Goldman Sachs Results Presentation Deck

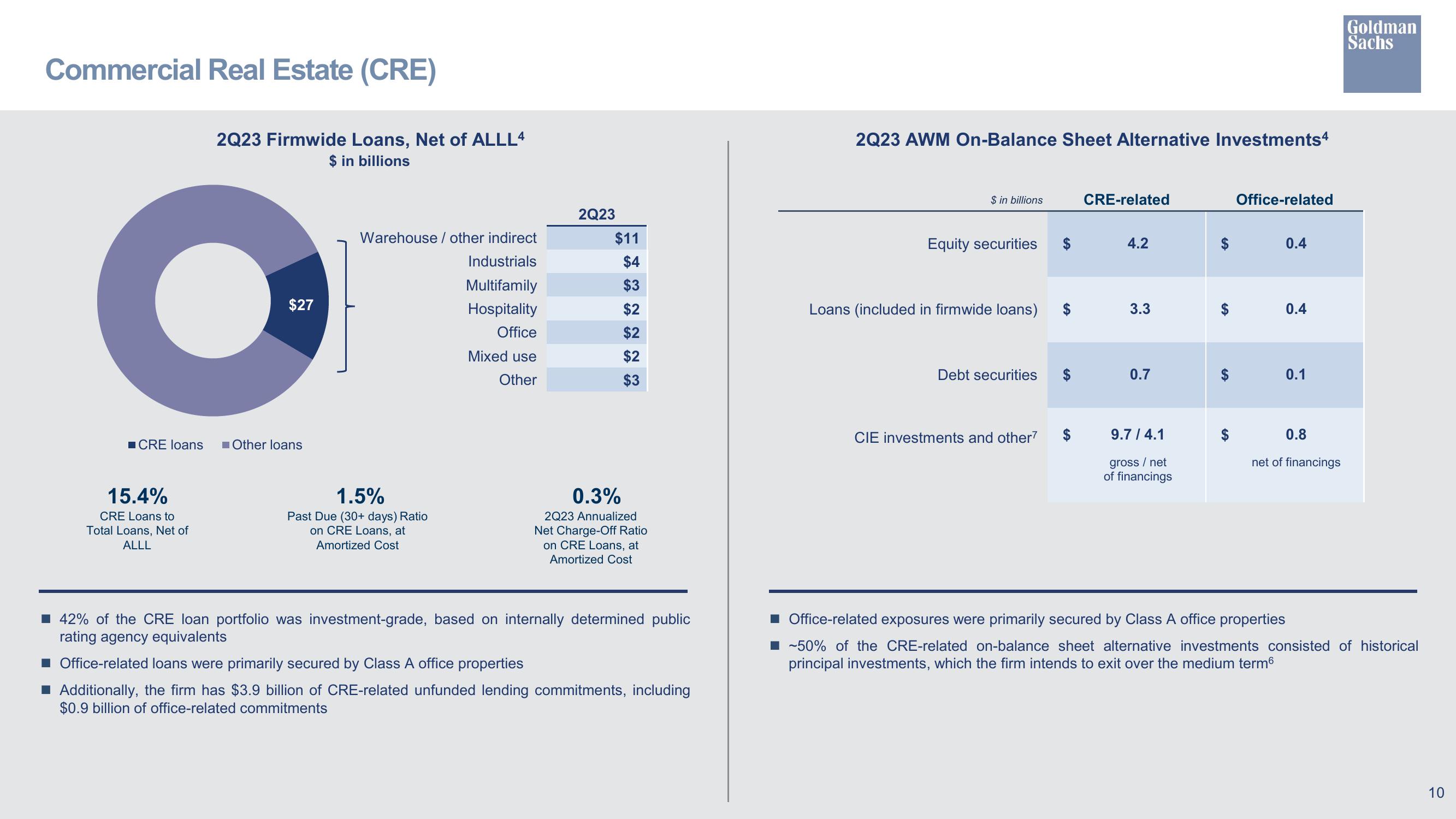

Commercial Real Estate (CRE)

●

$27

■CRE loans

2Q23 Firmwide Loans, Net of ALLL4

$ in billions

15.4%

CRE Loans to

Total Loans, Net of

ALLL

Other loans

Warehouse / other indirect

Industrials

Multifamily

Hospitality

Office

Mixed use

Other

1.5%

Past Due (30+ days) Ratio

on CRE Loans, at

Amortized Cost

2Q23

$11

$4

$3

$2

$2

$2

$3

0.3%

2Q23 Annualized

Net Charge-Off Ratio

on CRE Loans, at

Amortized Cost

■ 42% of the CRE loan portfolio was investment-grade, based on internally determined public

rating agency equivalents

■ Office-related loans were primarily secured by Class A office properties

■ Additionally, the firm has $3.9 billion of CRE-related unfunded lending commitments, including

$0.9 billion of office-related commitments

2Q23 AWM On-Balance Sheet Alternative Investments4

$ in billions

Equity securities

Loans (included in firmwide loans) $

Debt securities

CIE investments and other7

CRE-related

4.2

3.3

0.7

9.7 / 4.1

gross / net

of financings

SA

Office-related

0.4

0.4

0.1

0.8

net of financings

Goldman

Sachs

■ Office-related exposures were primarily secured by Class A office properties

■ ~50% of the CRE-related on-balance sheet alternative investments consisted of historical

principal investments, which the firm intends to exit over the medium term

10View entire presentation