Melrose Results Presentation Deck

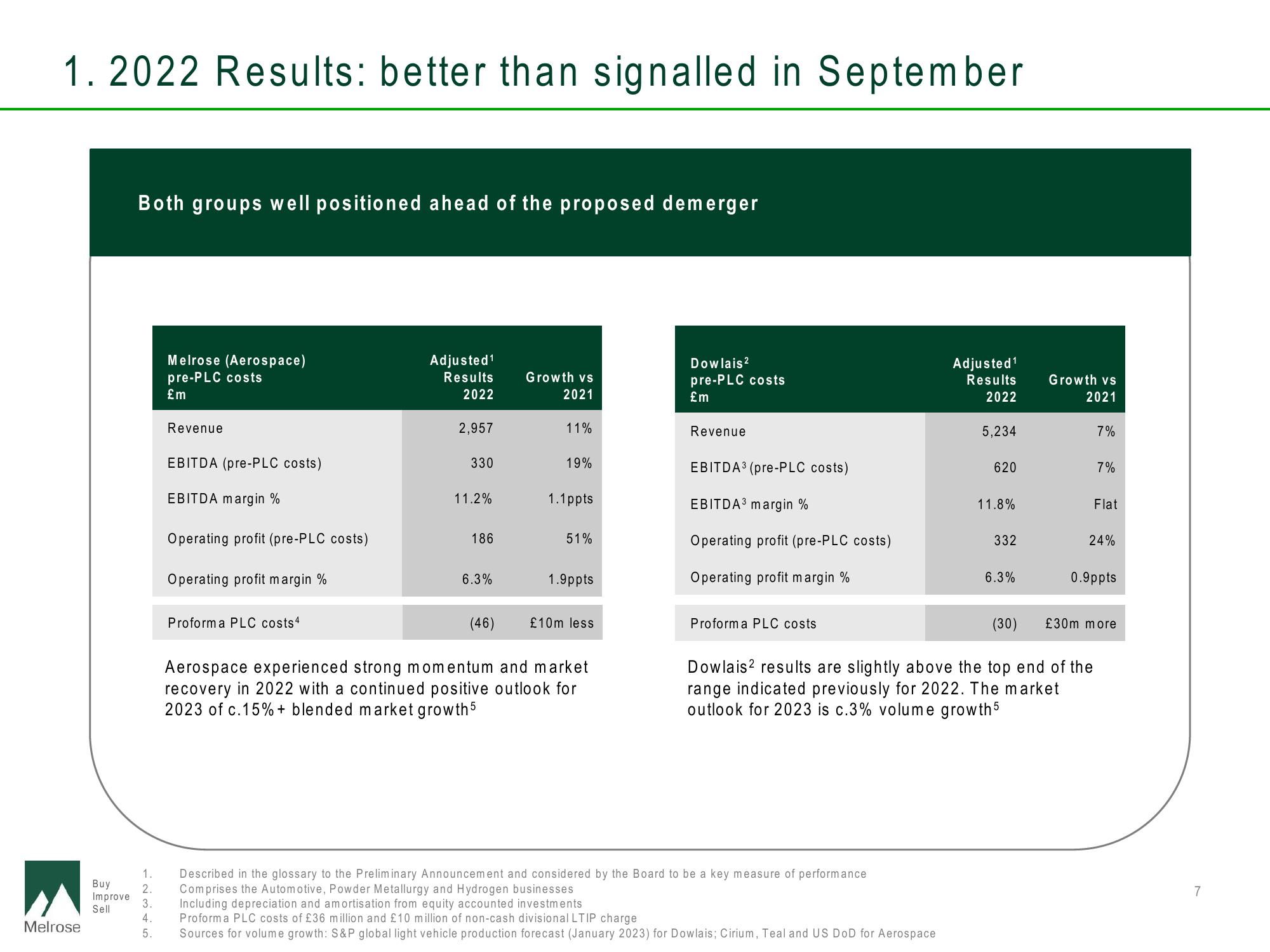

1. 2022 Results: better than signalled in September

Melrose

Buy

Improve

Sell

Both groups well positioned ahead of the proposed demerger

1.

2.

3.

4.

5.

Melrose (Aerospace)

pre-PLC costs

£m

Revenue

EBITDA (pre-PLC costs)

EBITDA margin %

Operating profit (pre-PLC costs)

Operating profit margin %

Proforma PLC costs4

Adjusted ¹

Results

2022

2,957

330

11.2%

186

6.3%

Growth vs

2021

11%

19%

1.1ppts

51%

1.9ppts

(46) £10m less

Aerospace experienced strong momentum and market

recovery in 2022 with a continued positive outlook for

2023 of c.15% + blended market growth 5

Dowlais²

pre-PLC costs

£m

Revenue

EBITDA ³ (pre-PLC costs)

EBITDA³ margin %

Operating profit (pre-PLC costs)

Operating profit margin %

Proforma PLC costs

Adjusted ¹

Results

2022

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Comprises the Automotive, Powder Metallurgy and Hydrogen businesses

Including depreciation and amortisation from equity accounted investments

Proforma PLC costs of £36 million and £10 million of non-cash divisional LTIP charge

Sources for volume growth: S&P global light vehicle production forecast (January 2023) for Dowlais; Cirium, Teal and US DoD for Aerospace

5,234

620

11.8%

332

6.3%

Growth vs

2021

7%

7%

(30)

Dowlais2 results are slightly above the top end of the

range indicated previously for 2022. The market

outlook for 2023 is c.3% volume growth 5

Flat

24%

0.9ppts

£30m more

7View entire presentation