Sterling Results Presentation Deck

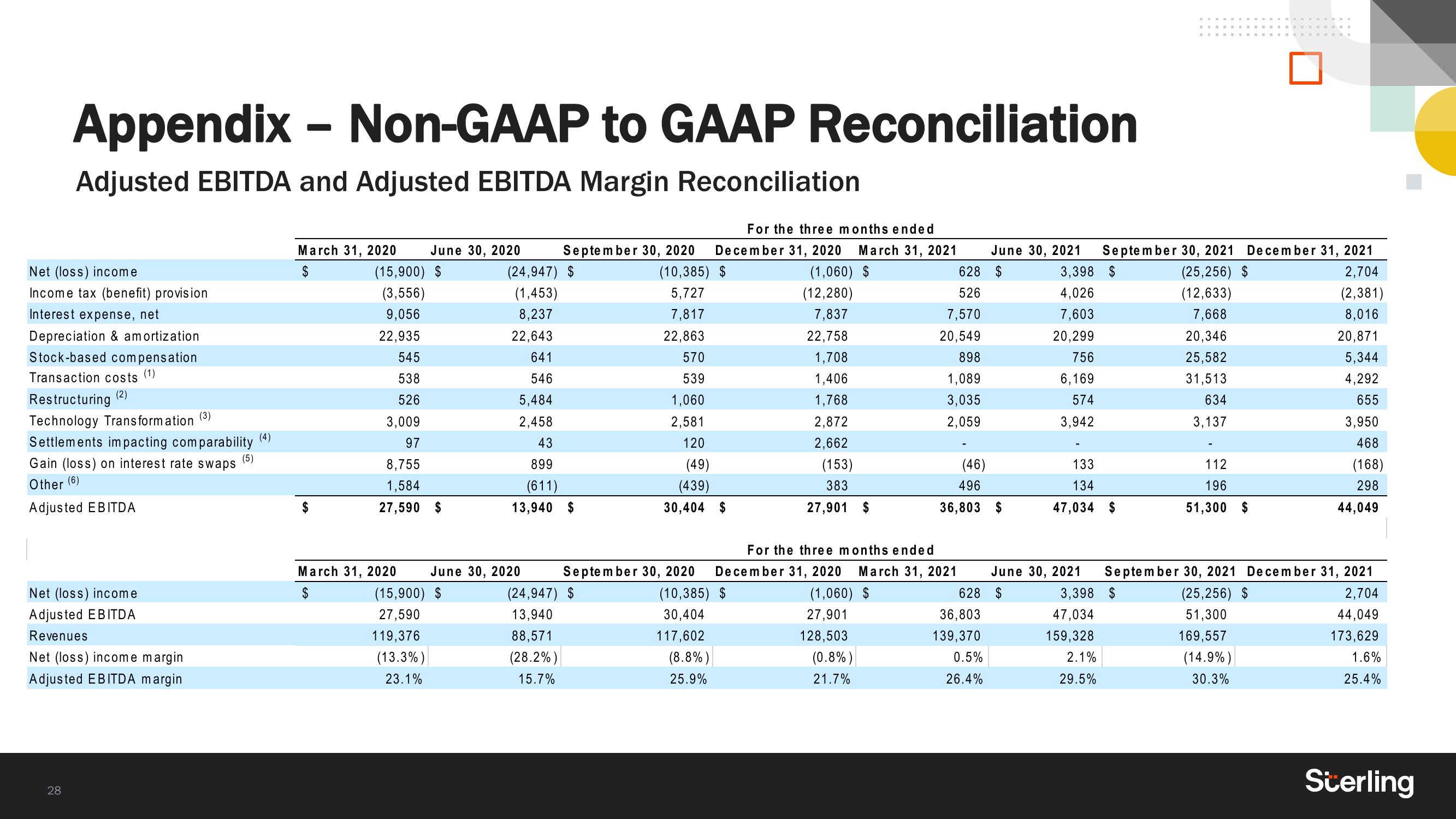

Appendix - Non-GAAP to GAAP Reconciliation

Adjusted EBITDA and Adjusted EBITDA Margin Reconciliation

Net (loss) income

Income tax (benefit) provision

Interest expense, net

Depreciation & amortization

Stock-based compensation

Transaction costs (1)

Restructuring (2)

(3)

Technology Transformation

Settlements impacting comparability

Gain (loss) on interest rate swaps

Other

(6)

Adjusted EBITDA

Net (loss) income

Adjusted EBITDA

Revenues

Net (loss) income margin

Adjusted EBITDA margin

28

(5)

(4)

March 31, 2020 June 30, 2020

$

(15,900) $

(3,556)

9,056

22,935

545

538

526

3,009

97

8,755

1,584

27,590 $

March 31, 2020

$

For the three months ended

September 30, 2020 December 31, 2020 March 31, 2021

(24,947) $

(10,385) $

(1,060) $

5,727

(1,453)

(12,280)

8,237

7,817

7,837

22,643

22,863

22,758

570

1,708

539

1,406

1,060

1,768

2,581

2,872

2,662

(15,900) $

27,590

119,376

(13.3%)

23.1%

641

546

5,484

2,458

43

899

(611)

13,940 $

June 30, 2020

120

(49)

(439)

30,404 $

September 30, 2020

(24,947) $

13,940

88,571

(28.2%)

15.7%

(10,385) $

30,404

117,602

(8.8%)

25.9%

(153)

383

27,901 $

For the three months ended

December 31, 2020 March 31, 2021

(1,060) $

27,901

128,503

June 30, 2021

628 $

526

7,570

20,549

898

1,089

3,035

2,059

(0.8%)

21.7%

(46)

496

36,803 $

0.5%

26.4%

3,398 $

4,026

7,603

20,299

756

6,169

574

3,942

June 30, 2021

628 $

36,803

139,370

September 30, 2021 December 31, 2021

(25,256) $

2,704

(12,633)

(2,381)

7,668

8,016

133

134

47,034 $

47,034

159,328

2.1%

29.5%

3,398 $

20,346

25,582

31,513

634

3,137

112

196

51,300 $

September 30, 2021 December 31, 2021

2,704

44,049

173,629

1.6%

25.4%

(25,256) $

51,300

169,557

20,871

5,344

4,292

655

(14.9%)

30.3%

3,950

468

(168)

298

44,049

SterlingView entire presentation