Near Investor Presentation Deck

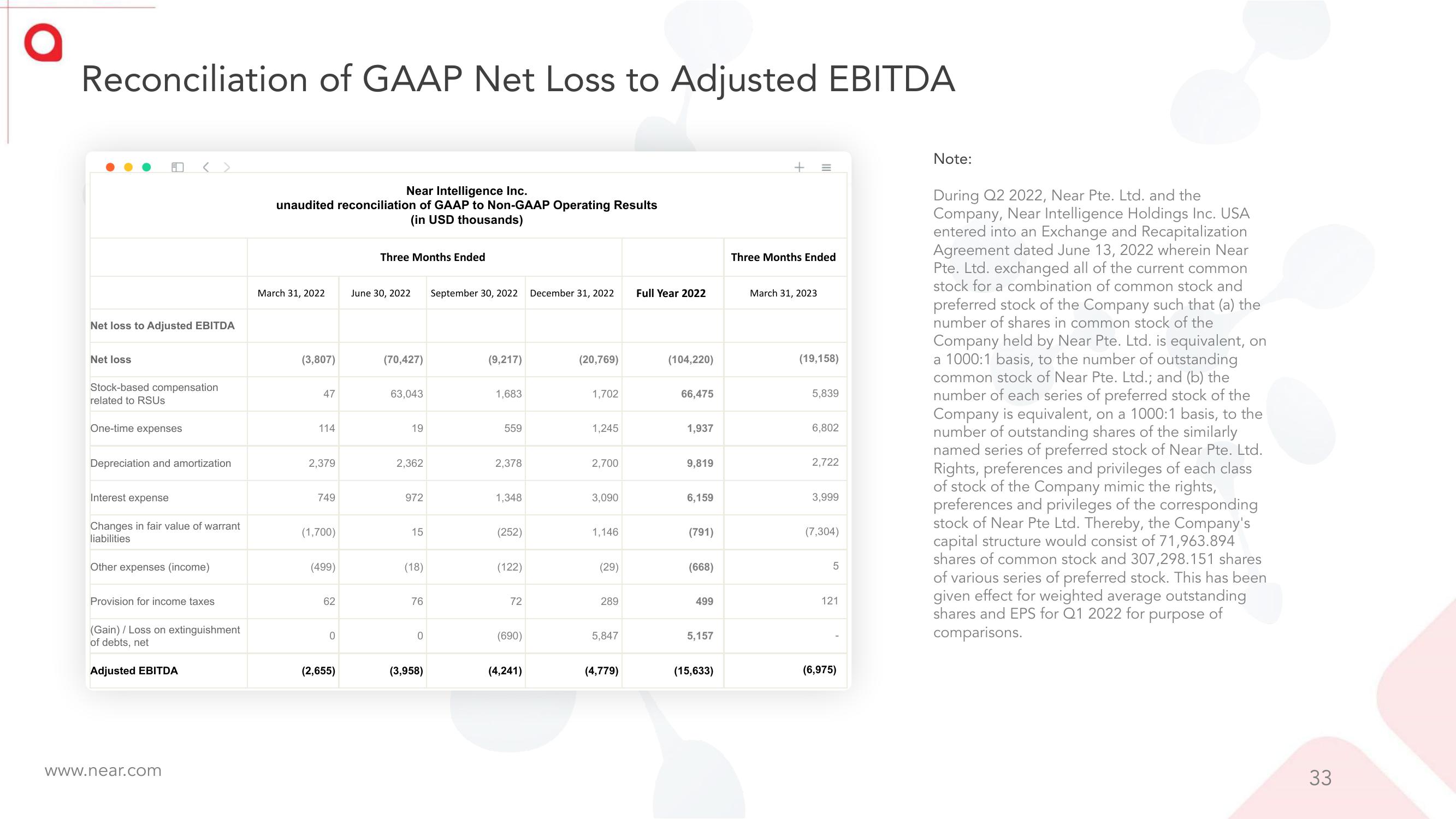

Reconciliation of GAAP Net Loss to Adjusted EBITDA

Net loss to Adjusted EBITDA

Net loss

Stock-based compensation

related to RSUS

One-time expenses

Depreciation and amortization

Interest expense

Changes in fair value of warrant

liabilities

Other expenses (income)

Provision for income taxes

(Gain) / Loss on extinguishment

of debts, net

Adjusted EBITDA

www.near.com

Near Intelligence Inc.

unaudited reconciliation of GAAP to Non-GAAP Operating Results

(in USD thousands)

March 31, 2022

(3,807)

47

114

2,379

749

(1,700)

(499)

62

0

(2,655)

Three Months Ended

June 30, 2022 September 30, 2022

(70,427)

63,043

19

2,362

972

15

(18)

76

0

(3,958)

(9,217)

1,683

559

2,378

1,348

(252)

(122)

72

(690)

(4,241)

December 31, 2022

(20,769)

1,702

1,245

2,700

3,090

1,146

(29)

289

5,847

(4,779)

Full Year 2022

(104,220)

66,475

1,937

9,819

6,159

(791)

(668)

499

5,157

(15,633)

+

Three Months Ended

March 31, 2023

(19,158)

5,839

6,802

2,722

3,999

(7,304)

5

121

(6,975)

Note:

During Q2 2022, Near Pte. Ltd. and the

Company, Near Intelligence Holdings Inc. USA

entered into an Exchange and Recapitalization

Agreement dated June 13, 2022 wherein Near

Pte. Ltd. exchanged all of the current common

stock for a combination of common stock and

preferred stock of the Company such that (a) the

number of shares in common stock of the

Company held by Near Pte. Ltd. is equivalent, on

a 1000:1 basis, to the number of outstanding

common stock of Near Pte. Ltd.; and (b) the

number of each series of preferred stock of the

Company is equivalent, on a 1000:1 basis, to the

number of outstanding shares of the similarly

named series of preferred stock of Near Pte. Ltd.

Rights, preferences and privileges of each class

of stock of the Company mimic the rights,

preferences and privileges of the corresponding

stock of Near Pte Ltd. Thereby, the Company's

capital structure would consist of 71,963.894

shares of common stock and 307,298.151 shares

of various series of preferred stock. This has been

given effect for weighted average outstanding

shares and EPS for Q1 2022 for purpose of

comparisons.

33View entire presentation