Strategically Positioning Truist Insurance Holdings for Long-Term Success

Highlighting the significant value of TIH and Truist

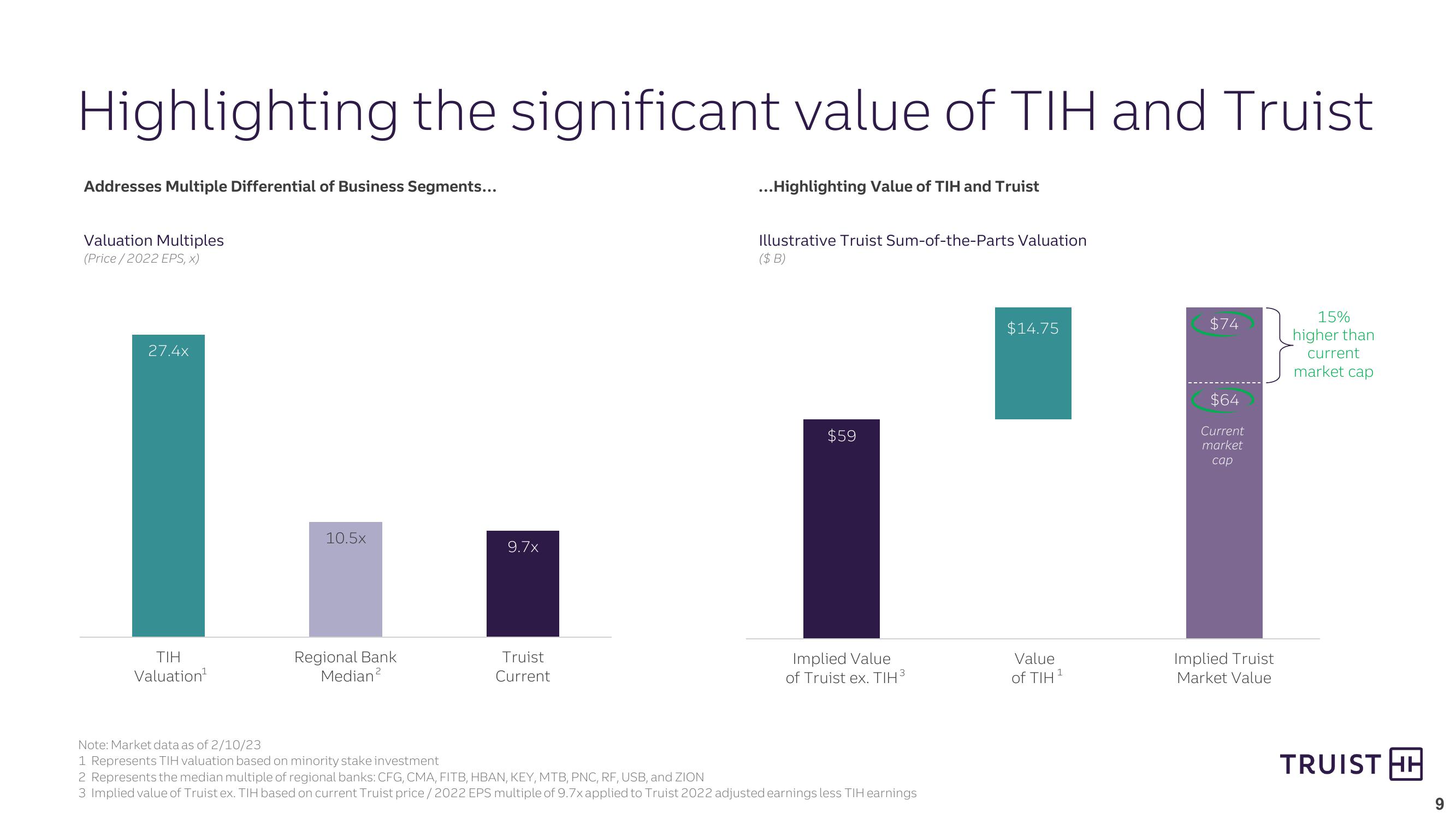

Addresses Multiple Differential of Business Segments...

...Highlighting Value of TIH and Truist

Valuation Multiples

(Price/2022 EPS, X)

27.4x

10.5×

9.7x

TIH

Valuation¹

Regional Bank

Median²

Truist

Current

Note: Market data as of 2/10/23

1 Represents TIH valuation based on minority stake investment

Illustrative Truist Sum-of-the-Parts Valuation

($ B)

$59

$14.75

$74

15%

higher than

current

market cap

$64

Current

market

cap

Implied Value

of Truist ex. TIH³

Value

of TIH 1

Implied Truist

Market Value

2 Represents the median multiple of regional banks: CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, USB, and ZION

3 Implied value of Truist ex. TIH based on current Truist price/ 2022 EPS multiple of 9.7x applied to Truist 2022 adjusted earnings less TIH earnings

TRUIST HH

9View entire presentation