Jefferies Financial Group Investor Day Presentation Deck

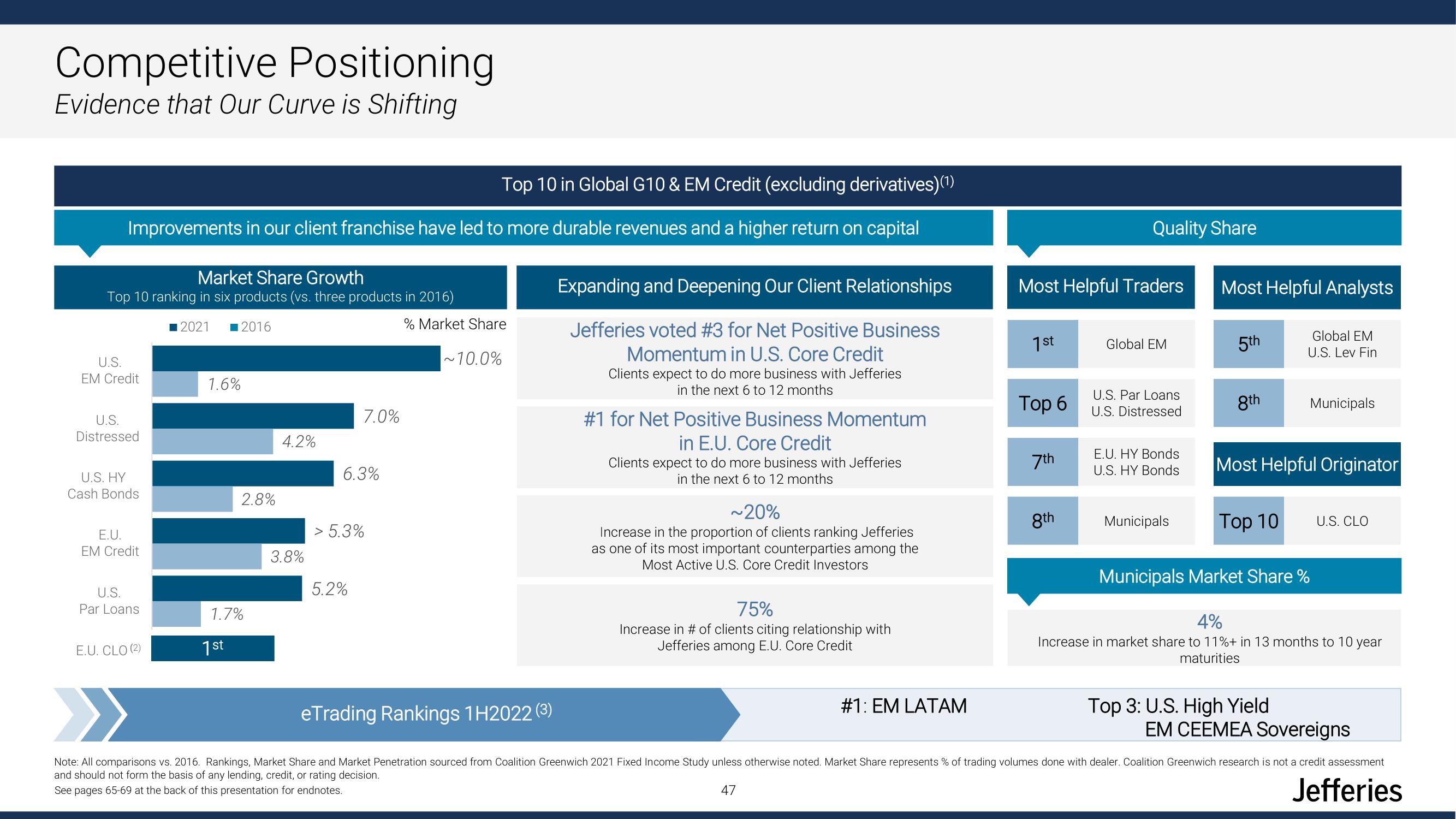

Competitive Positioning

Evidence that Our Curve is Shifting

Top 10 in Global G10 & EM Credit (excluding derivatives) (1)

Improvements in our client franchise have led to more durable revenues and a higher return on capital

Market Share Growth

Top 10 ranking in six products (vs. three products in 2016)

2021 ■2016

U.S.

EM Credit

U.S.

Distressed

U.S. HY

Cash Bonds

E.U.

EM Credit

U.S.

Par Loans

E.U. CLO (2)

1.6%

2.8%

1.7%

1st

4.2%

3.8%

7.0%

6.3%

> 5.3%

5.2%

% Market Share

~10.0%

Expanding and Deepening Our Client Relationships

Jefferies voted #3 for Net Positive Business

Momentum in U.S. Core Credit

Clients expect to do more business with Jefferies

in the next 6 to 12 months

#1 for Net Positive Business Momentum

in E.U. Core Credit

Clients expect to do more business with Jefferies

in the next 6 to 12 months

~20%

Increase in the proportion of clients ranking Jefferies

as one of its most important counterparties among the

Most Active U.S. Core Credit Investors

75%

Increase in # of clients citing relationship with

Jefferies among E.U. Core Credit

#1: EM LATAM

Most Helpful Traders

1st

Top 6

7th

Quality Share

8th

Global EM

U.S. Par Loans

U.S. Distressed

E.U. HY Bonds

U.S. HY Bonds

Municipals

Most Helpful Analysts

5th

8th

Top 10

Global EM

U.S. Lev Fin

Most Helpful Originator

Municipals Market Share %

Municipals

Top 3: U.S. High Yield

U.S. CLO

4%

Increase in market share to 11%+ in 13 months to 10 year

maturities

eTrading Rankings 1H2022 (3)

Note: All comparisons vs. 2016. Rankings, Market Share and Market Penetration sourced from Coalition Greenwich 2021 Fixed Income Study unless otherwise noted. Market Share represents % of trading volumes done with dealer. Coalition Greenwich research is not a credit assessment

and should not form the basis of any lending, credit, or rating decision.

47

See pages 65-69 at the back of this presentation for endnotes.

Jefferies

EM CEEMEA SovereignsView entire presentation