P3 Health Partners SPAC Presentation Deck

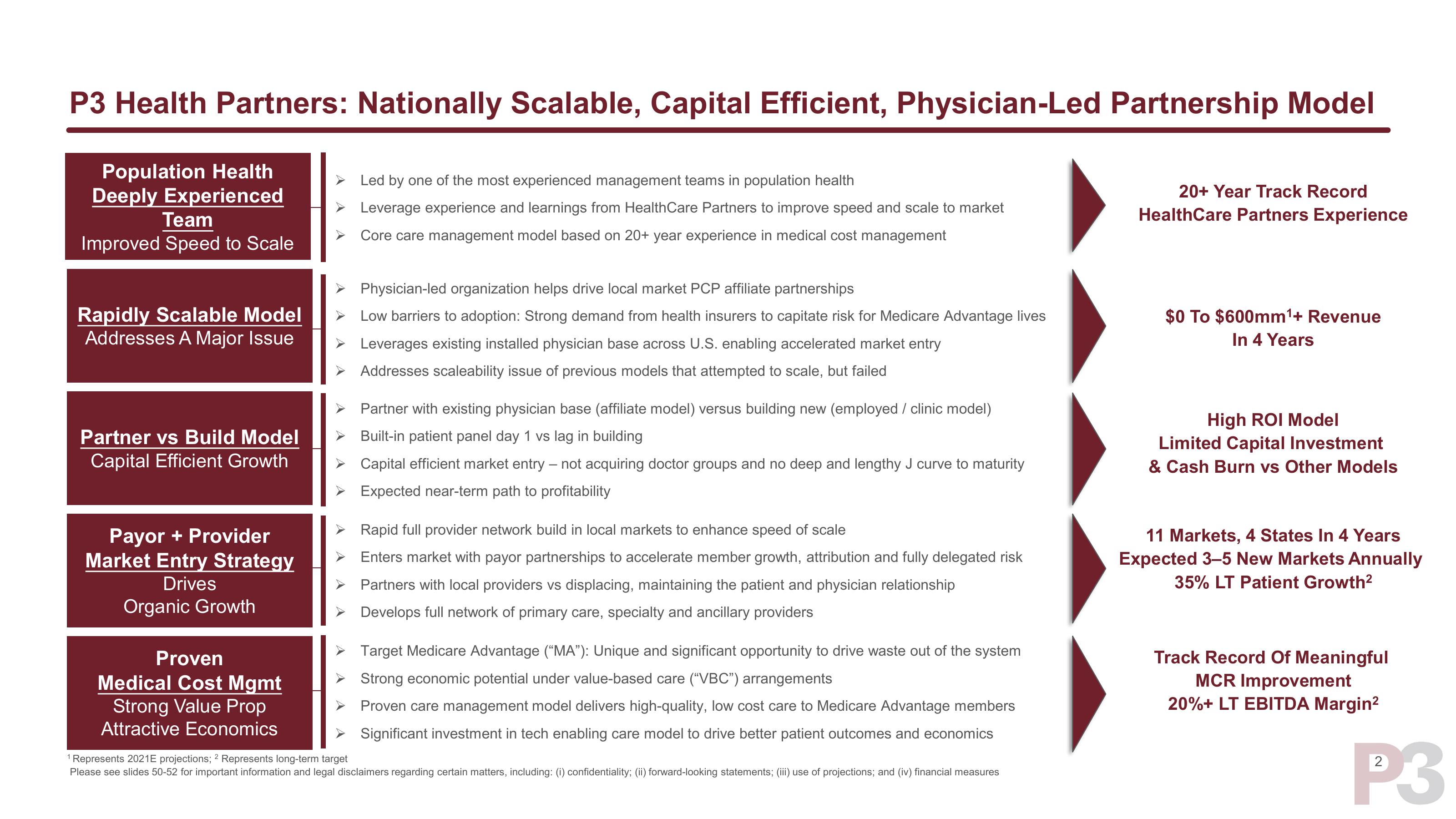

P3 Health Partners: Nationally Scalable, Capital Efficient, Physician-Led Partnership Model

Population Health

Deeply Experienced

Team

Improved Speed to Scale

Rapidly Scalable Model

Addresses A Major Issue

Partner vs Build Model

Capital Efficient Growth

Payor + Provider

Market Entry Strategy

Drives

Organic Growth

Proven

Medical Cost Mgmt

Strong Value Prop

Attractive Economics

Led by one of the most experienced management teams in population health

Leverage experience and learnings from Health Care Partners to improve speed and scale to market

Core care management model based on 20+ year experience in medical cost management

Physician-led organization helps drive local market PCP affiliate partnerships

Low barriers to adoption: Strong demand from health insurers to capitate risk for Medicare Advantage lives

➤ Leverages existing installed physician base across U.S. enabling accelerated market entry

Addresses scaleability issue of previous models that attempted to scale, but failed

Partner with existing physician base (affiliate model) versus building new (employed / clinic model)

Built-in patient panel day 1 vs lag in building

Capital efficient market entry - not acquiring doctor groups and no deep and lengthy J curve to maturity

Expected near-term path to profitability

Rapid full provider network build in local markets to enhance speed of scale

Enters market with payor partnerships to accelerate member growth, attribution and fully delegated risk

Partners with local providers vs displacing, maintaining the patient and physician relationship

Develops full network of primary care, specialty and ancillary providers

Target Medicare Advantage ("MA"): Unique and significant opportunity to drive waste out of the system

Strong economic potential under value-based care ("VBC") arrangements

Proven care management model delivers high-quality, low cost care to Medicare Advantage members

Significant investment in tech enabling care model to drive better patient outcomes and economics

¹ Represents 2021E projections; 2 Represents long-term target

Please see slides 50-52 for important information and legal disclaimers regarding certain matters, including: (i) confidentiality; (ii) forward-looking statements; (iii) use of projections; and (iv) financial measures

20+ Year Track Record

HealthCare Partners Experience

$0 To $600mm¹+ Revenue

In 4 Years

High ROI Model

Limited Capital Investment

& Cash Burn vs Other Models

11 Markets, 4 States In 4 Years

Expected 3-5 New Markets Annually

35% LT Patient Growth²

Track Record Of Meaningful

MCR Improvement

20%+ LT EBITDA Margin²

P3View entire presentation