Getty SPAC Presentation Deck

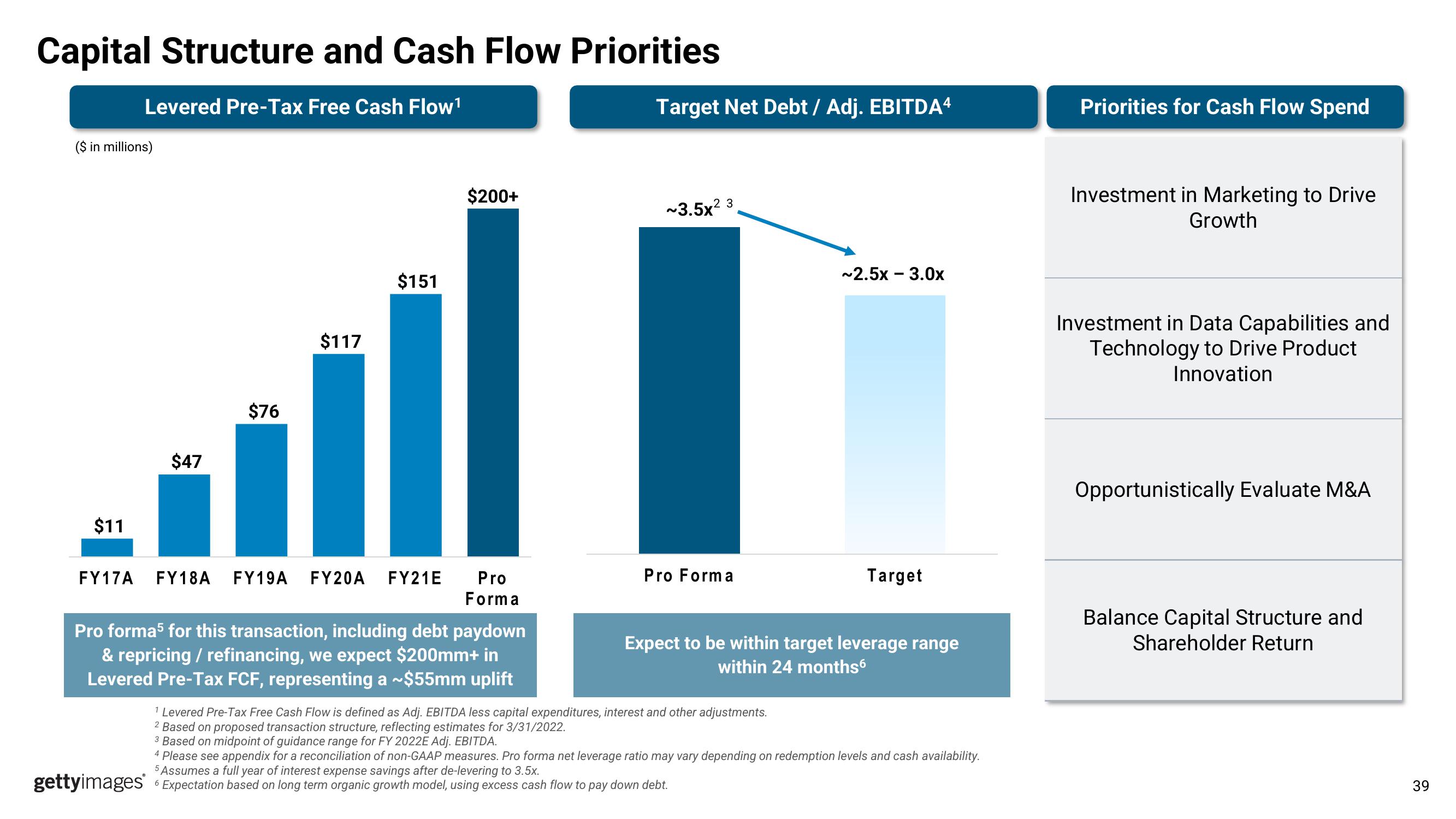

Capital Structure and Cash Flow Priorities

Levered Pre-Tax Free Cash Flow¹

($ in millions)

$11

$47

$76

$117

$151

FY17A FY18A FY19A FY20A FY21E

$200+

Pro

Forma

Pro forma5 for this transaction, including debt paydown

& repricing / refinancing, we expect $200mm+ in

Levered Pre-Tax FCF, representing a ~$55mm uplift

Target Net Debt / Adj. EBITDA4

~3.5x2

2 3

Pro Forma

~2.5x - 3.0x

Target

Expect to be within target leverage range

within 24 months6

¹ Levered Pre-Tax Free Cash Flow is defined as Adj. EBITDA less capital expenditures, interest and other adjustments.

2 Based on proposed transaction structure, reflecting estimates for 3/31/2022.

3 Based on midpoint of guidance range for FY 2022E Adj. EBITDA.

4 Please see appendix for a reconciliation of non-GAAP measures. Pro forma net leverage ratio may vary depending on redemption levels and cash availability.

5 Assumes a full year of interest expense savings after de-levering to 3.5x.

gettyimages Expectation based on long term organic growth model, using excess cash flow to pay down debt.

6

Priorities for Cash Flow Spend

Investment in Marketing to Drive

Growth

Investment in Data Capabilities and

Technology to Drive Product

Innovation

Opportunistically Evaluate M&A

Balance Capital Structure and

Shareholder Return

39View entire presentation