Cyxtera Results Presentation Deck

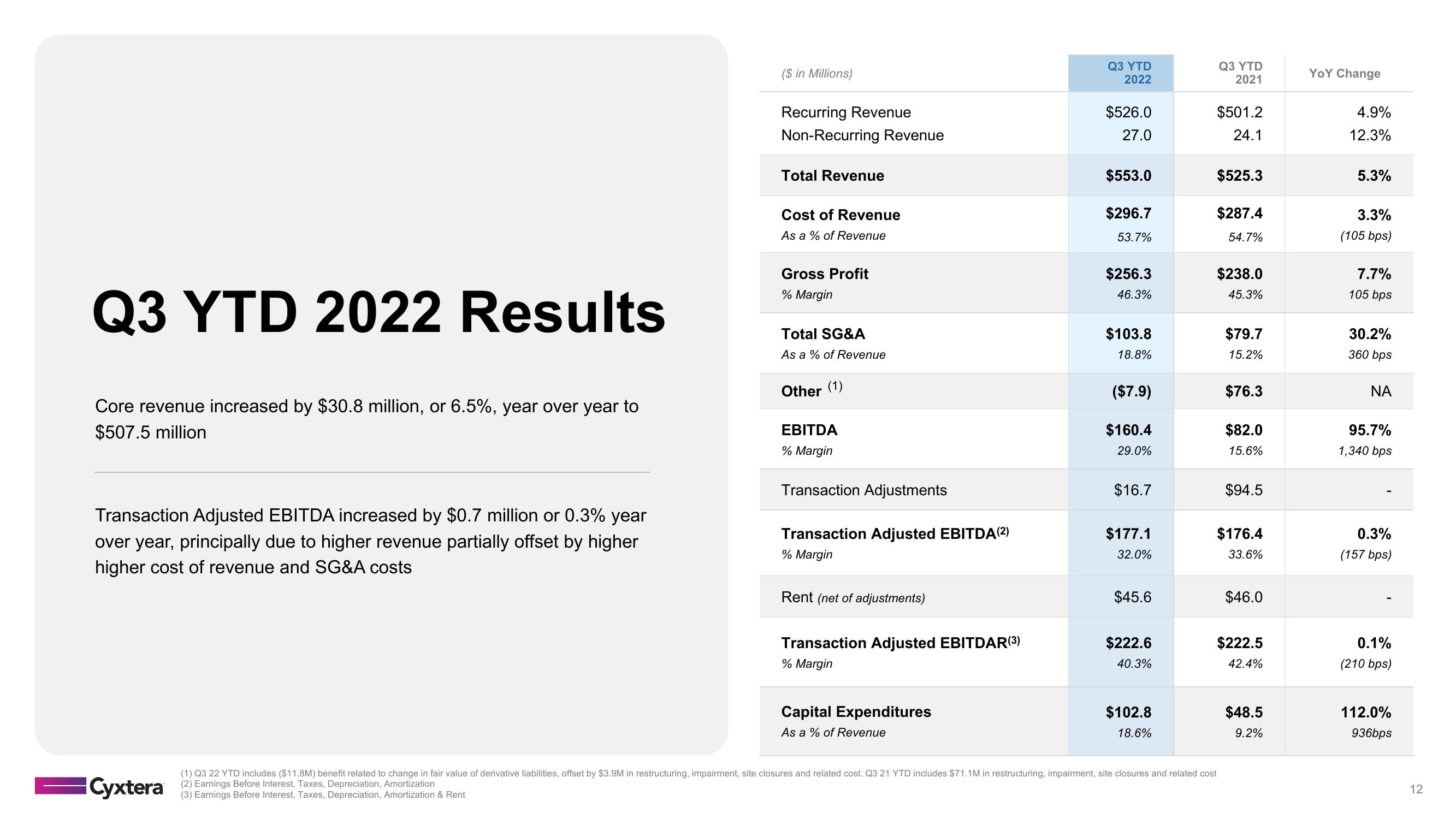

Q3 YTD 2022 Results

Core revenue increased by $30.8 million, or 6.5%, year over year to

$507.5 million

Transaction Adjusted EBITDA increased by $0.7 million or 0.3% year

over year, principally due to higher revenue partially offset by higher

higher cost of revenue and SG&A costs

Cyxtera

($ in Millions)

Recurring Revenue

Non-Recurring Revenue

Total Revenue

Cost of Revenue

As a % of Revenue

Gross Profit

% Margin

Total SG&A

As a % of Revenue

Other (1)

EBITDA

% Margin

Transaction Adjustments

Transaction Adjusted EBITDA (2)

% Margin

Rent (net of adjustments)

Transaction Adjusted EBITDAR(3)

% Margin

Capital Expenditures

As a % of Revenue

Q3 YTD

2022

$526.0

27.0

$553.0

$296.7

53.7%

$256.3

46.3%

$103.8

18.8%

($7.9)

$160.4

29.0%

$16.7

$177.1

32.0%

$45.6

$222.6

40.3%

$102.8

18.6%

Q3 YTD

2021

$501.2

24.1

$525.3

$287.4

54.7%

$238.0

45.3%

$79.7

15.2%

(1) Q3 22 YTD includes ($11.8M) benefit related to change in fair value of derivative liabilities, offset by $3.9M in restructuring, impairment, site closures and related cost. Q3 21 YTD includes $71.1M in restructuring, impairment, site closures and related cost

(2) Earnings Before Interest, Taxes, Depreciation, Amortization

(3) Earnings Before Interest, Taxes, Depreciation, Amortization & Rent

$76.3

$82.0

15.6%

$94.5

$176.4

33.6%

$46.0

$222.5

42.4%

$48.5

9.2%

YOY Change

4.9%

12.3%

5.3%

3.3%

(105 bps)

7.7%

105 bps

30.2%

360 bps

ΝΑ

95.7%

1,340 bps

0.3%

(157 bps)

0.1%

(210 bps)

112.0%

936bps

12View entire presentation