Melrose Results Presentation Deck

Cash generation qualities of all the businesses transformed

Melrose

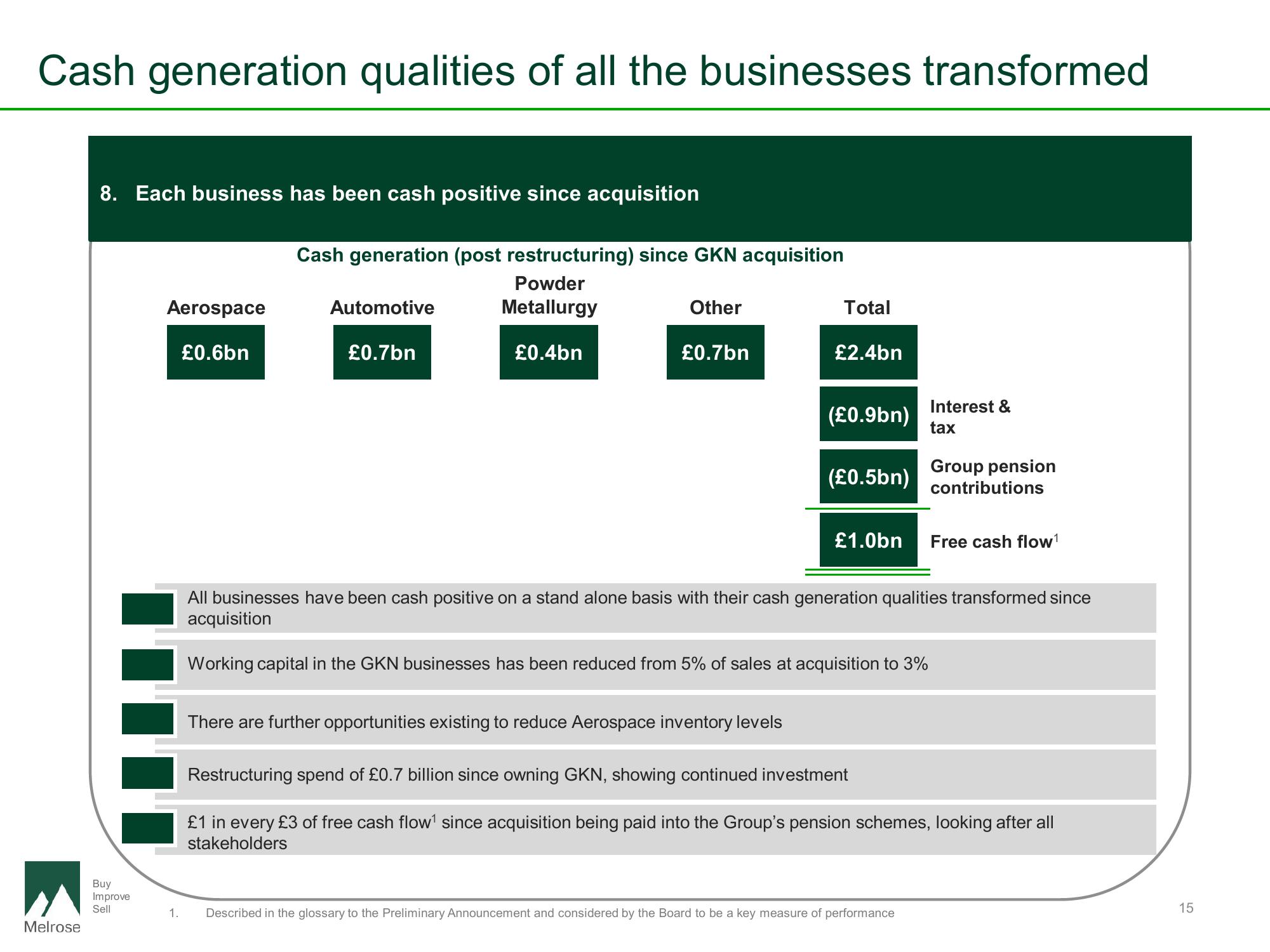

8. Each business has been cash positive since acquisition

Buy

Improve

Sell

Aerospace

£0.6bn

1.

Cash generation (post restructuring) since GKN acquisition

Powder

Metallurgy

£0.4bn

Automotive

£0.7bn

Other

£0.7bn

Total

There are further opportunities existing to reduce Aerospace inventory levels

£2.4bn

(£0.9bn)

(£0.5bn)

£1.0bn

Interest &

tax

Group pension

contributions

All businesses have been cash positive on a stand alone basis with their cash generation qualities transformed since

acquisition

Working capital in the GKN businesses has been reduced from 5% of sales at acquisition to 3%

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Free cash flow¹

Restructuring spend of £0.7 billion since owning GKN, showing continued investment

£1 in every £3 of free cash flow¹ since acquisition being paid into the Group's pension schemes, looking after all

stakeholders

15View entire presentation