Pathward Financial Results Presentation Deck

Low-cost

Deposits

HIGHLIGHTS

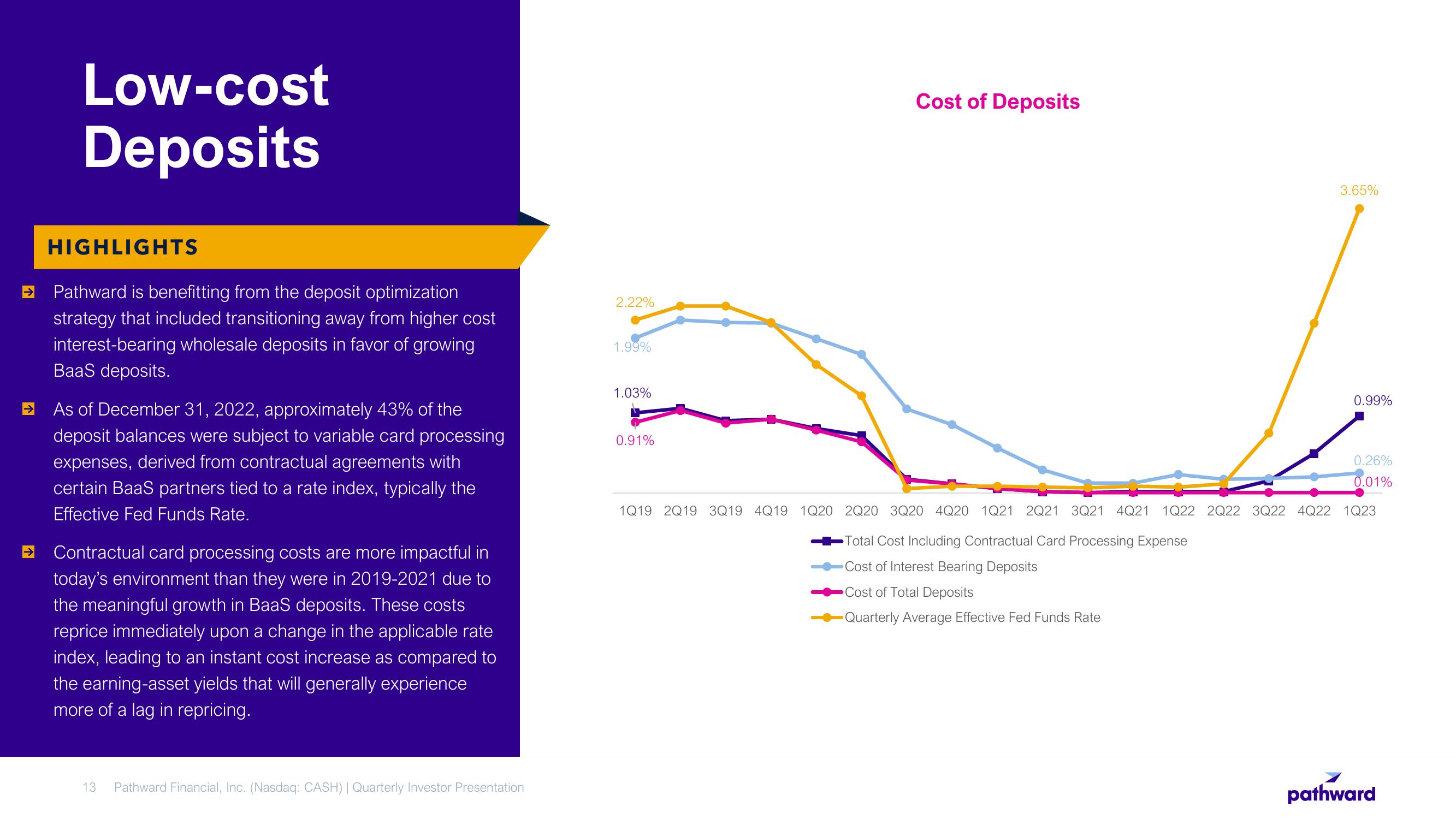

→ Pathward is benefitting from the deposit optimization

strategy that included transitioning away from higher cost

interest-bearing wholesale deposits in favor of growing

BaaS deposits.

As of December 31, 2022, approximately 43% of the

deposit balances were subject to variable card processing

expenses, derived from contractual agreements with

certain BaaS partners tied to a rate index, typically the

Effective Fed Funds Rate.

→ Contractual card processing costs are more impactful in

today's environment than they were in 2019-2021 due to

the meaningful growth in BaaS deposits. These costs

reprice immediately upon a change in the applicable rate

index, leading to an instant cost increase as compared to

the earning-asset yields that will generally experience

more of a lag in repricing.

13 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

2.22%

1.99%

1.03%

0.91%

Cost of Deposits

3.65%

0.99%

0.26%

0.01%

1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23

Total Cost Including Contractual Card Processing Expense

Cost of Interest Bearing Deposits

Cost of Total Deposits

Quarterly Average Effective Fed Funds Rate

pathwardView entire presentation