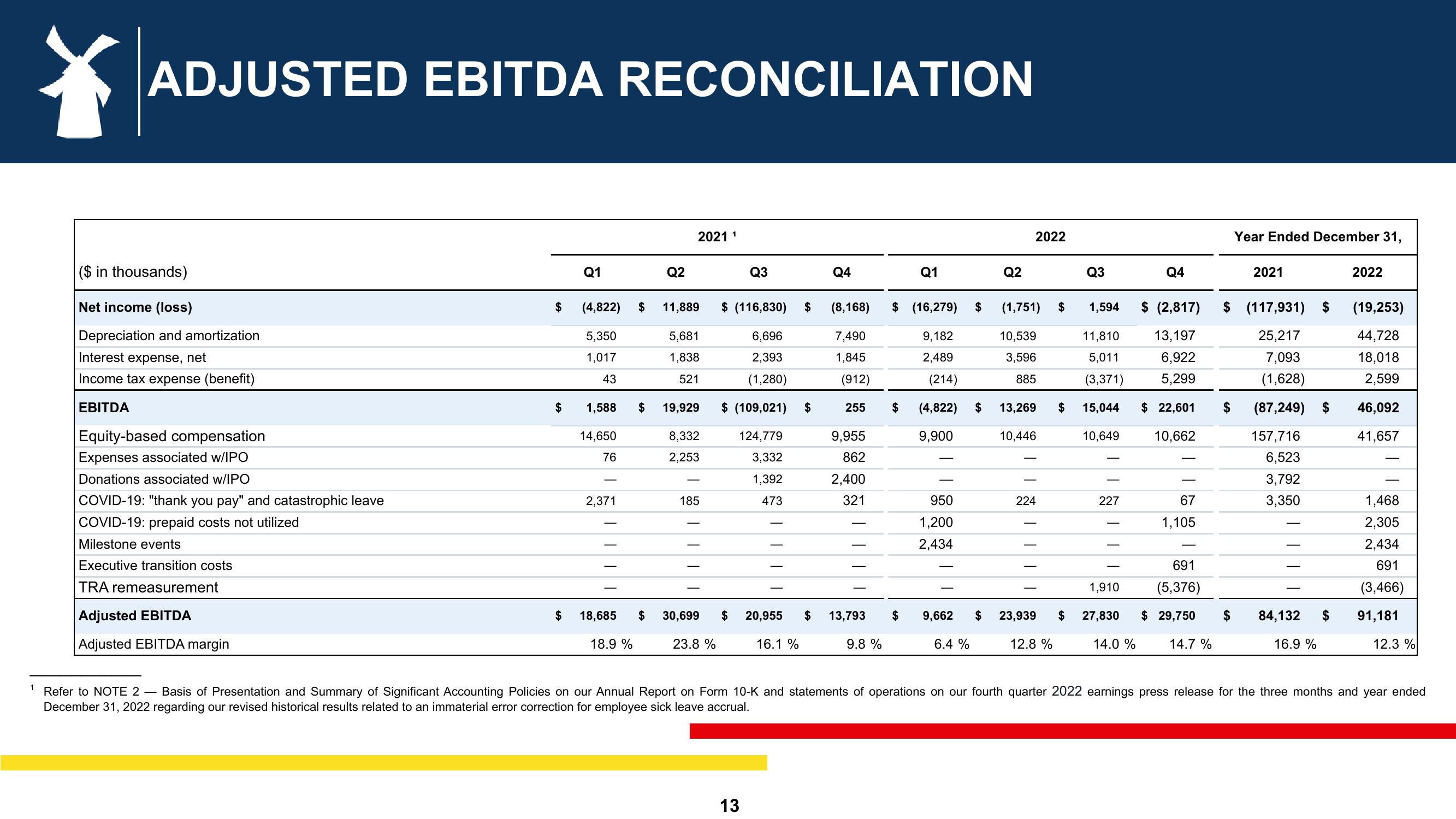

ADJUSTED EBITDA RECONCILIATION

($ in thousands)

Net income (loss)

Depreciation and amortization

Interest expense, net

Income tax expense (benefit)

EBITDA

Equity-based compensation

Expenses associated w/IPO

Donations associated w/IPO

COVID-19: "thank you pay" and catastrophic leave

COVID-19: prepaid costs not utilized

Milestone events

Executive transition costs

TRA remeasurement

Adjusted EBITDA

Adjusted EBITDA margin

$

$

$

Q1

(4,822)

5,350

1,017

43

1,588

14,650

76

TEI

2,371

$

Q2

2021 ¹

11,889

5,681

1,838

521

$ 19,929

8,332

2,253

185

|||

$ (116,830)

6,696

2,393

(1,280)

$ (109,021) $

124,779

3,332

1,392

473

18,685 $ 30,699 $

18.9 %

23.8 %

Q3

13

||||

20,955

16.1 %

$

$

Q4

(8,168)

7,490

1,845

(912)

255

9,955

862

2,400

321

13,793

9.8 %

Q1

$ (16,279)

$

9,182

2,489

(214)

$ (4,822) $

9,900

950

1,200

2,434

9,662 $

6.4 %

Q2

$ (1,751) $

10,539

3,596

885

2022

13,269

10,446

224

23,939

12.8 %

$

$

Q3

1,594

11,810

5,011

(3,371)

15,044

10,649

227

|||

Q4

67

1,105

$ (2,817) $ (117,931) $

13,197

6,922

5,299

$ 22,601

10,662

691

1,910 (5,376)

27,830 $ 29,750

14.0 %

14.7%

Year Ended December 31,

2021

$

25,217

7,093

(1,628)

$ (87,249) $

157,716

6,523

3,792

3,350

84,132 $

16.9 %

2022

(19,253)

44,728

18,018

2,599

46,092

41,657

1,468

2,305

2,434

691

(3,466)

91,181

12.3 %

Refer to NOTE 2 - Basis of Presentation and Summary of Significant Accounting Policies on our Annual Report on Form 10-K and statements of operations on our fourth quarter 2022 earnings press release for the three months and year ended

December 31, 2022 regarding our revised historical results related to an immaterial error correction for employee sick leave accrual.View entire presentation