HSBC Results Presentation Deck

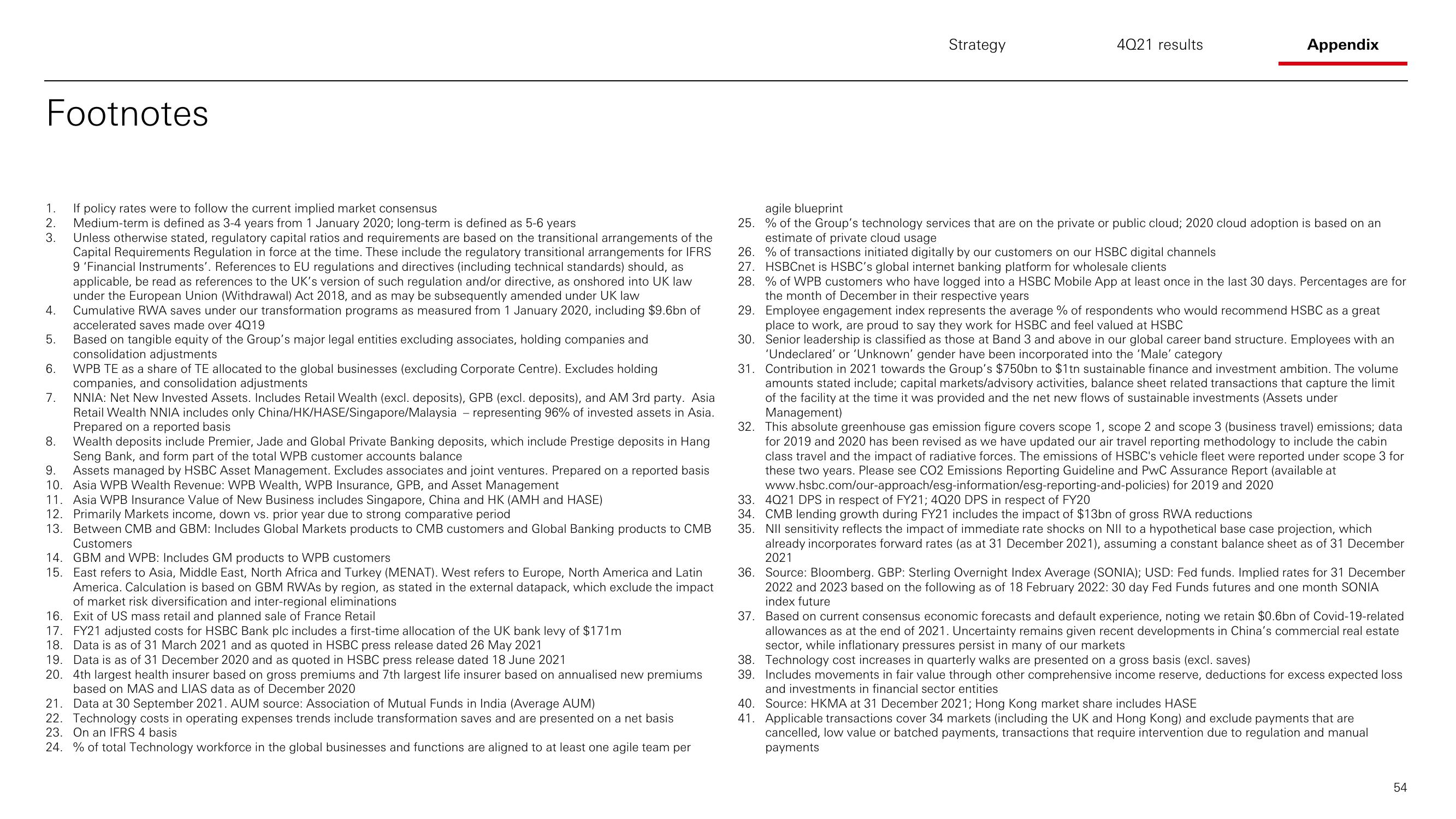

Footnotes

1.

If policy rates were to follow the current implied market consensus

2. Medium-term is defined as 3-4 years from 1 January 2020; long-term is defined as 5-6 years

3. Unless otherwise stated, regulatory capital ratios and requirements are based on the transitional arrangements of the

Capital Requirements Regulation in force at the time. These include the regulatory transitional arrangements for IFRS

9 'Financial Instruments'. References to EU regulations and directives (including technical standards) should, as

applicable, be read as references to the UK's version of such regulation and/or directive, as onshored into UK law

under the European Union (Withdrawal) Act 2018, and as may be subsequently amended under UK law

4. Cumulative RWA saves under our transformation programs as measured from 1 January 2020, including $9.6bn of

accelerated saves made over 4019

Based on tangible equity of the Group's major legal entities excluding associates, holding companies and

consolidation adjustments

6. WPB TE as a share of TE allocated to the global businesses (excluding Corporate Centre). Excludes holding

companies, and consolidation adjustments

NNIA: Net New Invested Assets. Includes Retail Wealth (excl. deposits), GPB (excl. deposits), and AM 3rd party. Asia

Retail Wealth NNIA includes only China/HK/HASE/Singapore/Malaysia - representing 96% of invested assets in Asia.

Prepared on a reported basis

5.

7.

8.

Wealth deposits include Premier, Jade and Global Private Banking deposits, which include Prestige deposits in Hang

Seng Bank, and form part of the total WPB customer accounts balance

9.

Assets managed by HSBC Asset Management. Excludes associates and joint ventures. Prepared on a reported basis

10. Asia WPB Wealth Revenue: WPB Wealth, WPB Insurance, GPB, and Asset Management

11. Asia WPB Insurance Value of New Business includes Singapore, China and HK (AMH and HASE)

12. Primarily Markets income, down vs. prior year due to strong comparative period

13. Between CMB and GBM: Includes Global Markets products to CMB customers and Global Banking products to CMB

Customers

14. GBM and WPB: Includes GM products to WPB customers

15. East refers to Asia, Middle East, North Africa and Turkey (MENAT). West refers to Europe, North America and Latin

America. Calculation is based on GBM RWAS by region, as stated in the external datapack, which exclude the impact

of market risk diversification and inter-regional eliminations

16. Exit of US mass retail and planned sale of France Retail

17. FY21 adjusted costs for HSBC Bank plc includes a first-time allocation of the UK bank levy of $171m

18. Data is as of 31 March 2021 and as quoted in HSBC press release dated 26 May 2021

19. Data is as of 31 December 2020 and as quoted in HSBC press release dated 18 June 2021

20. 4th largest health insurer based on gross premiums and 7th largest life insurer based on annualised new premiums

based on MAS and LIAS data as of December 2020

21. Data at 30 September 2021. AUM source: Association of Mutual Funds in India (Average AUM)

22. Technology costs in operating expenses trends include transformation saves and are presented on a net basis

23. On an IFRS 4 basis

24. % of total Technology workforce in the global businesses and functions are aligned to at least one agile team per

Strategy

4021 results

Appendix

agile blueprint

25.

% of the Group's technology services that are on the private or public cloud; 2020 cloud adoption is based on an

estimate of private cloud usage

26. % of transactions initiated digitally by our customers on our HSBC digital channels

27. HSBCnet is HSBC's global internet banking platform for wholesale clients

28. % of WPB customers who have logged into a HSBC Mobile App at least once in the last 30 days. Percentages are for

the month of December in their respective years

29. Employee engagement index represents the average % of respondents who would recommend HSBC as a great

place to work, are proud to say they work for HSBC and feel valued at HSBC

30. Senior leadership is classified as those at Band 3 and above in our global career band structure. Employees with an

'Undeclared' or 'Unknown' gender have been incorporated into the 'Male' category

31.

Contribution in 2021 towards the Group's $750bn to $1tn sustainable finance and investment ambition. The volume

amounts stated include; capital markets/advisory activities, balance sheet related transactions that capture the limit

of the facility at the time it was provided and the net new flows of sustainable investments (Assets under

Management)

32. This absolute greenhouse gas emission figure covers scope 1, scope 2 and scope 3 (business travel) emissions; data

for 2019 and 2020 has been revised as we have updated our air travel reporting methodology to include the cabin

class travel and the impact of radiative forces. The emissions of HSBC's vehicle fleet were reported under scope 3 for

these two years. Please see CO2 Emissions Reporting Guideline and PwC Assurance Report (available at

www.hsbc.com/our-approach/esg-information/esg-reporting-and-policies) for 2019 and 2020

33. 4021 DPS in respect of FY21; 4020 DPS in respect of FY20

34. CMB lending growth during FY21 includes the impact of $13bn of gross RWA reductions

35. NII sensitivity reflects the impact of immediate rate shocks on NII to a hypothetical base case projection, which

already incorporates forward rates (as at 31 December 2021), assuming a constant balance sheet as of 31 December

2021

36. Source: Bloomberg. GBP: Sterling Overnight Index Average (SONIA); USD: Fed funds. Implied rates for 31 December

2022 and 2023 based on the following as of 18 February 2022: 30 day Fed Funds futures and one month SONIA

index future

37. Based on current consensus economic forecasts and default experience, noting we retain $0.6bn of Covid-19-related

allowances as at the end of 2021. Uncertainty remains given recent developments in China's commercial real estate

sector, while inflationary pressures persist in many of our markets

38. Technology cost increases in quarterly walks are presented on a gross basis (excl. saves)

39. Includes movements in fair value through other comprehensive income reserve, deductions for excess expected loss

and investments in financial sector entities

40. Source: HKMA at 31 December 2021; Hong Kong market share includes HASE

41. Applicable transactions cover 34 markets (including the UK and Hong Kong) and exclude payments that are

cancelled, low value or batched payments, transactions that require intervention due to regulation and manual

payments

54View entire presentation