Investor Presentation

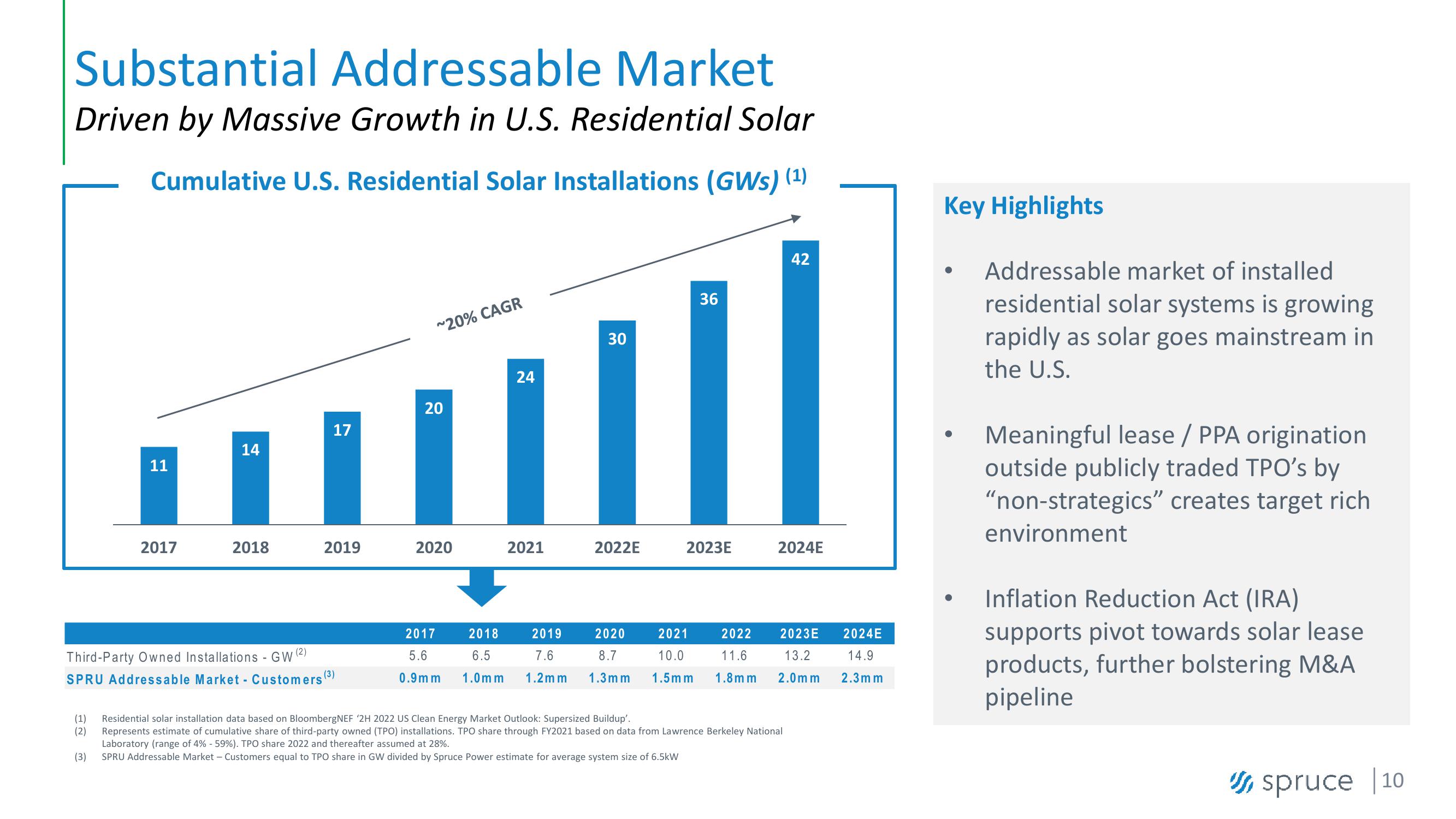

Substantial Addressable Market

Driven by Massive Growth in U.S. Residential Solar

Cumulative U.S. Residential Solar Installations (GWs) (1)

14

11

1

17

20

~20% CAGR

24

30

36

20

42

42

2017

2018

2019

2020

2021

2022E

2023E

2024E

2017

2018

2019

2020

2021

2022

Third-Party Owned Installations - GW

(2)

5.6

6.5

(3)

SPRU Addressable Market Customers

0.9mm

1.0mm

7.6

1.2mm 1.3mm

8.7

10.0

11.6

2023E

13.2

2024E

14.9

1.5mm

1.8mm

2.0mm

2.3mm

Key Highlights

Addressable market of installed

residential solar systems is growing

rapidly as solar goes mainstream in

the U.S.

Meaningful lease/ PPA origination

outside publicly traded TPO's by

"non-strategics" creates target rich

environment

Inflation Reduction Act (IRA)

supports pivot towards solar lease

products, further bolstering M&A

pipeline

(1) Residential solar installation data based on BloombergNEF '2H 2022 US Clean Energy Market Outlook: Supersized Buildup'.

(2) Represents estimate of cumulative share of third-party owned (TPO) installations. TPO share through FY2021 based on data from Lawrence Berkeley National

Laboratory (range of 4% -59%). TPO share 2022 and thereafter assumed at 28%.

(3)

SPRU Addressable Market - Customers equal to TPO share in GW divided by Spruce Power estimate for average system size of 6.5kW

spruce 10View entire presentation