DocGo Investor Presentation Deck

M&A STRATEGY

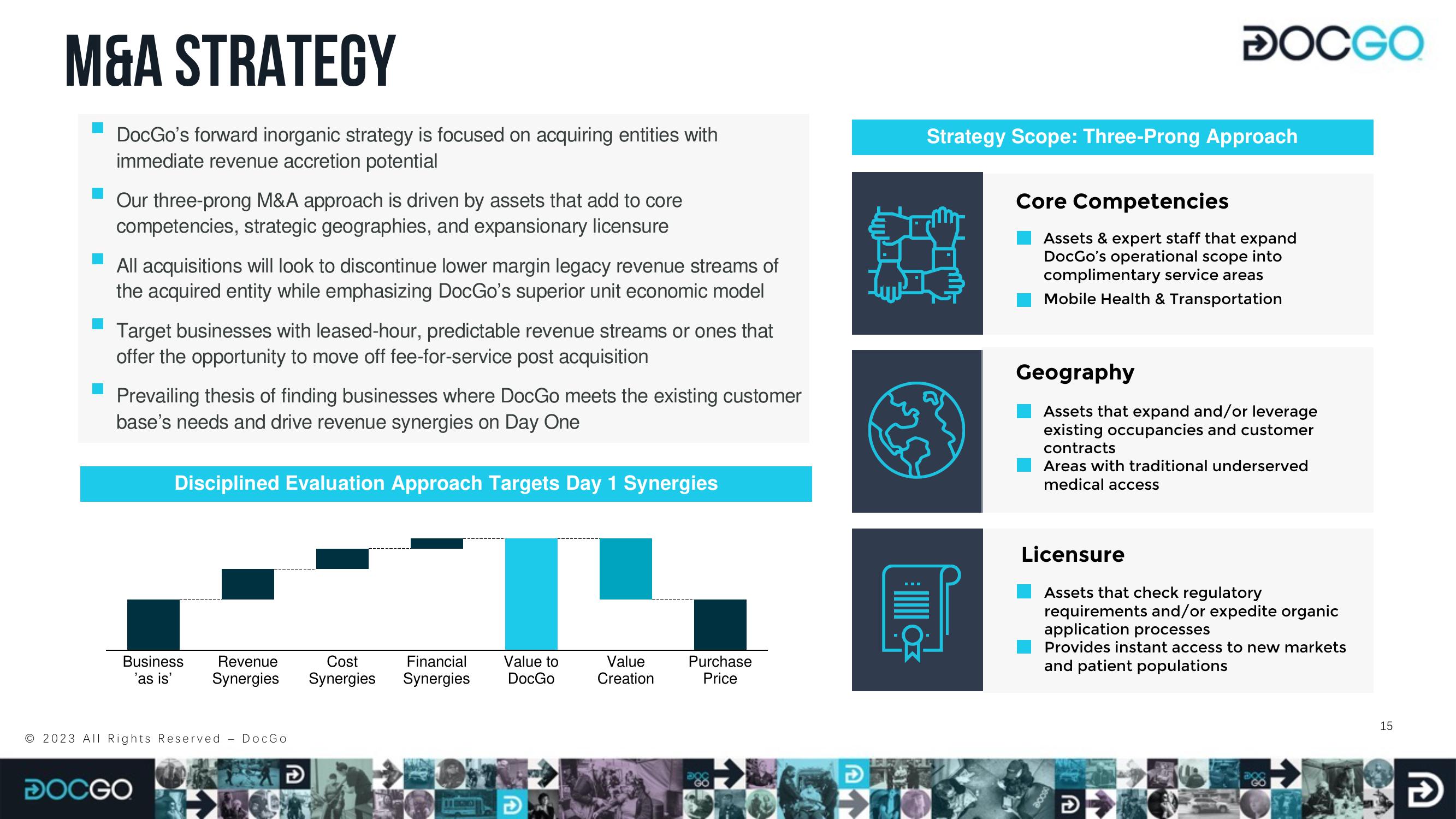

DocGo's forward inorganic strategy is focused on acquiring entities with

immediate revenue accretion potential

Our three-prong M&A approach is driven by assets that add to core

competencies, strategic geographies, and expansionary licensure

All acquisitions will look to discontinue lower margin legacy revenue streams of

the acquired entity while emphasizing DocGo's superior unit economic model

Target businesses with leased-hour, predictable revenue streams or ones that

offer the opportunity to move off fee-for-service post acquisition

Prevailing thesis of finding businesses where DocGo meets the existing customer

base's needs and drive revenue synergies on Day One

Disciplined Evaluation Approach Targets Day 1 Synergies

Business

'as is'

DOCGO

Revenue

Synergies

© 2023 All Rights Reserved - DocGo

Cost

Financial

Synergies Synergies

11 DGN

Value to

DocGo

Value

Creation

Purchase

Price

GO

Strategy Scope: Three-Prong Approach

Core Competencies

DOCGO

Assets & expert staff that expand

DocGo's operational scope into

complimentary service areas

Mobile Health & Transportation

Geography

Assets that expand and/or leverage

existing occupancies and customer

contracts

Areas with traditional underserved

medical access

Licensure

Assets that check regulatory

requirements and/or expedite organic

application processes

Provides instant access to new markets

and patient populations

beoo

D

P88

15

→View entire presentation