Pershing Square Activist Presentation Deck

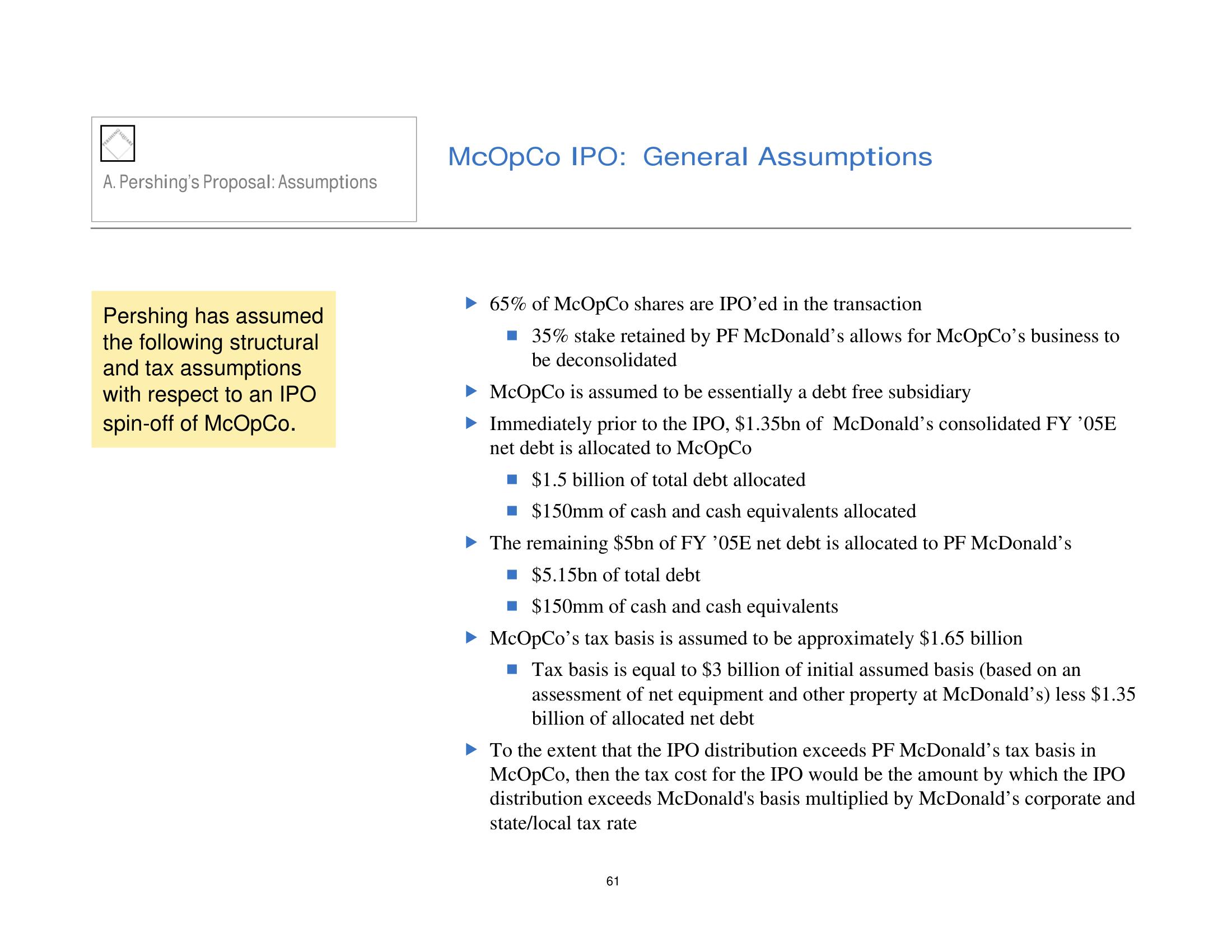

A. Pershing's Proposal: Assumptions

Pershing has assumed

the following structural

and tax assumptions

with respect to an IPO

spin-off of McOpCo.

McOpCo IPO: General Assumptions

65% of McOpCo shares are IPO'ed in the transaction

■ 35% stake retained by PF McDonald's allows for McOpCo's business to

be deconsolidated

McOpCo is assumed to be essentially a debt free subsidiary

Immediately prior to the IPO, $1.35bn of McDonald's consolidated FY '05E

net debt is allocated to McOpCo

■ $1.5 billion of total debt allocated

■ $150mm of cash and cash equivalents allocated

The remaining $5bn of FY '05E net debt is allocated to PF McDonald's

■ $5.15bn of total debt

■ $150mm of cash and cash equivalents

McOpCo's tax basis is assumed to be approximately $1.65 billion

■ Tax basis is equal to $3 billion of initial assumed basis (based on an

assessment of net equipment and other property at McDonald's) less $1.35

billion of allocated net debt

To the extent that the IPO distribution exceeds PF McDonald's tax basis in

McOpCo, then the tax cost for the IPO would be the amount by which the IPO

distribution exceeds McDonald's basis multiplied by McDonald's corporate and

state/local tax rate

61View entire presentation