Ashtead Group Results Presentation Deck

ROBUST AND FLEXIBLE DEBT STRUCTURE

$5,000m

$4,000m

$3,000m

$2,000m

$1,000m

26

$m

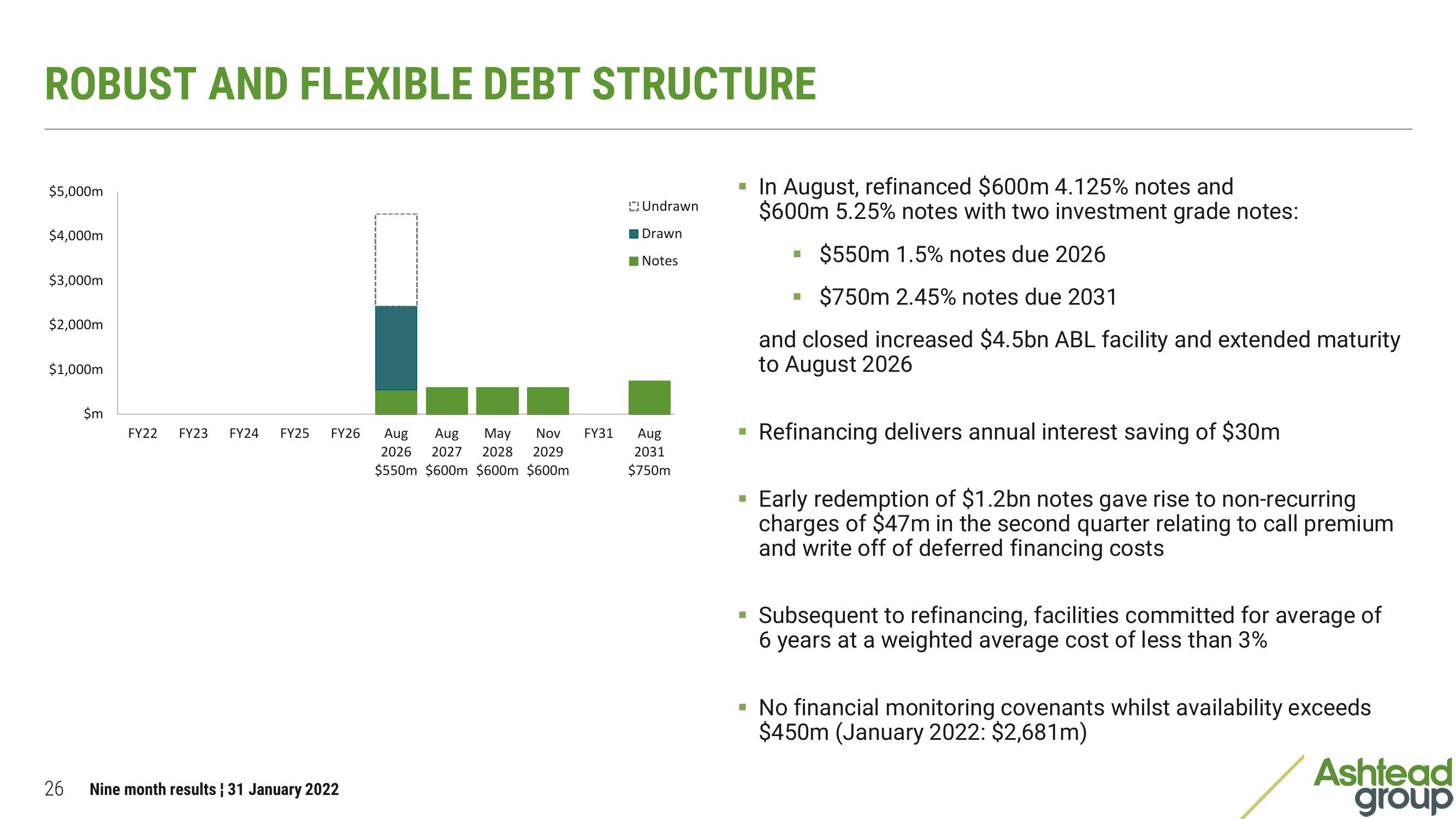

FY22 FY23 FY24 FY25 FY26 Aug

Aug

May Nov FY31

2026 2027 2028 2029

$550m $600m $600m $600m

Nine month results ¦ 31 January 2022

Undrawn

Drawn

Notes

Aug

2031

$750m

▪ In August, refinanced $600m 4.125% notes and

$600m 5.25% notes with two investment grade notes:

$550m 1.5% notes due 2026

$750m 2.45% notes due 2031

and closed increased $4.5bn ABL facility and extended maturity

to August 2026

■

Refinancing delivers annual interest saving of $30m

Early redemption of $1.2bn notes gave rise to non-recurring

charges of $47m in the second quarter relating to call premium

and write off of deferred financing costs

Subsequent to refinancing, facilities committed for average of

6 years at a weighted average cost of less than 3%

▪ No financial monitoring covenants whilst availability exceeds

$450m (January 2022: $2,681m)

Ashtead

groupView entire presentation