Pershing Square Activist Presentation Deck

(1)

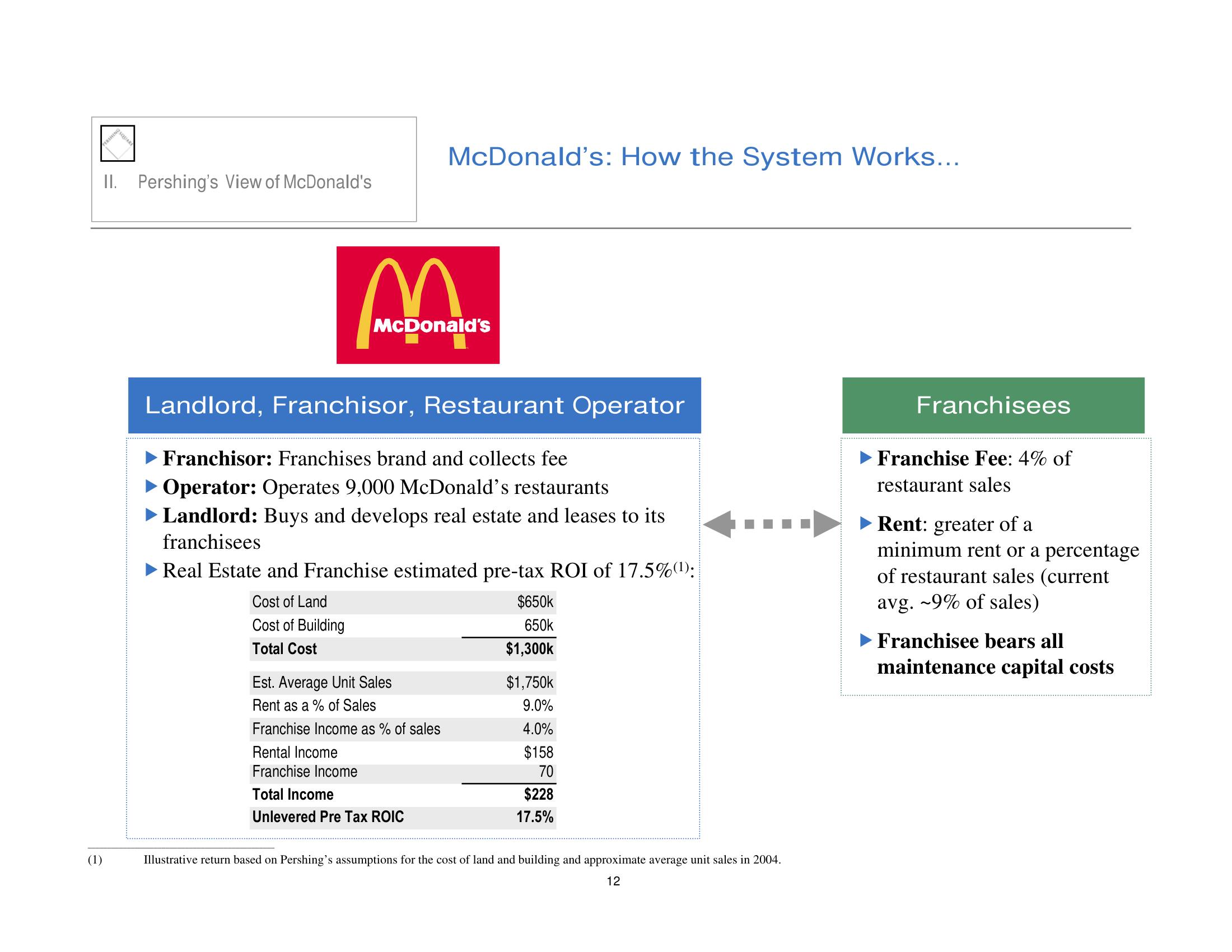

II. Pershing's View of McDonald's

McDonald's

McDonald's: How the System Works...

Landlord, Franchisor, Restaurant Operator

▶ Franchisor: Franchises brand and collects fee

Operator: Operates 9,000 McDonald's restaurants

Landlord: Buys and develops real estate and leases to its

franchisees

Real Estate and Franchise estimated pre-tax ROI of 17.5%(¹):

Cost of Land

Cost of Building

Total Cost

Est. Average Unit Sales

Rent as a % of Sales

Franchise Income as % of sales

Rental Income

Franchise Income

Total Income

Unlevered Pre Tax ROIC

$650k

650k

$1,300k

$1,750k

9.0%

4.0%

$158

70

$228

17.5%

Illustrative return based on Pershing's assumptions for the cost of land and building and approximate average unit sales in 2004.

12

Franchisees

Franchise Fee: 4% of

restaurant sales

Rent: greater of a

minimum rent or a percentage

of restaurant sales (current

avg. -9% of sales)

Franchisee bears all

maintenance capital costsView entire presentation