UBS Results Presentation Deck

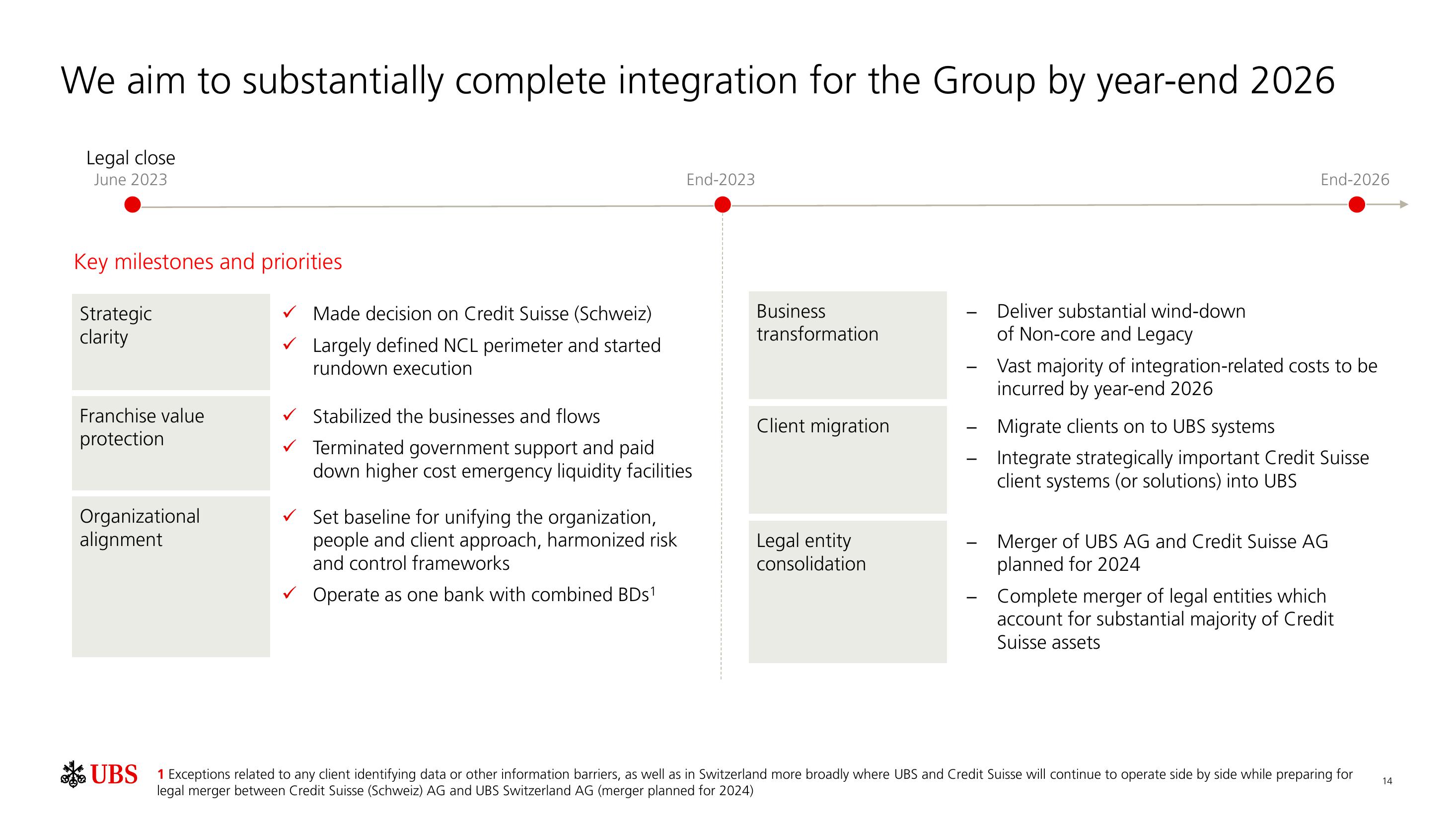

We aim to substantially complete integration for the Group by year-end 2026

Legal close

June 2023

Key milestones and priorities

Strategic

clarity

Franchise value

protection

Organizational

alignment

✓Made decision on Credit Suisse (Schweiz)

✓Largely defined NCL perimeter and started

rundown execution

End-2023

✓ Stabilized the businesses and flows

Terminated government support and paid

down higher cost emergency liquidity facilities

✓ Set baseline for unifying the organization,

people and client approach, harmonized risk

and control frameworks

Operate as one bank with combined BDs¹

Business

transformation

Client migration

Legal entity

consolidation

Deliver substantial wind-down

of Non-core and Legacy

End-2026

Vast majority of integration-related costs to be

incurred by year-end 2026

Migrate clients on to UBS systems

Integrate strategically important Credit Suisse

client systems (or solutions) into UBS

Merger of UBS AG and Credit Suisse AG

planned for 2024

Complete merger of legal entities which

account for substantial majority of Credit

Suisse assets

UBS 1 Exceptions related to any client identifying data or other information barriers, as well as in Switzerland more broadly where UBS and Credit Suisse will continue to operate side by side while preparing for

legal merger between Credit Suisse (Schweiz) AG and UBS Switzerland AG (merger planned for 2024)

14View entire presentation